Donation Amounts Gathered to Support Wildfire Victims

Special Donation Funds Apply to Both Individuals and Corporations

Individuals Receive 16.5% Tax Credit Plus 33% for Excess Amounts

Hometown Love Donations Offer Up to 33% Tax Credit

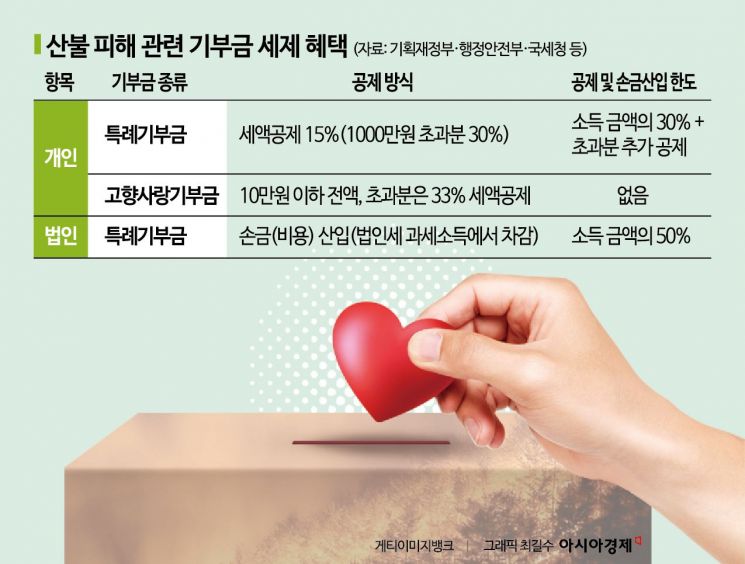

As the worst wildfire in history sweeps across various parts of the country, a wave of donations to help the affected areas and residents is continuing. Individuals, organizations, and companies are donating not only through private social welfare organizations but also directly to the regions. In the case of special disaster areas declared due to natural disasters, individuals and corporations can receive special tax benefits through the application of special donation funds, which offer more tax advantages compared to general donations. In particular, individuals who make hometown love donations can receive a 33% tax credit, making the benefits the greatest.

The forest area around Danchon-myeon, Uiseong-gun, Gyeongbuk, and Iljik-myeon, Andong-si, is charred black. Photo by Yonhap News

The forest area around Danchon-myeon, Uiseong-gun, Gyeongbuk, and Iljik-myeon, Andong-si, is charred black. Photo by Yonhap News

According to the Ministry of Economy and Finance, the Ministry of the Interior and Safety, the National Tax Service, and the Community Chest of Korea on the 3rd, as the wildfire that occurred last month in Uiseong, Gyeongsangbuk-do spread to the Gyeongbuk area, Gyeongsangnam-do, and Ulsan, causing extensive damage, support efforts have been continuously made. As of the 1st, the total amount of donations collected by the Community Chest of Korea is 22.8 billion KRW. Since donations are also being gathered by various private organizations such as the Korean Red Cross and Hope Bridge National Disaster Relief Association, the total scale of donations is expected to increase significantly when combined.

Donations and relief supplies given by individuals and corporations receive more tax benefits compared to general donations. The government has declared eight areas as special disaster zones, including Ulju-gun in Ulsan, Uiseong-gun, Andong-si, Cheongsong-gun, Yeongyang-gun, Yeongdeok-gun in Gyeongbuk, and Sancheong-gun and Hadong-gun in Gyeongnam, making the application of "special donation funds" possible. Special donation funds include public interest donations such as free donations of goods to the state or local governments, defense contributions and gifts to military personnel, and relief goods for disaster victims caused by natural disasters, and they receive more tax support than general donations.

When an individual donates to a private organization in the form of a general donation, they receive a tax credit of 16.5% (15% national tax + 1.5% local tax) of the donation amount within 30% of their income amount. If recognized as a special donation fund, the basic tax credit rate remains 16.5%, but if the donation exceeds 30% of the income amount and the excess amount exceeds 10 million KRW, a 33% (30% national tax + 3% local tax) tax credit is applied to the excess amount. Unlike general donations, donations exceeding 30% of the income amount can also be deducted, resulting in greater benefits.

Corporations can include donations as deductible expenses and reduce their corporate tax and local corporate income tax burden by subtracting these expenses from taxable income. For general donations, corporations can only recognize deductible expenses up to 10% of their income amount, but for special donation funds, the deductible limit is expanded up to 50% of the income amount. For example, if a corporation’s net profit is 10 billion KRW, it can recognize deductible expenses up to 1 billion KRW for general donations, but with the application of special donation funds, deductible expenses can be included up to 5 billion KRW, significantly reducing corporate tax and local corporate income tax.

For individuals, according to the revised Restriction of Special Taxation Act in February, they can receive higher tax benefits by using the hometown love donation rather than special donation funds. The hometown love donation is a system that allows individuals to donate to local governments where they do not reside, receiving a full tax credit for up to 100,000 KRW and a 33% (30% national tax + 3% local tax) tax credit for the excess amount. Additionally, donors can receive local specialty products or other gifts from the donated local government. There is no income limit, so anyone can receive the maximum benefit, but the maximum annual donation amount is 5 million KRW. The benefit application period is up to three months after the declaration of the special disaster area. The Ministry of the Interior and Safety stated that although the related Enforcement Decree of the Restriction of Special Taxation Act is under legislative notice, all local governments declared as special disaster areas this year can apply retroactively.

Meanwhile, the Ministry of Economy and Finance and the National Tax Service have guided that although private organizations eligible for special donation funds are originally limited, donations directed to disaster areas like this wildfire can be recognized as special donation funds even if made through general organizations. The Ministry of Economy and Finance announces organizations that can be designated as special donation funds quarterly. A Ministry of Economy and Finance official said, "We have received many inquiries from general donation organizations," adding, "We explain that relief goods for disaster victims caused by natural disasters are eligible for special donation fund application."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.