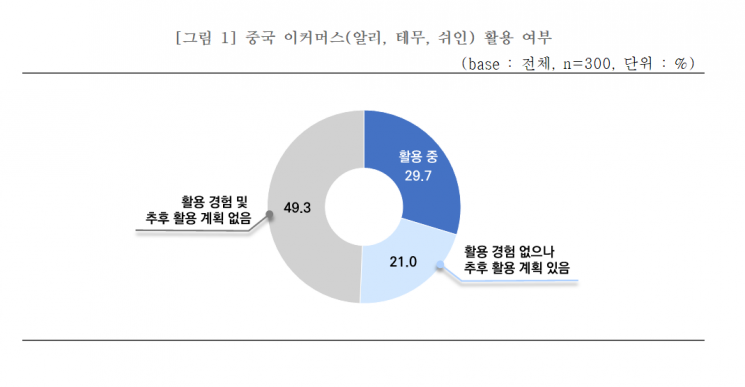

"Currently Utilizing Chinese E-commerce" 29.7%

"Plan to Use in the Future" 21.0%

Among domestic small and medium-sized enterprises (SMEs), more than half are either currently utilizing Chinese e-commerce or have intentions to do so in the future. However, the majority of companies have not established response strategies to the expansion of Chinese e-commerce into the domestic market.

According to the results of the "Survey on Opinions of SMEs and Small Business Owners Regarding the Expansion of Chinese E-commerce into the Domestic Market" released by the Korea Federation of SMEs on the 2nd, 29.7% of companies are currently using Chinese e-commerce, and 21.0% expressed intentions to use it in the future. Meanwhile, 49.3% stated that they have no experience or plans to use it. This survey was conducted from the 17th to the 21st of last month, targeting 300 SMEs in manufacturing and distribution sectors.

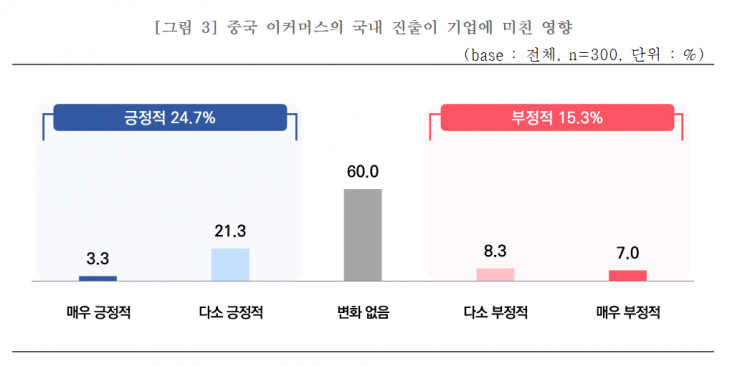

The most common method of utilizing Chinese e-commerce was "Entering Chinese e-commerce platforms to expand domestic market share" (65.2%). This was followed by "Purchasing products from Chinese e-commerce for domestic resale (parallel imports)" (11.2%) and "Procuring raw materials or components through Chinese e-commerce" (6.7%). Regarding the impact of Chinese e-commerce's expansion into the domestic market, 24.7% responded positively, which was higher than the 15.3% who responded negatively, while 60.0% reported no change.

The main reasons for positive impact were "Diversification of domestic and international online sales channels" (47.3%), followed by "Reduction in entry fees compared to existing distribution channels" (16.2%), and "Cost reduction (raw material procurement, logistics and shipping fees, etc.)" (14.9%). The reasons for negative impact included "Loss of consumers due to decreased price competitiveness of own products" (45.7%), "Decline in brand value of domestic companies (counterfeits, etc.)" (19.6%), "Discriminatory disadvantages such as tariff-free and certification-free imports" (17.4%), and "Increase in marketing costs" (8.7%).

Regarding response strategies to the expansion of Chinese e-commerce into the domestic market, 63.7% reported "No special response strategy." Other strategies included "Expanding use of domestic e-commerce platforms" (10.3%), "Developing differentiated products" (9.0%), and "Price reduction" (8.7%).

As the top priority support policy for the domestic expansion of Chinese e-commerce, the highest percentage (34.7%) answered "Strengthening certification and inspection for companies entering Chinese e-commerce platforms." Other responses included "Support for domestic e-commerce platform companies (such as fee reductions)" (32.3%), "Strengthening customs clearance and quality inspections for overseas direct purchase products" (26.3%), "Strengthening sanctions against intellectual property rights infringements such as patents and trademarks" (23.0%), and "Enhancing logistics competitiveness through support for logistics costs" (21.7%).

Choo Moon-gap, Director of the Economic Policy Headquarters at the Korea Federation of SMEs, said, "The results of this survey confirm that Chinese e-commerce presents both new challenges and opportunities for SMEs. Considering the likelihood that the influence of Chinese e-commerce in the domestic market will continue to expand, it is necessary to proactively strengthen quality certification and inspection, as well as intellectual property protection, to minimize damage to SMEs. Additionally, policy support such as assistance for e-commerce platform entry and logistics cost support should be expanded to help SMEs adapt to the new distribution environment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.