SNE Research: Global EV Battery Market Grows Over 40% Early This Year

Domestic Companies' Market Share Drops, Samsung SDI Falls to Eighth Place

Chinese Companies Lead Growth, Uncertainty Rises with New US Tariffs

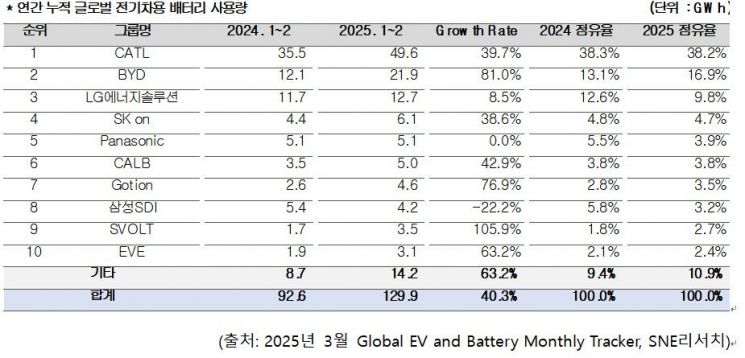

The electric vehicle battery market at the beginning of the year recorded growth in the 40% range compared to the previous year. Nevertheless, the market share of domestic battery companies significantly declined. In particular, Samsung SDI's market share dropped by four ranks within a year, raising alarms.

According to energy sector market research firm SNE Research, the battery usage installed in electric vehicles worldwide (including pure electric vehicles, plug-in hybrids, and hybrids) from January to February this year was 129.9 gigawatt-hours (GWh), showing a 40.3% growth compared to the same period last year. Considering that the growth rate of electric vehicle batteries in 2024 was 27.2%, the start of this year is understood to be favorable. An SNE Research official stated, "China is understood to have driven the entire market."

Despite the overall market expansion, domestic battery companies could not smile. The combined market share of the three domestic companies was 17.7%, down 5.5 percentage points compared to the same period last year. LG Energy Solution maintained third place with an 8.5% growth, which was below the average. SK On rose to fourth place with 38.6% growth. On the other hand, Samsung SDI experienced a 22.2% decline, dropping its market share to eighth place. This is a significant drop from fourth place in the same period last year.

It is understood that the reduction in Samsung SDI battery proportion was greatly influenced by its major customer, US-based Rivian, releasing models equipped with LFP (Lithium Iron Phosphate) batteries. Additionally, sales of the Audi Q8 e-tron model also decreased.

In the case of SK On, sales increased due to steady sales of Hyundai Motor's Ioniq 5, EV6 facelift models, and Mercedes-Benz's EQA and EQB models. For LG Energy Solution, the growth rate fell short of expectations due to a 35.7% decrease in Tesla supply volume.

China's CATL maintained its number one market share with a 39.7% growth compared to the same period last year. Chinese BYD recorded a high growth rate of 81.0%. BYD, which installs self-produced batteries in electric vehicles, aims to sell 6 million new cars this year following 4 million last year. It is rapidly increasing its market share by expanding beyond the Chinese domestic market into Asian and European markets, including Korea.

This year, the battery market faces increased uncertainty due to additional tariff policies by the US Trump administration. SNE Research explained, "The US announced tariff increases on Chinese batteries and key raw materials, causing tension throughout the global electric vehicle supply chain. Accordingly, global companies that relied on Chinese raw materials and batteries are pushing for supply chain restructuring, and strategic responses such as expanding local production in North America and diversifying raw material suppliers have emerged as important tasks for Korean battery companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.