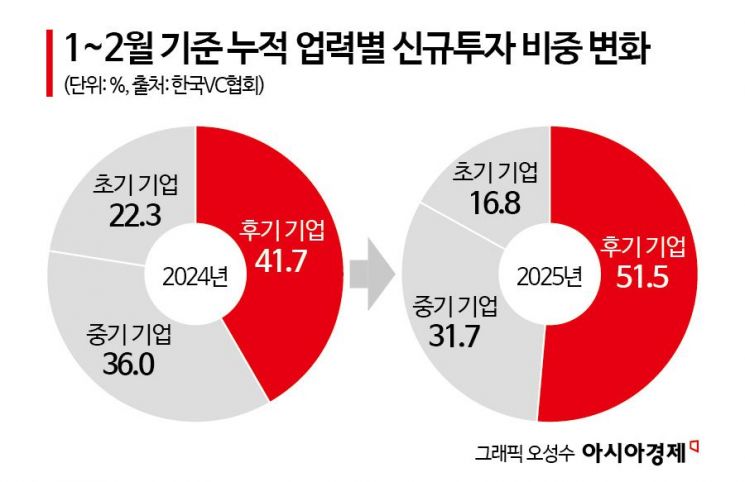

Late-Stage Investments Rise to 51.5%

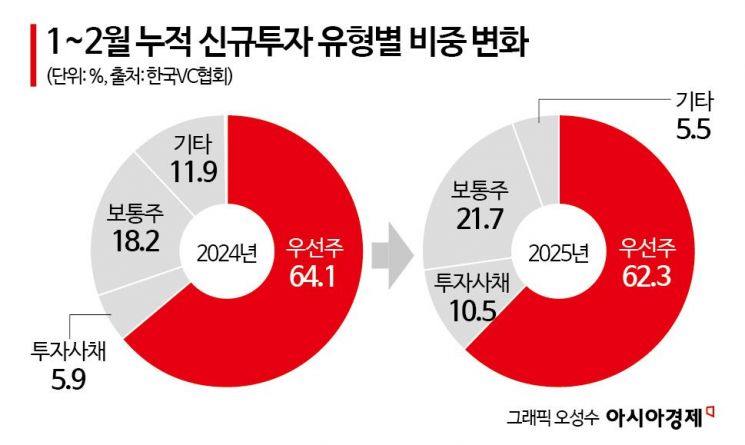

Greater Share for Convertible Bonds and Common Stocks, Decline in Preferred Stocks

Amid the prolonged cold spell in venture investment, the venture capital (VC) industry’s trend toward stability-oriented investment is solidifying. This is due to the increased difficulty of exits (investment recovery) caused by the simultaneous slump in the initial public offering (IPO) market, raising concerns that the fundamental goal of VCs?to invest in early-stage companies with growth potential?is being shaken.

According to the Korea VC Association on the 3rd, a survey of the proportion of new investments by VC experience in Korea from January to February this year showed that the share of 'late-stage investments' exceeded half, reaching 51.5%. This is a significant increase from 41.7% in the same period last year. Meanwhile, the share of early-stage investments decreased from 22.3% to 16.8%, and mid-stage investments dropped from 36.0% to 31.7%.

Although the overall scale of new investments showed a gradual recovery, VCs have become more selective in picking startups. During this period, new investment funds amounted to 765.5 billion KRW, a 22.1% increase compared to 626.8 billion KRW in the same period last year. However, the number of investee companies receiving new investments decreased from 444 to 351. By industry, ICT services (25.9%) and bio/medical (18.5%) sectors were the main pillars of investment.

This reflects the concentration of funds on companies with verified business models and stable revenue structures. The market has been in a slump following the overheated venture investment period of 2021?2022, with consecutive failures in IPO successes.

A domestic VC CEO said, "Risks have increased regardless of domestic or international markets," adding, "We have to deploy funds that were postponed, so we are setting investment candidate criteria to find and attach to 'companies with absolutely good performance'." Another VC industry insider explained, "While there is a mood of watching the market itself, we cannot keep the money idle. Since exits are difficult not only through IPOs but overall, VCs find it hard to open their wallets."

Accordingly, exit strategies are diversifying. Looking at new investment types from January to February this year, the proportion of convertible bonds increased from 5.9% in the same period last year to 10.5%, and common stock rose from 18.2% to 21.7%. The proportion of preferred stock slightly decreased from 64.1% to 62.3% in the same period last year. Typically, VCs prefer to sell held preferred stocks after an IPO. As the market itself shrinks, it is interpreted that the proportion of investments in more liquid common stocks or convertible bonds (CBs) has increased.

Researcher Suyeon Kim of Hanwha Investment & Securities explained, "Exits are becoming more difficult in Korea, causing investment to stagnate. As IPO and delisting requirements are strengthened together, more companies are withdrawing their review requests, and venture investments have started to be affected. The venture investment market is recovering more slowly than in other countries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)