Surplus Margin Expands as Early-Year Seasonal Factors Fade

IT Export Growth Continues Despite Semiconductor Export Decline

Exports of Non-IT Items Like Automobiles and Pharmaceuticals Also Increase

Imports Rebound After One Month

Third Longest Surplus Streak Since the 2000s

U.S. Tariff Impact a Variable... "Uncertainty to Increase After April"

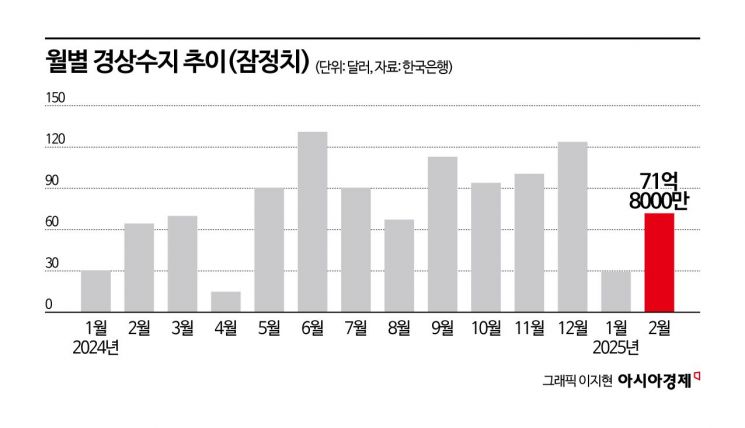

South Korea's current account surplus in February recorded $7.18 billion, continuing a surplus streak for 22 consecutive months. The surplus widened compared to the previous month due to the disappearance of seasonal factors at the beginning of the year and an expansion in export growth. Amid the third longest surplus streak since the 2000s, there are forecasts that uncertainty may increase after April due to the tariff impact from the new U.S. administration.

Export growth continues despite semiconductor export decline... surplus margin expands

According to the preliminary balance of payments data released by the Bank of Korea on the 8th, South Korea's current account surplus in February was $7.18 billion. The surplus increased compared to $2.94 billion in the previous month. It also rose compared to $6.44 billion a year ago. The current account surplus has continued for 22 consecutive months since May 2023. Song Jae-chang, head of the Financial Statistics Department at the Bank of Korea's Economic Statistics Bureau 1, explained, "The surplus expanded significantly as the seasonal factors from the previous month were resolved."

The current account surplus was driven by the goods balance, which combines exports and imports. The goods balance in February was $8.18 billion, increasing compared to $2.5 billion in the previous month and $6.92 billion in the same month last year.

Exports amounted to $53.79 billion, a 3.6% increase compared to the same period last year. By item, semiconductor exports declined, but the growth trend in IT items such as computers and camera modules continued. Non-IT items such as automobiles and pharmaceuticals also increased, turning overall exports upward. Customs-based semiconductor exports were $9.8 billion, down 2.5% compared to the same month last year. Meanwhile, passenger car exports rose 18.8% to $5.85 billion. By export region, the Middle East increased by 19.8% year-on-year, Southeast Asia by 9.2%, and the United States by 1%.

Imports were $45.61 billion, up 1.3% compared to the same period last year. Although raw material imports continued to decline due to falling energy prices, capital goods imports expanded and consumer goods also increased, turning to growth after one month. In January, raw material imports based on customs data recorded $22.59 billion, down 9.1% year-on-year. Most major items saw reduced imports, including coal (-32.7%), gas (-26.7%), and crude oil (-16.9%). On the other hand, capital goods imports increased 9.3%, centered on semiconductor manufacturing equipment (33.5%), and consumer goods imports rose 11.7%.

Song said, "Looking at customs data for March, the goods balance remains favorable in March as well," but added, "While March is manageable, the market evaluates the tariff policies of the Trump administration as strong, so from April onward, long-term uncertainty will increase and concerns about economic slowdown will inevitably rise."

He continued, "Items with a high export share to the U.S. will be affected, and indirect exports or Southeast Asia may also be impacted. If global trade slows down, exports to China could also be a factor in decline," but added, "We need to closely monitor how tariff rates will be adjusted and how neighboring countries will respond."

Service and travel balances show little improvement... deficit widens

The service balance, which includes travel and transportation balances, shows little improvement. In February, the service balance recorded a deficit of $3.21 billion. The deficit amount increased compared to $2.06 billion in January and $1.87 billion in February last year. The travel balance was a deficit of $1.45 billion, with the deficit narrowing compared to the previous month, but deficits widened in intellectual property royalties (-$580 million) and other business services (-$1.08 billion).

Song explained, "The travel balance deficit narrowed as the winter vacation peak season for overseas travel ended and the number of departures decreased due to the base effect of the long Lunar New Year holiday in January," and "The intellectual property balance deficit widened as domestic companies increased payments of royalties related to research and development to overseas companies." Other business services consist of research and development services, professional and management consulting services, and architectural and engineering services. Song said, "The deficit widened as domestic companies' income from overseas subsidiaries decreased."

The primary income balance remained at $2.62 billion, the same level as the previous month. The dividend income balance recorded $1.68 billion, with the surplus narrowing compared to the previous month due to a decrease in dividend income from securities investments. The interest income balance increased the surplus to $1.2 billion.

The net financial account, which is assets minus liabilities, increased by $4.96 billion. The increase was larger than the previous month's $3.72 billion. Direct investment saw domestic investors' overseas investments increase by $4.55 billion, centered on automobiles and secondary batteries, while foreign investors' domestic investments rose by $910 million. Securities investment showed domestic investors' overseas investments increase by $13.2 billion, mainly in stocks, and foreign investors' domestic investments increased by $2.24 billion, mainly in bonds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.