'March Nationwide Apartment Price Trends'

Reconstruction Demand Concentrated in Gangnam, Yeouido, and Mokdong

Prices Rise as High Pre-Sale Prices Are Sustainable

Provincial Decline Widens to 0.05%

Seoul apartment prices have risen for nine consecutive weeks. Despite Gangnam's three districts and Yongsan-gu being designated as land transaction permission zones, Seoul housing prices maintained an upward trend as prices of reconstruction apartments surged.

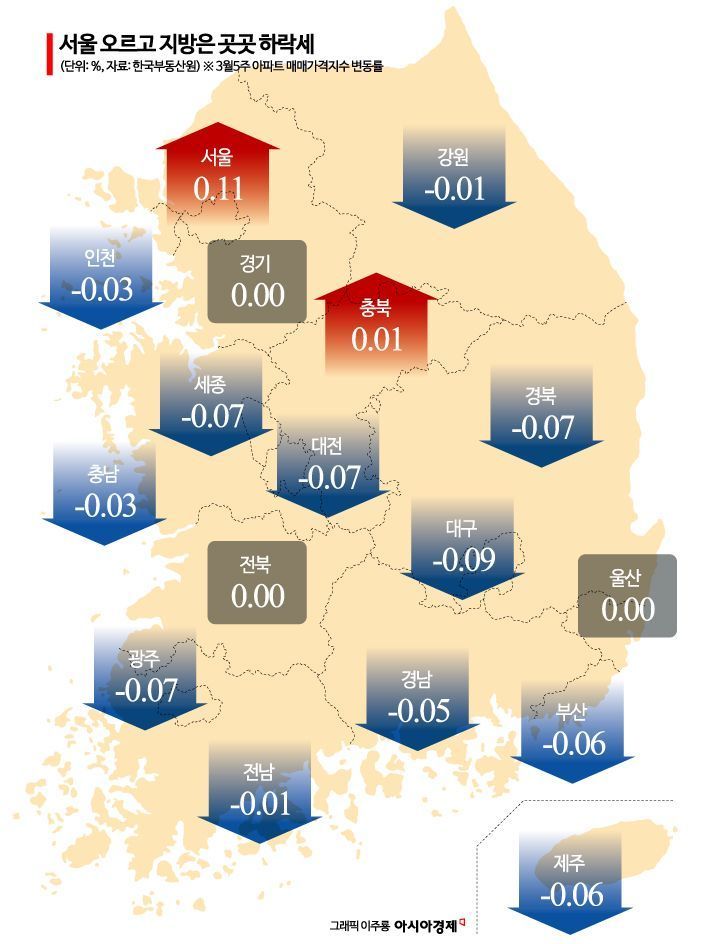

According to the nationwide apartment price trend announced by the Korea Real Estate Board on the 3rd, Seoul apartment sale prices in the fifth week of March (as of the 31st) rose by 0.11% compared to the previous week.

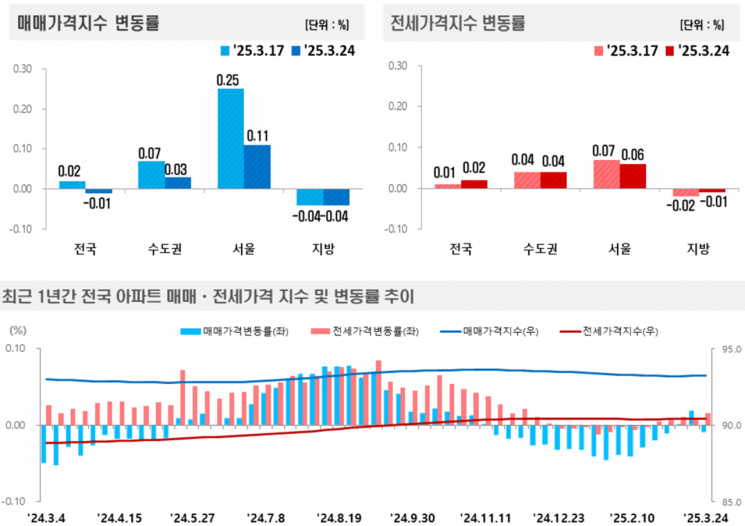

This is the same rate of increase as the previous week, when the rate of rise slowed after the expansion of the land transaction permission system on the 24th. Seoul housing prices have risen every week since turning upward in the first week of February. Last month, Seoul apartment prices expanded to 0.14% → 0.2% → 0.25% until the third week. The Korea Real Estate Board analyzed, "Due to increased cautious sentiment, transaction volumes were not high, and the overall market showed mixed trends," adding, "Demand for reconstruction-promoting complexes remains steady."

