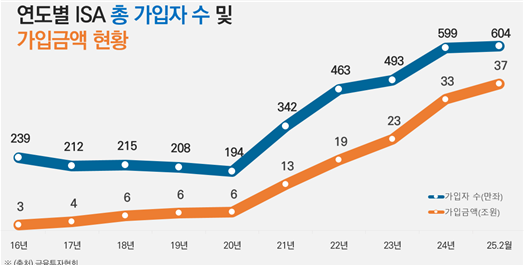

The number of subscribers to the Individual Savings Account (ISA), introduced by the government in 2016 to support wealth formation through comprehensive asset management for the public, has surpassed 6 million in about 9 years.

The Korea Financial Investment Association announced on the 31st that as of the end of last month, the number of ISA subscribers was 6,043,000, with subscription amounts totaling 36.5408 trillion KRW.

ISA is a tax-advantaged account that allows investment in various financial products such as domestic listed stocks, funds and ETFs, REITs, and deposits/savings all within a single account.

After a certain period, profits and losses among financial products within the account are aggregated, and up to 2 million KRW (up to 4 million KRW for the low-income type) of net profit is tax-exempt under the general type. Amounts exceeding this are subject to a low separate tax rate of 9.9%.

The number of ISA subscribers and subscription amounts have sharply increased since the introduction of the ‘brokerage-type ISA’ in 2021, which allows subscribers to directly invest and manage financial products. Brokerage-type subscribers numbered 5,056,000, accounting for 83.7% of the total. The trust-type, which had 1,719,000 subscribers at the end of 2020, decreased by 851,000 to 868,000 (14.4%) as of last month. During the same period, the discretionary type also declined from 220,000 to 119,000 (2.0%), a decrease of 101,000.

By financial sector, securities companies had the most subscribers at 5.1 million (84.3%), driven by the popularity of the brokerage-type ISA, which can only be opened at securities firms. Banks, which serve as the main channel for trust-type accounts focused on deposits and savings, had 947,000 subscribers (15.7%), about half of the 1,783,000 at the end of 2020.

Among brokerage-type subscription funds, 40.6% are managed in ETFs and 32.8% in stocks. Trust-type accounts are composed of 95.0% deposits and savings, while discretionary-type accounts hold 97.1% in funds.

ISA subscriptions have increased across all age groups. The proportion of subscribers in their 20s and 30s, who are relatively familiar with financial investment products, rose from 32.8% at the end of 2020 to 40.1% as of last month.

By ISA type, the 20s and 30s age group had a higher proportion in brokerage-type (44%), discretionary-type (28%), and trust-type (20%), while those aged 50 and above had higher proportions in trust-type (59%), discretionary-type (50%), and brokerage-type (33%).

By gender, among the 20s and 30s, males (1.31 million) outnumbered females (1.11 million), whereas among those aged 50 and above, female subscribers (1.23 million) outnumbered males (1.01 million).

With the government’s plan to expand ISA tax benefits, the scale of ISA subscriptions is expected to grow further. According to the ‘2025 Economic Policy Direction’ announced earlier this year, the tax-exempt limit will increase to 5 million KRW for the general type (10 million KRW for the low-income type). The annual contribution limit will also expand from 20 million KRW (total 100 million KRW) to 40 million KRW (total 200 million KRW). The National Assembly is actively discussing the expansion of ISA benefits.

Lee Hwan-tae, Head of the Industry Market Division at the Korea Financial Investment Association, introduced ISA as “a ‘universal financial technology account’ that has broadened opportunities for the public to build assets while serving as a catalyst for real economy growth.” He added, “If the eligible age for subscription is expanded to minors along with the tax benefit expansion, it will help activate personal finance and strengthen the virtuous cycle structure of the capital market.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.