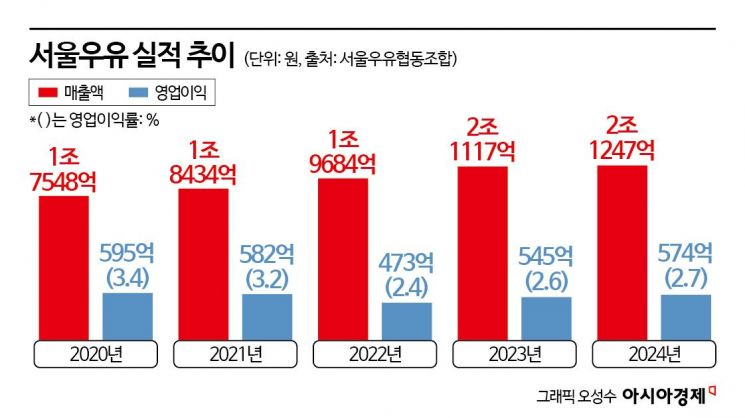

Sales Reach 2.1247 Trillion Won Last Year, Operating Profit at 57.4 Billion Won

Premium White Milk Like A2+ Drives Market Share to No. 1

Challenges Remain: Low Profitability and Tariff-Free Imported Dairy Products

Seoul Milk Cooperative has maintained its position as the strongest player in the dairy industry by surpassing 2 trillion won in sales for two consecutive years, leveraging the competitiveness of its core business, white milk. However, challenges such as declining milk consumption and the distribution of tariff-free imported milk remain to be addressed.

Seoul Milk Leads with Premium A2, Surpasses 2 Trillion Won for Two Consecutive Years

According to Seoul Milk Cooperative's business disclosure on the 31st, last year Seoul Milk's sales amounted to 2.1247 trillion won, a 0.6% increase compared to the previous year (2.1117 trillion won). Operating profit was 57.4 billion won, up 5.3% from 54.5 billion won the previous year.

Seoul Milk attributes this success to a strategy focused on core business competitiveness by emphasizing high-quality domestic raw milk despite challenging internal and external conditions. In April last year, Seoul Milk strengthened its raw milk competitiveness by introducing 'A2+ Milk,' which is made exclusively from cows with the A2 protein genotype, featuring first-grade somatic cell count and 1A-grade bacterial count high-quality raw milk containing only A2 protein. A2 milk is a premium milk product that excludes A1 protein, which causes stomach discomfort, making it easier to digest and gaining popularity as a comfortable milk option.

Seoul Milk explained, "By launching A2+, a market-leading product using high-quality raw milk, we were able to enhance the cooperative's profitability and respond to the expansion of imported sterilized milk with quality." They added, "Since its launch, A2+ milk has achieved cumulative sales of 33 million units (based on 200ml) by December, successfully establishing itself in the market and receiving positive consumer feedback." According to market research firm Nielsen, Seoul Milk's market share in the domestic milk market last year was 44.9%, maintaining first place thanks to the smooth market entry of A2+ milk.

The fermented milk business also contributed. The fermented milk sector saw overall sales grow by more than 10% year-on-year, driven by the growth of major brands such as 'The Jinhan' and 'Biyotte.' In particular, plain yogurt sales have increased by about 30% annually over the past four years, achieving 140% of the previous year's sales last year. Additionally, in the processed products sector, cheese sales increased by 100.1% year-on-year, supported by new product launches such as 'Healthy Cheese' and 'Triple Shred.'

Seoul Milk plans to continue its growth this year through premium products like A2+. While the domestic milk market is shrinking due to low birth rates, Seoul Milk, the number one dairy company in Korea, aims to use 'A2 milk' as a breakthrough and plans to fully switch its raw milk to 'A2' by 2030. Since six out of ten Koreans suffer from lactose intolerance (lactase deficiency), making it difficult to consume milk, the dairy industry intends to overcome these challenges with A2 milk, which aids digestion.

Moon Jin-seop, chairman of Seoul Milk Cooperative, said, "Despite the difficult dairy industry environment, our unwavering focus on our core business strategy has paid off." He added, "We will continue to produce various high value-added products based on high-quality raw milk and introduce products that reflect consumer trends, befitting the reputation of Korea's leading dairy company."

Challenges Remain Despite Joining the 2 Trillion Club: Profitability and Tariff-Free Imports

However, Seoul Milk still faces challenges such as improving profitability. Last year, Seoul Milk's operating profit margin was 2.7%, remaining in the 2% range for three consecutive years since 2022. Compared to Binggrae, which focuses on processed milk with a high margin and had a 9.0% operating profit margin last year, Seoul Milk's margin is about one-third, and it is also significantly lower than Maeil Dairies' 3.9%.

Although Seoul Milk has declared that strengthening core business competitiveness is its top priority as the strongest domestic white milk brand, white milk consumption continues to decline. The company cannot rely solely on white milk for its future. According to the Korea Rural Economic Institute, domestic raw milk consumption last year was 4.153 million tons, a 3.6% decrease from the previous year, and per capita raw milk consumption capacity is estimated to have decreased by 3.7% to 80.8 kg.

The recent launch of the new product 'Seoul Milk Melon' is also interpreted as part of a strategy to overcome stagnation in the white milk market. Seoul Milk is actively expanding its processed milk lineup this year with products such as 'Minos Banana Milk' and 'Gangneung Coffee Einsp?nner.'

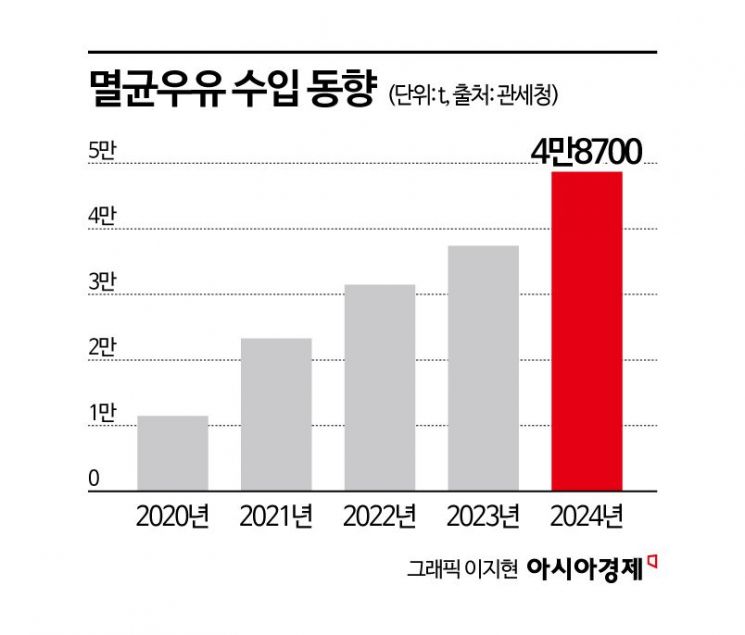

In particular, Seoul Milk faces competition from imported milk due to the elimination of milk tariffs under free trade agreements (FTA). Starting next year, tariff-free imports will apply to dairy products, with tariffs on U.S. dairy products decreasing from 4.8% last year to 2.4% this year, and 0% next year. This is expected to lead to a surge in demand for imported sterilized milk, which is cheaper than domestic milk and has a longer shelf life.

In fact, last year, imports of sterilized milk increased by 30.2% year-on-year to 49,000 tons.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)