Prices are rising not only in the Gangnam 4 districts (Gangnam, Seocho, Songpa, Gangdong) but also in reconstruction-promoting complexes in northern Seoul. By district, Seongdong-gu (0.30%) saw the highest increase. It was followed by Songpa-gu (0.28%), Gangnam-gu (0.21%), Yongsan-gu and Yangcheon-gu (0.20%), Mapo-gu (0.18%), Seocho-gu and Yeongdeungpo-gu (0.16%), and Gangdong-gu (0.15%). Gangnam-gu includes reconstruction-promoting complexes such as Gaepo and Apgujeong, Yangcheon includes Mokdong and Sinjeong, and Yeongdeungpo includes Yeouido and Singil.

Woo Nam-gyo, a senior researcher at the Korea Real Estate Board, said regarding the rise centered on reconstruction complexes, "The demand for sales and price increases centered on reconstruction areas is not just this week," adding, "The prices of listings in those areas continue to rise."

The same applies to Gwacheon-si in Gyeonggi Province. Gwacheon recorded the second highest increase nationwide (0.39%) following the previous week (0.55%). The Gwacheon Jugong 5 complex has received management disposition approval, and the 8th and 9th complexes have started relocation. Researcher Woo explained, "The development of the Knowledge Information Town has also overlapped, increasing local expectations."

However, the rise centered on reconstruction complexes does not apply equally to all areas. Ham Young-jin, head of the Real Estate Research Lab at Woori Bank, said, "Although Nowon-gu has many apartments built in the 1980s, it has not recently attracted much attention in the market," adding, "It is difficult to explain apartment price increases simply by the possibility of reconstruction."

He continued, "In Seoul, there has been almost no new supply since the 'Raemian One Perla' in Bangbae-dong, Seocho-gu, earlier this year, so supply is insufficient and preference for new supply remains high," adding, "Areas like Gangnam, Yeouido, and Mokdong have demand that can bear high pre-sale prices, so reconstruction feasibility is highly evaluated, leading to continued price increases."

Apartment Sales Price Index Change Rate (top left) and Jeonse Price Index Change Rate. The graph below shows the trend of nationwide apartment sales and Jeonse price indices and their change rates over the past year. Provided by Korea Real Estate Board.

Apartment Sales Price Index Change Rate (top left) and Jeonse Price Index Change Rate. The graph below shows the trend of nationwide apartment sales and Jeonse price indices and their change rates over the past year. Provided by Korea Real Estate Board.

In Gyeonggi Province, following Gwacheon-si, Seongnam's Sujeong-gu (0.27%) and Bundang-gu (0.24%) also rose. On the other hand, Gimpo-si (-0.18%) and Anseong-si (-0.19%) declined. Incheon (-0.03%) saw a reduced rate of decline compared to the previous week (-0.07%). Michuhol-gu (0.04%) and Bupyeong-gu (0.03%) rose. The entire metropolitan area rose by 0.03%.

The situation is different in the provinces. The five major metropolitan cities nationwide all declined simultaneously, with the rate of decline expanding. Daegu (-0.09%), Daejeon (-0.07%), Gwangju (-0.07%), North Gyeongsang (-0.07%), and Jeju (-0.06%) saw large declines, and Sejong also fell by -0.07%, expanding from the previous week's (-0.03%) decline. The provinces overall fell by -0.05%, a larger drop than the previous week. Nationwide apartment prices fell by 0.01% this week following the previous week.

Meanwhile, apartment jeonse (long-term lease) prices continued to rise. Nationwide, they rose by 0.02%, maintaining the same rate as the previous week. Seoul rose by 0.05%. The increase was 0.01 percentage points less than the previous week. Jeonse demand concentrated in Gangdong-gu (0.16%), Songpa-gu (0.15%), and Yeongdeungpo-gu (0.10%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.