KOSPI Rebounded After Previous Impeachment Rulings

Expectations for Improved Foreign Investor Demand with Falling Exchange Rate

Cautious Approach Needed Amid Persistent Trade Uncertainties

As the domestic stock market begins to digest the biggest events of the year?U.S.-originated tariffs and the impeachment political turmoil?attention is turning to future investment strategies. Experts are leaving the door open for a short-term rebound possibility following the resolution of political uncertainties, while advising caution in investing in sectors heavily exposed to tariff risks.

According to the financial investment industry on the 8th, many analyses predicting a bullish KOSPI emerged around the time of the impeachment ruling on Yoon Seok-yeol. The factors weighing down domestic market sentiment?U.S. President Donald Trump's tariff bombs and the impeachment turmoil?have begun to dissipate.

Kim Su-yeon, a researcher at Hanwha Investment & Securities, said, "The negative factors that increased uncertainty in the stock market over the past four months have been resolved," adding, "With the ruling confirmed, suppressed valuations are likely to expand and stabilize upward. I expect the KOSPI to rise." Starting with the full resumption of short selling on the 31st of last month, followed by the U.S. announcement of reciprocal tariffs on the 3rd, and then Yoon Seok-yeol's impeachment ruling the next day, the market is gradually erasing the negative uncertainties one by one.

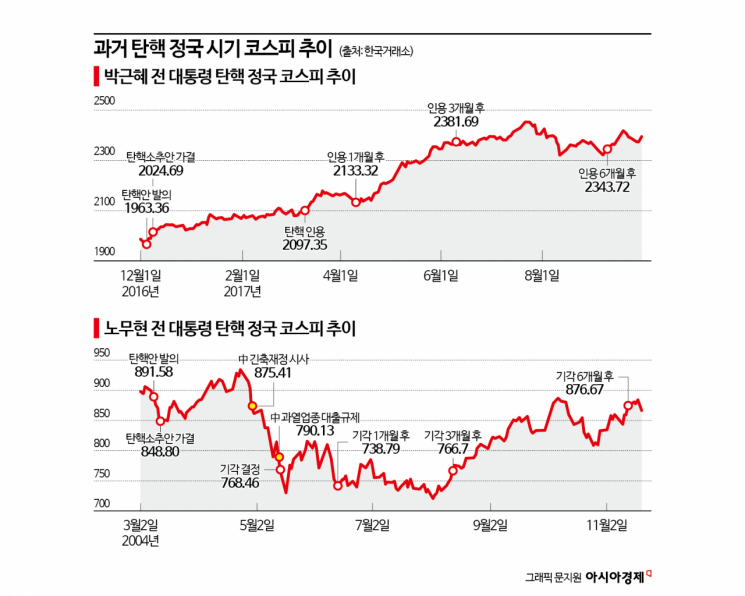

The fact that the stock market rebounded for about a year during the previous two impeachment periods also supports the bullish view. Previously, the KOSPI rose 16% over one year following the impeachment ruling of former President Roh Moo-hyun on May 14, 2004. It also increased by 17.62% over one year after the impeachment ruling of former President Park Geun-hye on March 10, 2017. Additionally, entering an early presidential election phase, various election pledges from political parties and leading candidates, as well as the push for supplementary budget bills and fiscal policies, are factors stimulating investment sentiment.

Lee Kyung-min, a researcher at Daishin Securities, said, "The KOSPI, which was leveled down by the U.S. tariff shock, is expected to continue its rebound based on support around the 2430 level, with the first rebound target at 2750," adding, "There is a high possibility that expectations for policy-related stocks of presidential candidates will flow in due to the new administration and confirmation of the early presidential election."

However, there is also a cautious view that it is too early to be complacent. With separate tariffs on semiconductors and pharmaceuticals?previously excluded from U.S. reciprocal tariffs?being anticipated, and the won-dollar exchange rate potentially falling, concerns arise that Korea's export price competitiveness could be directly hit.

Hwang Jun-ho, a researcher at Sangsangin Securities, said, "If the protectionist trend triggered by the U.S. spreads to other countries, Korea's exports, already weakened by the current economic slowdown, are likely to perform worse, especially in consumer goods," adding, "This week, the domestic stock market is expected to continue its downward trend due to downward pressure from the burden of reciprocal tariffs by the Trump second-term administration and the resulting increase in trade uncertainties."

However, experts agree that improvements in foreign investor demand due to a falling exchange rate could provide momentum for stock price increases and should be closely monitored. Lee Jae-man, a researcher at Hana Securities, advised, "In the early phase of the won's stabilization, an approach strategy focusing on large-cap and export stocks, where foreign ownership ratios have shrunk, is necessary," adding, "In particular, semiconductors (-3.4 percentage points) and shipbuilding (-2.5 percentage points) are sectors where foreign ownership has decreased the most compared to their 2024 peaks, so increasing their weight seems necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.