EV Chasm Deepens with US Tariffs

Rising Uncertainty for Separator Business

Restructuring Inevitable in Petrochemicals

LG HelloVision Also Downsizing

LG Display Needs Portfolio Advancement

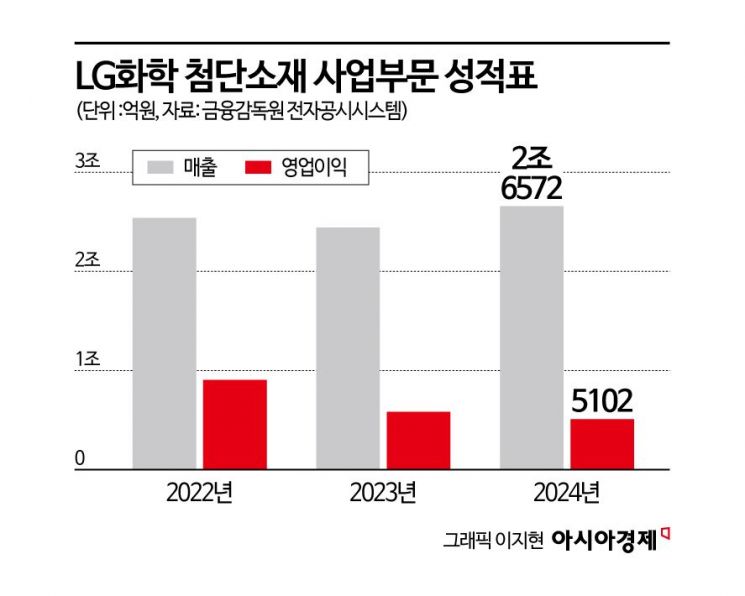

LG Chem acquired the separator business from LG Electronics in 2021 for 525 billion KRW. However, as the increase in electric vehicle demand did not progress as expected, profitability recovery lagged behind the growth in scale. Margin pressure continued due to volatility in battery raw material prices, making it difficult to find a breakthrough.

LG Chem chose to form a joint venture with a Chinese separator company. At that time, the Joe Biden administration in the U.S. implemented the Inflation Reduction Act (IRA), which stipulated that to receive subsidies for electric vehicle purchases in the U.S., battery components including separators could not be sourced from Foreign Entities of Concern (FEOC). Since China was designated as an FEOC, LG Chem's interests aligned with this policy. From the Chinese companies' perspective, Korean production was necessary to penetrate the U.S. market, and LG Chem believed it could produce separators relatively cheaply at its domestic plants.

In particular, the separator market was dominated by established players such as Japan's Sumitomo Chemical and Toray, while Chinese startups and state-owned enterprises were aggressively expanding their facilities. The wet separator technology for batteries acquired from DuPont by LG Chem also lacked sufficient time to differentiate itself.

However, the situation changed when the U.S. administration shifted to Donald Trump's Republican government. Electric vehicle demand continued to struggle, and the Trump administration moved to block even China's indirect exports. From LG Chem's perspective, the joint venture with China became burdensome.

Especially as the group emphasized a strategy of selection and concentration starting this year, the separator business appears to be gradually losing its place. Koo Kwang-mo, chairman of LG Group, recently mentioned 'selection and concentration,' delivering a message that businesses with high uncertainty should be boldly withdrawn from, and resources should be focused on areas where competitive advantages can be secured.

Because of this, the withdrawal from the separator business is interpreted as a signal of group-level restructuring. Besides materials like separators, LG Chem is also facing inevitable restructuring in its petrochemical sector. The naphtha cracker (NCC) utilization rate, which exceeded 90% in 2021, dropped to the 70% range by mid-2023. An LG Group official commented on the petrochemical portfolio adjustment, saying, "The deficit is currently decreasing," and that it is "a process of overcoming difficulties."

Other affiliates are also looking for areas to downsize. LG HelloVision has faced difficulties, recording losses for three consecutive years and conducting its first-ever voluntary retirement last year since its founding. Although it plans to establish mid- to long-term growth engines through new businesses such as rental and education this year, voices are calling for priority on structural reform amid the overall challenges in the paid broadcasting market.

LG Display, which is also in the red, needs to advance its portfolio. It is seeking breakthroughs centered on the OLED business, but the technological gap with Chinese companies is gradually narrowing.

LG Household & Health Care, which recorded an operating profit of 459 billion KRW last year, is also concerned about the domestic market slump in China. LG Household & Health Care has declared a global business restructuring this year. Opinions both inside and outside the group suggest the need for portfolio advancement and business reorganization.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.