"Focusing on TV Dramas Even at the Risk"

Adjusting Production Costs with Cost-Minimized Dramas

"Securing IP to Explore New Opportunities Such as Remakes"

"Production companies must build self-sustainability by securing intellectual property (IP)." This was a statement repeatedly emphasized by Yoon Ki-yoon, CEO of SLL, at the '2025 Broadcasting and Video Leaders Forum' seminar held on the 28th of last month at the Content Korea Lab (CKL) Corporate Support Center in Jung-gu, Seoul. He stated, "Accumulating IP is essential to ensure the future," adding, "There is still opportunity because global interest in K-content is high."

SLL is a key partner studio of Netflix. Last year, it provided original content such as Black and White Chef: The Culinary Class War, Parasite: The Grey, and In the Forest Where No One Is, generating profits. However, all IP had to be transferred. Netflix purchases content by setting prices at 1-20% above production costs. While production companies must forgo potential future earnings from IP, they secure stable profits without losses.

Initially, many production companies preferred this model because it guaranteed production costs and profits. Recently, however, there has been a shift back toward broadcasters. This is because Netflix’s content investment decisions have extended to 2-3 years, and even after initial approval, ongoing negotiations such as continuous script revisions have increased. Most production companies find it difficult to bear the costs incurred during this period. Ultimately, Netflix original content has become the domain of large content producers like CJ ENM and SLL or select partner studios.

Despite the close relationship, SLL seeks change due to difficulties in diversifying revenue. CEO Yoon revealed, "Since we do not have the rights to various businesses such as spin-offs from successful works, we want to focus on TV dramas even if it means taking risks."

The situation outside Netflix is equally challenging. Above all, with the widespread adoption of OTT platforms, TV viewership ratings have significantly declined. This has caused cracks in the advertising market, shaking the basic framework for recouping production costs. CEO Yoon said, "The domestic broadcasting advertising market size has shrunk from 3.5 trillion won to 2.6 trillion won, decreasing by 300 billion won annually," adding, "Profitability inevitably worsens."

For terrestrial broadcasters, the maximum advertising revenue for a 16-episode series during prime viewing hours is around 15 billion won. If the production cost per episode exceeds 1 billion won, advertising revenue alone cannot cover production costs. Considering the market characteristics where hits are unpredictable, the production cost that broadcasters can afford without incurring losses is about 7 to 8 billion won. In a highly competitive drama market, meeting viewers’ expectations under these conditions is not easy.

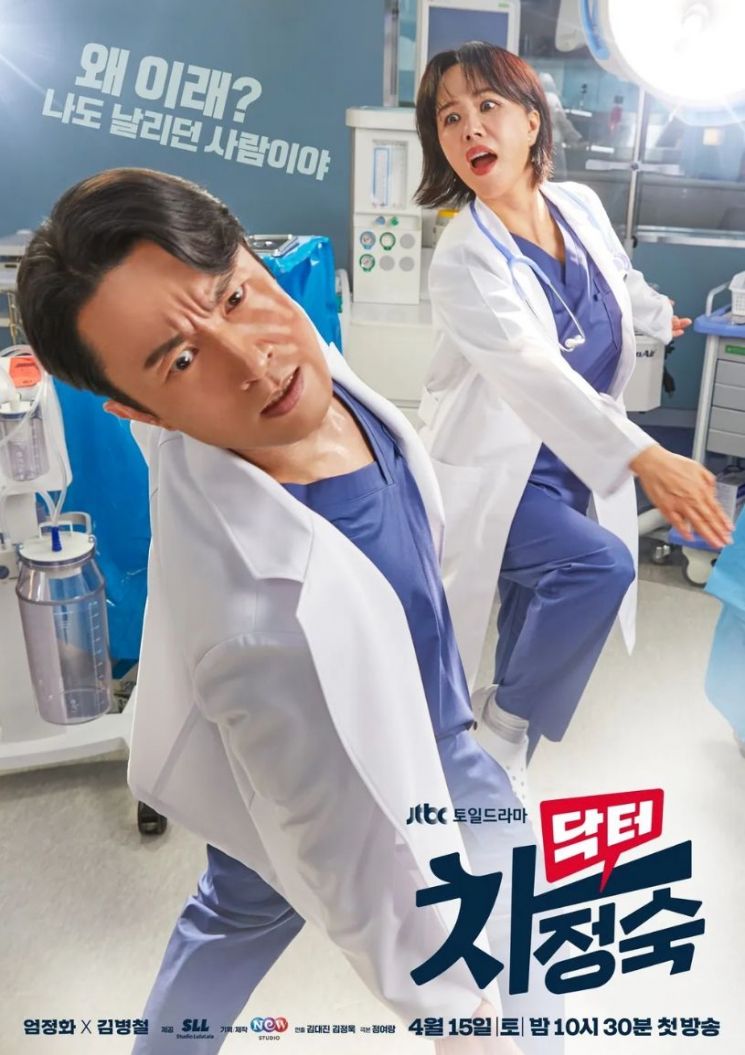

SLL plans to seek new solutions by securing IP through cost reduction. CEO Yoon explained, "We are adjusting production costs with dramas that minimize expenses, such as CJ ENM’s Seonjae Upgo Twieo, which features rookie actors, and SLL’s Doctor Cha Jeong-sook, which stars older actors," adding, "Securing IP even in this way allows us to explore new avenues like remake rights sales and Korea-Japan co-productions." He emphasized, "If the government can foster win-win outcomes through effective policy support, more production companies will achieve good results in the global market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)