Exports to the U.S. Reached 14.832 Trillion Won Last Year

Tariff Application Timing to Differ by Semiconductor Type

Mobile APs Likely to Be the First Target

Tariff Scope Expected to Gradually Expand

Impact on Smartphone Sales for Companies Like Samsung

HBM: Korean Companies Hold 80% Market Share

Concerns Over Industry-Wide Decline in Demand

The Trump administration in the U.S. has announced plans to impose tariffs on semiconductors, causing tension within the domestic industry. Last year, the scale of semiconductor exports to the U.S. amounted to 14.832 trillion won, second only to automobiles. If the 25% tariff applied to automobiles is also imposed on semiconductors, exports to the U.S. are expected to inevitably suffer damage.

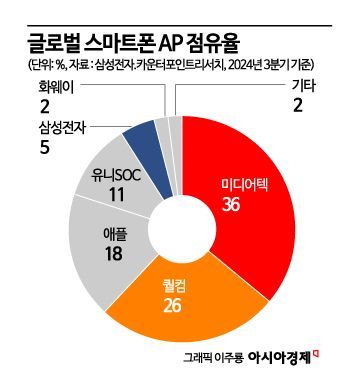

Industry insiders and experts anticipate that the timing of tariff application will vary depending on the type of semiconductor. The first target is likely to be mobile application processors (APs). Since APs are key components installed in smartphones produced by Samsung Electronics, this could even affect phone sales.

On the 4th, Kyunghee Kwon, a research fellow at the Korea Institute for Industrial Economics and Trade, said in a phone interview with Asia Economy, "Currently, the easiest and quickest targets for the Trump administration to impose tariffs on are APs and leading-edge memory." A semiconductor industry official also expressed confidence, saying, "It is difficult for the Trump administration to impose tariffs on the entire semiconductor category from the start," and predicted, "It is highly likely that tariffs will be imposed on APs first and then gradually expanded."

APs are semiconductors critically installed in major electronic devices, including smartphones. The reason APs are mentioned as the first target is due to remarks made during the confirmation hearing of Howard Lutnick, the nominee for U.S. Secretary of Commerce, in January. At that time, Lutnick singled out Apple and Qualcomm as "companies to watch," stating that "Apple and Qualcomm have unnecessarily incurred costs and caused the decline of domestic manufacturing by building factories abroad and producing APs outside their home country."

Currently, Apple, Qualcomm, and others produce most of their APs in China, Vietnam, India, and other countries. From our perspective, Samsung Electronics’ Exynos, which is under development, could become subject to tariffs, but since most mobile APs are procured externally, there is a possibility that tariffs will lead to an increase in the final product price. An industry insider agreed on the possibility of smartphone price increases due to AP tariffs, saying, "I agree," and added, "It is necessary to thoroughly review the future impacts."

The scenario most feared by our companies is the imposition of tariffs on memory items, including High Bandwidth Memory (HBM). HBM is typically bundled with Nvidia’s artificial intelligence (AI) chips and installed in AI servers. While it is widely expected that semiconductor tariffs will be imposed on "finished products," the definition of finished products is ambiguous, and if HBM alone is considered a finished product, it will be difficult to escape the encirclement of U.S. tariffs. In particular, Korean companies currently hold more than 80% of the global market share for HBM, so Korean companies are expected to be significantly impacted. Already, the stock prices of major U.S. big tech companies such as Nvidia and Apple have plummeted amid concerns that price increases due to semiconductor tariffs will reduce demand for AI servers. Apple’s stock fell by more than 9%.

The imposition of tariffs on the semiconductor sector is not limited to the semiconductor industry alone but could have widespread effects across industries such as information technology (IT), automobiles, defense, and artificial intelligence (AI), raising concerns about a comprehensive decline in demand.

Seongdae Cho, head of the Trade Research Division at the Korea International Trade Association, said, "Although semiconductor production supply chains are limited to a very small number of countries, their applications are very diverse, so the U.S., which intends to impose tariffs, will consider these aspects." He added, "Since tariffs have been imposed on steel and aluminum used in finished products, if the same method is applied to semiconductors, the scope of targets could become very broad."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.