Jinwook Kim, Citi Economist

"Implemented More Strongly Than Expected"

Difference of 0.169 Percentage Points From Previous Forecast

Negative Impact on This Year's GDP Growth Forecast of 1.0%

The U.S. Donald Trump administration has formalized the imposition of reciprocal tariffs on major trading partners worldwide, applying a 25% tariff on South Korea. The market evaluates this as a stronger level than expected, and analyses suggest it will have a more negative impact on South Korea's gross domestic product (GDP) than previously anticipated.

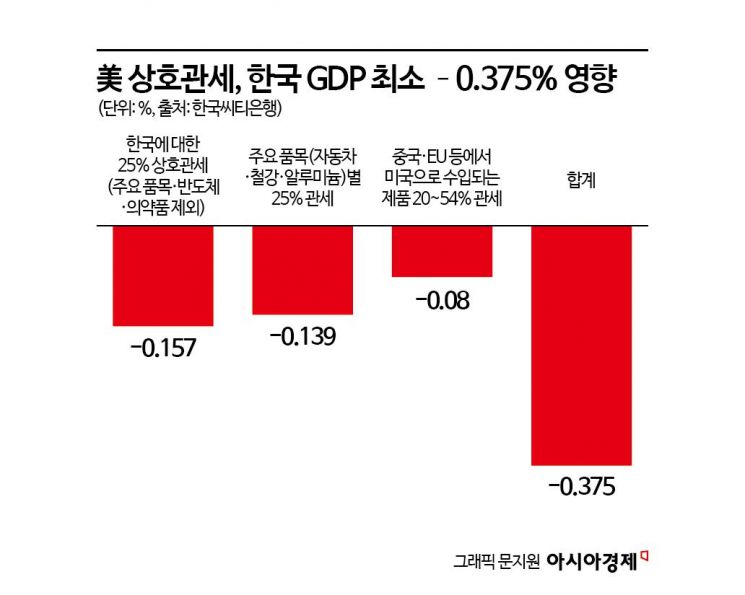

Jinwook Kim, a Citi economist, stated this on the 3rd in a report titled "Sharper than expected US reciprocal tariff." He said, "A stronger-than-expected level of U.S. global reciprocal tariffs has been announced," and analyzed that "(the tariffs announced so far) will have at least an annual impact of -0.375% on South Korea's GDP."

This forecast is 0.169 percentage points more negative than Kim's previous prediction. On the 27th of last month, he predicted that reciprocal tariffs would impact South Korea's GDP by -0.206%. At that time, he estimated this based on the tariff South Korea imposed on the U.S. last year (0.79%) plus a 10% value-added tax.

Specifically, Economist Kim anticipated that this reciprocal tariff measure could impact South Korea's GDP by -0.157%. When announcing the reciprocal tariff measures, the U.S. excluded products such as copper, pharmaceuticals, semiconductors, and wood products, in addition to steel, aluminum, automobiles, and parts, which are already subject to a 25% tariff. He expected that the sector-specific 25% tariffs on automobiles and parts, steel, and aluminum would have an impact of -0.139%. Tariffs on products made in other countries and imported into the U.S. are also expected to negatively affect South Korea's GDP.

Kim warned, "The U.S. tariffs ranging from 20% to 54% on products imported from China, the European Union (EU), and others will have at least a -0.08% impact on South Korea's GDP," adding, "Considering the indirect effects on Vietnam (46% reciprocal tariff), Taiwan (32%), and Japan (25%), the negative impact could increase further."

This reciprocal tariff measure is also expected to affect South Korea's GDP growth forecast for this year. Citi recently revised South Korea's GDP growth forecast down from 1.2% to 1.0%. Economist Kim viewed the reciprocal tariff measure as a downside risk to this forecast.

However, considering the Trump administration's transaction-focused approach, he predicted that there is still room for negotiation. In fact, U.S. Treasury Secretary Steven Mnuchin stated, "The tariffs announced on the 3rd are the maximum, and countries can take measures to reduce tariffs afterward." Economist Kim noted that South Korea could respond by expanding direct investment by Korean companies in the U.S. in sectors such as automobiles, purchasing U.S.-made liquefied natural gas (LNG), crude oil, weapons, and aircraft, and increasing cost-sharing for the stationing of U.S. troops in South Korea.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.