On April 7, Individuals Net Bought 1.6 Trillion Won as KOSPI Fell Over 5%

Individuals Actively Responded to Market Plunges With Net Buying This Year

The Most Purchased Stock During Market Crashes Was "Samsung Electronics"

Individual investors have actively engaged in buying at low prices whenever the stock market plunged this year. The stocks they purchased were semiconductors.

According to the Korea Exchange on the 9th, individual investors have net bought 5.6996 trillion won in the domestic stock market from the beginning of this year until the 7th. During the same period, institutional investors purchased 3.3267 trillion won, while foreign investors sold off 14.729 trillion won.

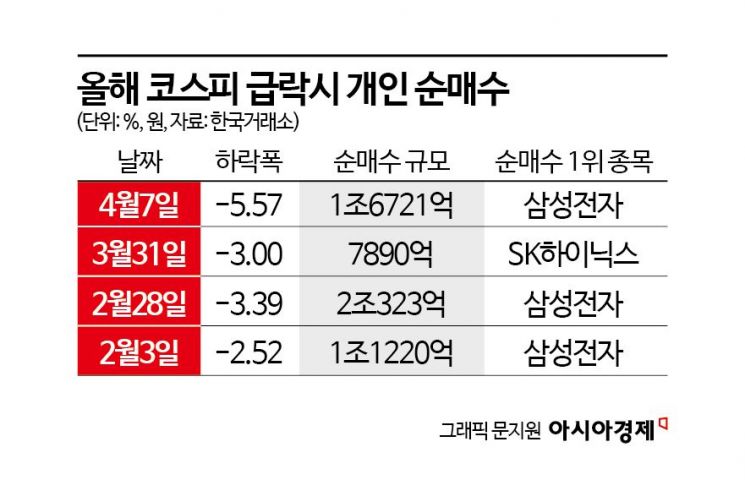

Individuals particularly took advantage of market crashes by buying at low prices. On the 7th, when the KOSPI fell more than 5%, individuals net bought 1.6721 trillion won in the KOSPI market. Earlier, on March 31, when the KOSPI dropped 3.0%, they purchased 789 billion won, and on February 28, when it fell 3.39%, they bought 2.0323 trillion won worth of stocks, marking the largest daily net purchase this year. On February 3, when the market declined 2.5%, they also net bought 1.122 trillion won.

On the other hand, foreign investors showed a selling bias during market crashes, driving the market downturn. On the 7th, foreign investors sold more than 2 trillion won in the KOSPI market. On March 31, they net sold 1.5754 trillion won, on February 28, 1.5524 trillion won, and on February 3, 868.8 billion won.

Institutional investors net bought 257.1 billion won and 667.3 billion won on the 7th and March 31, respectively, but recorded net sales of 616.7 billion won and 370.4 billion won on February 28 and February 3.

Lee Soo-jung, a researcher at Meritz Securities, said, "Typically, individual investors maintain an average purchase strategy during downturns, while foreigners and institutions sell during the initial shock and repurchase after earnings per share (EPS) stabilize downward, inducing price-earnings ratio (PER) normalization."

Individuals appeared to use the market crashes as opportunities to buy semiconductors at low prices. The most purchased stocks during the four market drops were always semiconductors. On the 7th, Samsung Electronics was the most net bought at 520.9 billion won, followed by SK Hynix at 456.8 billion won. On March 31, SK Hynix was net bought by 167.5 billion won, followed by Samsung Electronics at 127.7 billion won. On February 28, Samsung Electronics was net bought by 310.4 billion won and SK Hynix by 242.3 billion won, and on February 3, Samsung Electronics was the largest purchase at 446.3 billion won.

Individual investors seem to have been net buying whenever prices fell, expecting a recovery in semiconductors. Kim Dong-won, a researcher at KB Securities, said, "Samsung Electronics' quarterly earnings are expected to continue an upward trend from the first quarter low through the fourth quarter." The previous day, Samsung Electronics announced preliminary first-quarter results that exceeded market expectations. Samsung Electronics' consolidated operating profit for the first quarter of this year was 6.6 trillion won, a 0.15% decrease compared to the same period last year. According to financial information provider FnGuide, the consensus operating profit for Samsung Electronics in the first quarter of this year (average securities firm forecast) was 4.9613 trillion won.

Despite a market plunge of over 5% on the 7th, individual investors bought more than 1 trillion won, defending the index, indicating they expect the market to rebound. On the 7th, individuals net bought KODEX Leverage ETF worth 249.5 billion won and KODEX KOSDAQ150 Leverage ETF worth 147.2 billion won, making them the most purchased ETFs overall. Leverage ETFs can yield twice the returns of the underlying index when it rises.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.