Prices Rise for Eight Brands Starting from the 1st

High Exchange Rate and Raw Material Costs Drive Increases

Inflation Rate Exceeds 3%, Intensifying Consumer Burden

Korea Food Industry Association: "Price Hikes Unrelated to Political Instability"

Domino price increases have become a reality in the domestic food industry. Amid sluggish domestic demand, rising exchange rates, increased raw material costs, and growing labor expenses, the industry views product price hikes as an inevitable choice. However, as high inflation continues to strain household budgets, criticism has emerged that food companies took advantage of the power vacuum created by last year's year-end martial law incident and impeachment crisis to raise prices.

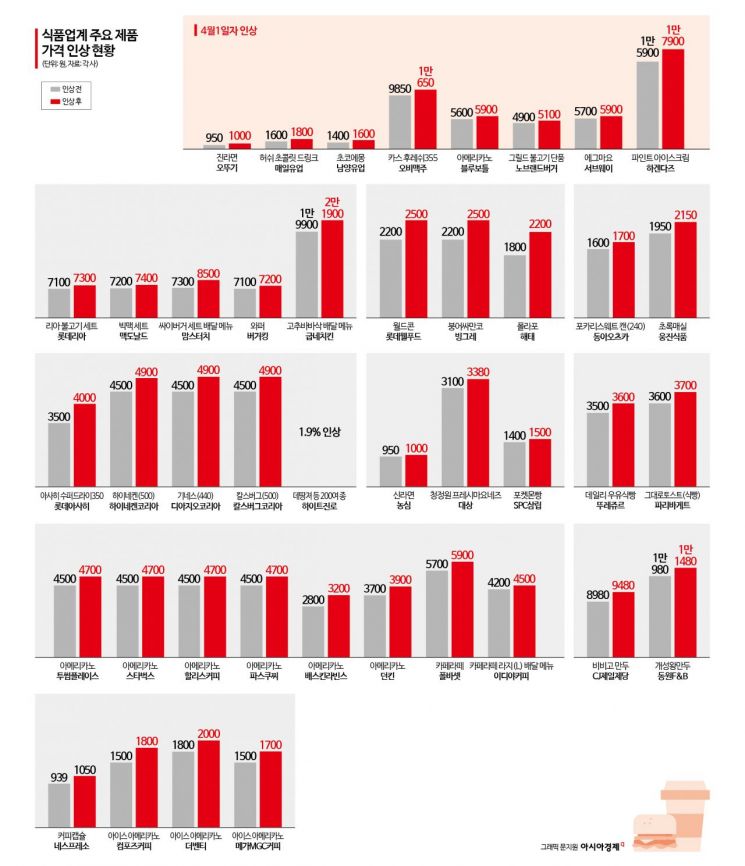

According to the food industry on the 1st, product prices from eight food companies were raised starting that day. Ottogi increased the average ex-factory price of 16 ramen products including Jin Ramen, Odongtongmyun, and Jjashu-leng, while OB Beer raised prices for beers such as Cass, Heineken, Carlsberg, and Guinness.

On the same day, Namyang Dairy Products and Maeil Dairies decided to raise prices on some of their products by an average of 8.9%. Namyang’s Choco Emong (190ml) will increase from 1,400 won to 1,600 won, a 14.3% rise. Maeil Dairies’ Hershey’s Chocolate Drink (190ml) will go up by 200 won to 1,800 won. Sandwich brand Subway, No Brand Burger operated by Shinsegae Food, Blue Bottle, and H?agen-Dazs also joined the price hike trend.

Lotte GRS’s burger franchise Lotteria is set to raise prices on the 3rd. Prices for 65 menu items will increase by an average of 3.3%.

Price hikes in the food industry have been pouring in since the beginning of this year. Prices are rising across sectors including ramen, confectionery and bakery, alcoholic beverages, coffee, and burgers. The only company mentioned as not having raised prices is Samyang Foods.

The domino price increases this year are attributed to rising raw material costs and a high exchange rate. Global agricultural product prices surged due to climate change, pushing up raw material prices, while the rising exchange rate further increased import costs. Logistics and labor costs have also significantly increased, contributing to the situation, according to the food industry.

In fact, the price of cocoa, a raw material for chocolate, was $8,071 per ton as of the 20th of last month, up 35.4% compared to last year and 250.6% compared to the average year. This marks roughly a threefold increase since 2023. The cause is flooding and droughts that have consecutively hit West African regions such as C?te d'Ivoire and Ghana, the main cocoa producing areas.

Coffee bean prices also rose, with the international Arabica coffee bean price reaching $8,629 per ton as of the 21st of last month, a 20% increase compared to the same period last year. Brazil, the world's largest coffee producer, has experienced severe drought and abnormal heat, worsening coffee tree yields. Vietnam, the world's second-largest coffee producer, has seen climate changes such as droughts and heavy rains caused by El Ni?o affecting farms, leading to a shift toward more profitable durian cultivation and a decrease in coffee production. The U.S. Department of Agriculture (USDA) estimated coffee production at 168 million bags as of December last year, 1.2 million bags lower than the June forecast of the same year.

However, the price of wheat flour, a major ingredient in processed foods, has been declining this year. According to the Korea Agro-Fisheries & Food Trade Corporation, the average international wheat price this year is $203.77 per ton, 3% lower than last year's average and 13% below the average year.

An industry insider explained, "Nothing has escaped price increases, including coffee beans and cocoa," adding, "International prices for wheat flour and butter are relatively stable, but the high exchange rate is increasing the burden." Recently, the won-dollar exchange rate has fluctuated around the 1,450 won level. The exchange rate, which soared due to the emergency martial law in December last year, has become entrenched at a high level with the inauguration of the second Trump administration in the U.S.

Processed Food and Dining Price Inflation Expected to Exceed 3%... Consumer Burden Intensifies

According to the price hikes, consumer burdens are increasing. Due to successive food price increases, the inflation rate for processed foods and dining out is expected to exceed 3%. According to Statistics Korea, the processed food price inflation rate remained in the 1% range last year but surged to 2.7% in January this year and further to 2.9% in February, surpassing the overall consumer price index increase of 2%. The dining out price inflation rate was 3% in February.

Some criticism has been raised regarding price hikes during the power vacuum period caused by the impeachment crisis. Following the December 3 emergency martial law incident, food companies have successively raised prices, allegedly taking advantage of the government's relaxed price control amid political turmoil to improve profitability.

In response, the Korea Food Industry Association stated in a press release that "Due to ongoing domestic demand stagnation, high exchange rates, high oil prices, worsening international conditions, and rising international raw material prices caused by abnormal climate, price increases for processed foods are unavoidable," adding, "The industry has restrained price hikes for several years and the current political instability is unrelated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.