Expansion of the Definition of Trade Barriers... Report Objectives Also Change

Xi Jinping's Policy to Promote 'Made in China' Products Called "Harmful"

Detailed Mention of South Korea's Beef and Processed Food Import Bans

On April 2 (local time), the '2025 National Trade Estimate Report on Foreign Trade Barriers (NTE)', considered the 'benchmark' for the U.S. reciprocal tariffs to take effect, was released on March 31. This report, prepared by the U.S. Trade Representative (USTR), broadly redefined trade barriers compared to 2024, which narrowly defined them and recognized each country's 'sovereignty.' For South Korea, it raised the issue of defense offset trade for the first time and intensified criticism regarding network usage fees. For China, it directly criticized preferential policies for domestic products and hinted at countermeasures related to shipping and shipbuilding industry policies.

'Expansion of the Definition of Trade Barriers... Enforcement of Trade Laws as Report Objective

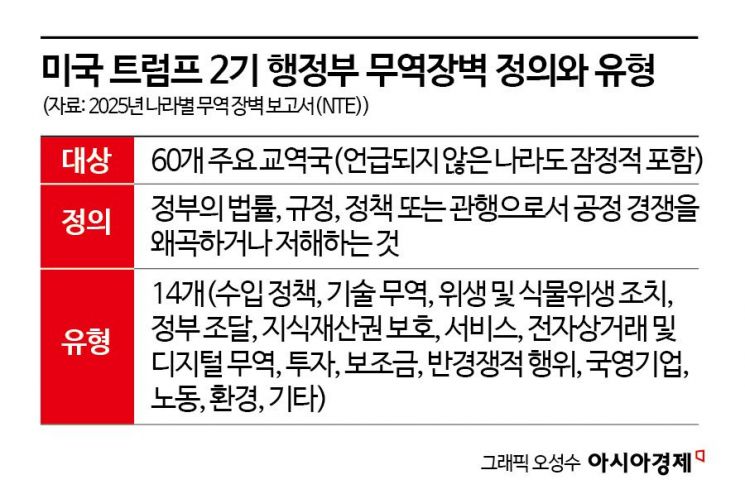

Earlier, the USTR incorporated feedback from U.S. economic organizations and institutions last month to prepare this NTE for implementing reciprocal tariff policies. The 397-page report this year significantly expanded the definition of trade barriers. Last year, trade barriers were narrowly defined as "government measures that excessively hinder the exchange of goods and services between countries," but this year, they are broadly defined as "government laws, regulations, policies, or practices that distort or impede fair competition." This includes government-led industrial promotion policies and non-market policies and practices such as government subsidy-based exports. Measures to protect domestic industries or artificially promote exports of specific items, as well as insufficient intellectual property (IP) protection, are all considered trade barriers.

The report's purpose also changed. Last year, it stated it would "help promote the interests of American workers," but this year, it explicitly states it is "an important means to enforce U.S. trade laws and promote the nation's economic and security interests." The types of trade barriers remain the same as the previous year, totaling 14 categories: import policies, technology trade, sanitary and phytosanitary measures, government procurement, IP protection, services, e-commerce and digital trade, investment, subsidies, anti-competitive practices, state-owned enterprises, labor, environment, and others. Additionally, the report includes a special review of trade agreement performance related to telecommunications.

South Korea's Trade Barriers Highlighted: Beef Import Restrictions and Offset Trade

Regarding South Korea, the report pointed out issues with defense offset trade. It noted that through the defense offset trade program, policies have been pursued prioritizing domestic technology and products over foreign defense technology. It also pointed out that offset trade obligations may arise for foreign contractors when contract values exceed $10 million (approximately 1.47 billion KRW). Offset trade refers to a trade method where, when purchasing weapons, military supplies, or services exceeding $10 million from abroad, the contracting party receives technology transfer, parts manufacturing/export, or military support in return. This is the first time the NTE report has mentioned South Korea's offset trade.

Beef import restrictions were also cited as an issue. The report described South Korea's agreement in 2008 with the U.S. to open the beef market, allowing imports only from cattle under 30 months of age, as a "transitional measure" that was "maintained for 16 years," criticizing it. It also noted that South Korea bans imports of processed beef products such as jerky and sausages regardless of cattle age, describing the import ban on processed beef products more specifically than in previous years.

South Korea's regulatory system related to agriculture and biotechnology was also criticized. The U.S. government officially raised concerns about approval procedures and related policies for genome-edited products at the Korea-U.S. Free Trade Agreement (FTA) Sanitary and Phytosanitary (SPS) Committee meeting on September 24 last year, which was noted for the first time. However, it also mentioned that a draft easing regulations on Living Modified Organisms (LMO) was prepared in the Korean National Assembly last year.

