Transaction Volume in Permit-Free Zones Over 39 Days

Jamsil, Samsung, Daechi, Cheongdam: 99 to 353 Cases; Seoul: 4,559 to 9,665 Cases

Record-High Transactions in Jamsil, Samsung, Daechi, Cheongdam Jump 6.5 Times Compared to Before

After the lifting of the land transaction permit zone designation, apartment transaction volumes in the areas of Jamsil, Samsung, Daechi, and Cheongdam increased more than 3.6 times compared to before the announcement of the lifting. During the same period, the total apartment transaction volume in Seoul also more than doubled.

On the 7th, Zigbang investigated transaction volumes from February 13, immediately after the lifting of the land transaction permit zone, to March 23, just before the re-designation enforcement. The total apartment sales transactions within the regulated areas amounted to 353 cases, more than 3.6 times the 99 cases recorded during the 39 days before the lifting (January 4 to February 11). The total transaction volume in Seoul was 9,665 cases, 2.1 times higher than the 4,559 cases during the same period before the lifting.

Transactions setting new record prices increased by 6.5 times. In Jamsil, Samsung, Daechi, and Cheongdam, record-breaking transactions rose from 13 cases before the lifting to 84 cases afterward. Compared to the entire Seoul area, where record-breaking cases increased from 362 to 839 (2.3 times), this is about three times higher. Since the reporting deadline for actual transactions has not yet passed, the final transaction volume tally may change.

Among Jamsil, Samsung, Daechi, and Cheongdam, Jamsil-dong had the highest transaction volume

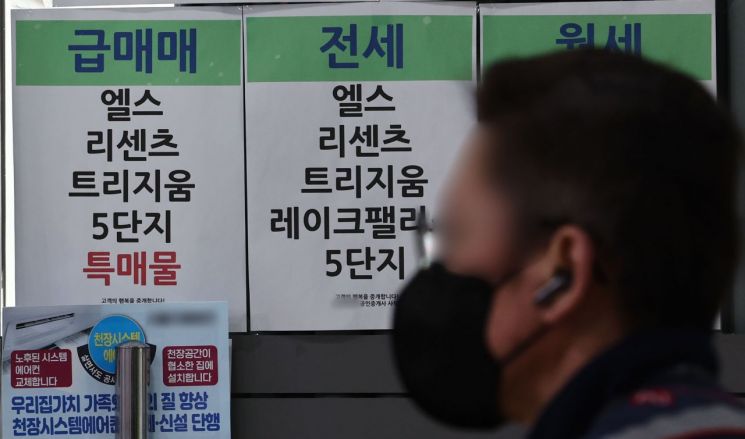

Within the areas subject to lifting, Jamsil-dong had the highest number of transactions. Over 39 days, a total of 135 apartment transactions occurred in Jamsil-dong. By specific complexes, the top three were the Jamsil "Big Three": △Rescentz with 38 cases △Jamsil Els with 34 cases △Trizium with 30 cases.

These three complexes have a combined scale approaching 15,000 households and are highly preferred by both investors and actual buyers due to excellent transportation networks and convenient living infrastructure. They serve as leading indicators for Seoul apartment transactions.

Next in transaction volume were △Samsung-dong with 86 cases △Daechi-dong with 71 cases △Cheongdam-dong with 61 cases. In Samsung-dong, Samsung Hillstate 1st Complex recorded 16 cases; in Daechi-dong, Daechi Hyundai had 10 cases; and in Cheongdam-dong, Cheongdam Xi had 11 cases.

Transaction volume by district after lifting, Gangnam-gu ranks first

By autonomous district, the transaction volumes were highest in △Gangnam-gu (excluding areas subject to regulation lifting) with 676 cases △Gangdong-gu with 652 cases △Songpa-gu (excluding areas subject to regulation lifting) with 652 cases △Seongdong-gu with 637 cases.

Gangnam-gu includes three neighborhoods subject to regulation, and areas such as Gaepo, Dogok, and Yeoksam-dong are evaluated as regions with well-balanced residential preference factors including school districts, transportation, and living infrastructure. By neighborhood, Gaepo-dong had 131 cases, Dogok-dong 122 cases, and Yeoksam-dong 116 cases. In Gaepo-dong, △Gaepo Raemian Forest had 23 cases △Raemian Bless Tige had 21 cases; in Dogok-dong, △Dogok Rexle had 25 cases △Gyeongnam had 13 cases; in Yeoksam-dong, △Yeoksam Raemian had 17 cases △Teheran I-Park had 13 cases.

In Gangdong-gu, many newly built large complexes within 10 years of completion exist, and its accessibility to the Gangnam area is excellent, attracting strong interest from both actual buyers and investors. It appears to be increasingly preferred as a secondary choice for actual buyers seeking an environment comparable to the Gangnam living area. The complex with the highest transaction volume was Raemian Hillstate Godeok (49 cases), followed by △Godeok Arteon with 46 cases △Godeok Gracium with 43 cases, with transactions mainly concentrated in newly built complexes.

In Songpa-gu, after the lifting of regulations in Jamsil-dong, buying demand spread throughout Songpa-gu, and transactions increased mainly in large complexes, with △Helio City recording 76 cases △Park Rio 58 cases △Olympic Family Town 31 cases.

Transaction volume during the 4 days after the announcement of expanded designation higher than the previous week

In the areas subject to lifting of the land transaction permit zone, transaction volumes initially surged and then showed a decreasing trend. Weekly transaction volumes show that in the first week immediately after the lifting, a total of 122 cases were traded. Buyers who moved quickly responded immediately once the transaction restrictions were lifted. Subsequently, transaction volumes decreased to 66, 57, 47, and 26 cases respectively. As demand concentrated, asking prices rose and listings were withdrawn, widening the price gap between buyers and sellers, which also affected transaction volumes.

On the 19th of last month, the government and Seoul City announced the expanded re-designation of the land transaction permit zone, and the transaction volume during the following 4 days (35 cases) slightly increased compared to the previous week (26 cases). Since the reporting deadline for transactions has not yet passed, the exact transaction volume trend may still change.

Two weeks after the re-designation of the land transaction permit zone, the metropolitan area real estate market is expected to experience short-term transaction contraction. Due to loan regulations and strengthened tax measures, buyers' cautious sentiment is deepening, and a wait-and-see market continues.

Kim Min-young, manager of Zigbang Big Data Lab, explained, "In the short term, the cautious stance is likely to continue, but there is also a possibility of selective price increases centered on higher-grade areas. It is necessary to observe further whether this adjustment will be a temporary pause or lead to a trend reversal."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.