Household Loan Growth Accelerates in April Compared to March Every Year

This Year, Spring Moving Season Demand, Rate Cut Expectations, and Toheoje Lifting Coincide

Financial Sector: "Strengthening Real-Time Monitoring and Vigilance"

Although the pace of household loan growth slowed in March, tension is spreading inside and outside the financial sector that it is still too early to be reassured. Every year, the increase narrows in March but then reverses to growth again in April. Typically, April is the spring moving season, and it is widely expected that the impact of loan increases due to the lifting of the Land Transaction Permission System (Toheoje) will be reflected in April. Financial authorities and banks are closely monitoring the situation.

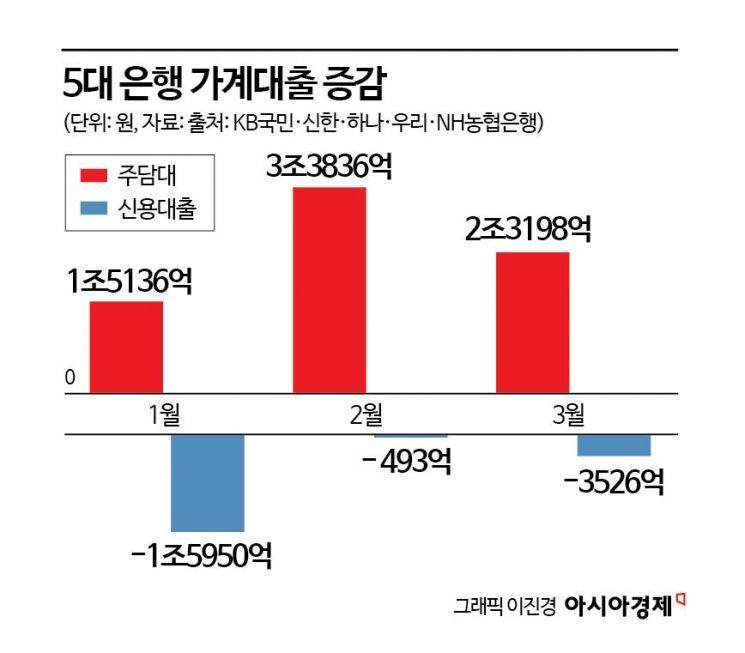

On the 3rd, it was found that the increase in household loan balances at the end of March for the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) was halved compared to the previous month. The household loan balance of the five major banks in March was KRW 738.5511 trillion, an increase of KRW 1.7992 trillion from the previous month (KRW 739.7519 trillion). This is about half the previous increase of KRW 3.0931 trillion. Housing mortgage loans in March amounted to KRW 585.6805 trillion, up KRW 2.3198 trillion from the previous month. This is somewhat lower compared to the previous increase of KRW 3.3836 trillion (from January to February). Credit loans stood at KRW 101.6063 trillion, down KRW 3.526 billion from the previous period.

Although the growth in household loans has eased, financial authorities and banks remain cautious. Typically, April sees a surge in demand due to the spring moving season, and considering the time lag until loan execution following the lifting of Toheoje, it is expected that the increase in loans will be reflected starting in April.

According to the 'February Housing Statistics' released by the Ministry of Land, Infrastructure and Transport, apartment sales in Seoul (4,743 cases) increased sharply by 46.7% compared to the previous month (3,233 cases). The Ministry analyzed this as a result of the new semester moving demand, expectations of interest rate cuts, and the lifting of Toheoje coinciding.

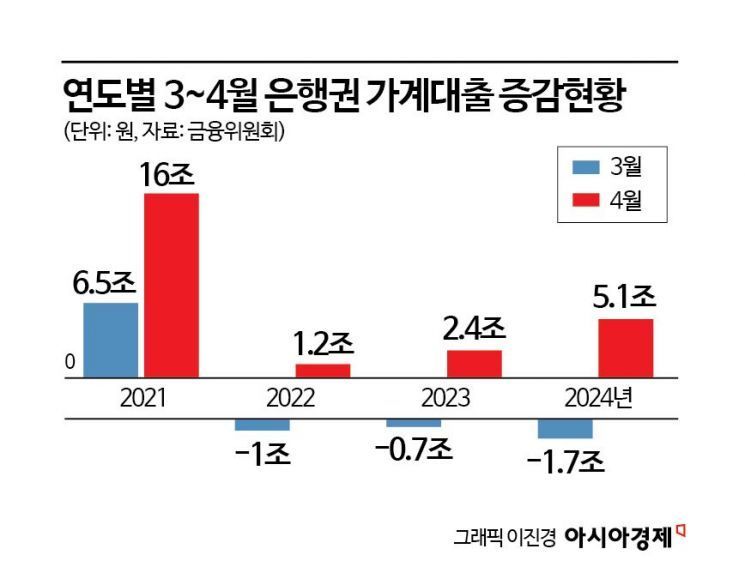

Looking at the household loan trends from the Financial Services Commission, it can be confirmed that household loans in the banking sector decreased every March but turned to growth again in April. According to the FSC, household loans increased by KRW 6.5 trillion in March 2021 but surged to KRW 16 trillion in April. In 2022, it shifted from a decrease of KRW 1 trillion in March to an increase of KRW 1.2 trillion in April. In 2023, it went from a decrease of KRW 700 billion in March to an increase of KRW 2.4 trillion in April, and in 2024, from a decrease of KRW 1.7 trillion in March to an increase of KRW 5.1 trillion in April.

On the 1st, Lee Bok-hyun, Governor of the Financial Supervisory Service, said at an executive meeting, "The impact of the short-term surge in housing prices and transaction volumes in Seoul and some metropolitan areas in February and March is being reflected in household loans from late March with a time lag," and urged, "Please conduct detailed monitoring by region."

Kim Byung-hwan, Chairman of the Financial Services Commission, also said on the 26th of last month, "Although both February and March movements were within management targets, considering the usual 1-2 month lag between signing a house contract and loan approval, we are monitoring the situation."

The banking sector is also not lowering its guard. It is expected that the impact of the lifting of Toheoje will be reflected from the end of March. Previously, when Seoul City expanded the Toheoje designation from Jamsil, Samsung, Daechi, and Cheongdam (Jam·Sam·Dae·Cheong) to the three Gangnam districts (Gangnam, Seocho, Songpa) and Yongsan District, banks immediately introduced strengthened household loan management measures, such as blocking mortgage loans for homeowners.

A financial sector official said, "Although we immediately introduced measures such as strengthening mortgage loans for homeowners following the expanded Toheoje designation, loan demand had already surged due to expectations of interest rate cuts," adding, "We are responding with daily management and continuous monitoring."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.