Among digital trade barriers, criticism of network usage fees intensified. The report claimed that the current monopoly of South Korea's Internet Service Providers (ISPs) is strengthening and anti-competitive. It stated that multiple bills requiring content providers to pay network usage fees to ISPs have been submitted to the Korean National Assembly, and argued that some Korean ISPs also provide content, so requiring U.S. content providers to pay fees would benefit Korean competitors. The online platform bill promoted by South Korea was also cited as a similar regulatory case.

The expansion of U.S. automobile manufacturers' entry into the Korean market was listed as a 'priority' issue. Concerns were raised about transparency issues regarding emission-related parts regulations under South Korea's Air Quality Preservation Act. For the pharmaceutical and medical device industries, the report mentioned industry concerns about a lack of transparency in South Korea's pricing and reimbursement policies and insufficient opportunities for stakeholders to provide input on proposed policy changes. Additionally, the report cited restrictions such as a ban on foreign investment in terrestrial broadcasting, foreign ownership limits for cable and satellite broadcasters, and investment restrictions in meat wholesale businesses. It also pointed out a lack of guidelines for enforcement in South Korea's chemical substance management laws and enforcement decrees, as well as insufficient protection of business confidential information.

The report also mentioned that South Korea's National Intelligence Service imposes additional cybersecurity certification requirements through the Security Evaluation System (SES), and that public institutions in South Korea require network equipment procured to include encryption functions certified by the National Intelligence Service. In particular, it claimed that the Korea Internet & Security Agency's Cloud Security Assurance Program (CSAP) "creates significant barriers for foreign cloud service providers seeking to enter South Korea's public sector."

Direct Criticism of China... Relatively Mild Tone Toward Japan

A view of Balboa Port near the Panama Canal. The Panama Canal, partially operated by the Hong Kong company CK Hutchison Holdings, has recently emerged as a new point of contention in the US-China conflict. /Photo by AFP and Yonhap News

A view of Balboa Port near the Panama Canal. The Panama Canal, partially operated by the Hong Kong company CK Hutchison Holdings, has recently emerged as a new point of contention in the US-China conflict. /Photo by AFP and Yonhap News

The report devoted 48 pages to China, featuring structural and strategic warning messages to the Chinese government. It is a post-evaluation of the 'Phase One Trade Agreement' reached between the U.S. and China in December 2019. While last year it only pointed out insufficient implementation, this year it criticized that "the agreement clearly failed to bring fundamental changes to China's state-led non-market system." It also criticized China for failing to fulfill purchase commitments.

Particularly, it openly targeted the 'Made in China 2025' policy, which Chinese President Xi Jinping has promoted since 2015 to secure core industrial competitiveness. The report described it as "far-reaching and harmful." It noted that the ultimate goal of this policy is for Chinese companies to dominate the domestic market and then use that as a base to dominate global markets. It added that such Chinese policies impose burdens on other World Trade Organization (WTO) members and the WTO system. For example, regarding semiconductors, the U.S. government claims that China is implementing large-scale policies such as subsidies, state capital support, and easing export controls to foster its domestic semiconductor industry.

The report also included references to the shipping industry, which has recently been at the forefront of the U.S.-China trade war. It stated, "The U.S. shipbuilding industry faces a significant challenge of losing commercial shipbuilding capacity and competitiveness," attributing this largely to unfair practices by the Chinese shipbuilding industry. The report noted that China's commercial ship market share increased from 5% in 1999 to over 50% in 2023. It added, "We continue to consider the use of trade remedies, including Section 301 of the Trade Act of 1974, to address these harms." Earlier market reports indicated that the U.S. government is considering measures such as raising port entry fees exclusively for Chinese vessels.

Regarding Japan, the report maintained a relatively mild tone. It stated, "The U.S. and Japan continue to implement the U.S.-Japan Trade Agreement (USJTA) and the U.S.-Japan Digital Trade Agreement (USJDTA)," but added a caveat that "progress is lacking in agriculture, digital trade, and regulatory transparency."

The USTR prepares the NTE annually by March 31 and submits it to the President and Congress. However, this year's report was released just before the reciprocal tariffs take effect on April 2, giving it special significance. The market expects that the issues raised in this year's report will influence whether reciprocal tariffs are imposed by each country and the tariff rates if imposed.

Meanwhile, following the NTE report release, U.S. economic organizations showed mixed reactions. The Computer & Communications Industry Association (CCIA) supported digital trade barriers and expressed strong support for the USTR. Conversely, the International Dairy Foods Association (IDFA) commented that sanctions such as raising port entry fees for Chinese vessels up to $1 million would negatively impact the U.S. dairy industry.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.