Korea Insurance Development Institute Conducts Study on Injuries in Minor Accidents

Results to Be Used in "Injury Risk Analysis Reports"

Preventing Automobile Insurance Payout Leakage Caused by "Nai-ronhwanja" Minor Injury Patients

The insurance industry is launching a study on how much injury occupants sustain in minor car-to-car collisions. The purpose is to establish evidence to assess the appropriateness of excessive medical treatment for minor injury patients, who are the main cause of rising loss ratios in automobile insurance.

According to the insurance industry on the 31st, the Korea Insurance Development Institute recently announced a bid for a research project on the occurrence of injuries to occupants in minor accidents. In this study, the institute will investigate and analyze occupant injuries and sequelae when cars collide from the side. They plan to recreate side-impact collisions involving eight men and women aged 20 to 40, followed by diagnoses from specialists and medical examinations.

The institute plans to use the results derived from the study to prepare injury risk analysis reports. These reports are documents prepared by the institute upon request from insurers to evaluate the likelihood of compensation and the scale of damages for personal injuries caused by traffic accidents. They also have evidentiary value in courts. From 2021 to 2023, injury risk analysis reports were adopted in 48 out of 50 cases where lawsuits were filed between perpetrators and victims over minor accidents.

Last year, the institute also conducted minor car collision tests at speeds around 10 km/h and concluded that the risk of occupant injury is minimal. After recreating accidents involving 53 adult men and women and conducting examinations such as magnetic resonance imaging (MRI), no abnormal findings were observed. Shim Sang-woo, head of the Automobile Technology Research Center at the Korea Insurance Development Institute, explained, "Objective criteria related to injury risk are necessary for reasonable personal liability compensation in minor car accidents," adding, "Since minor accidents vary in types such as rear-end, front-end, and side collisions, we are conducting multiple studies to secure data."

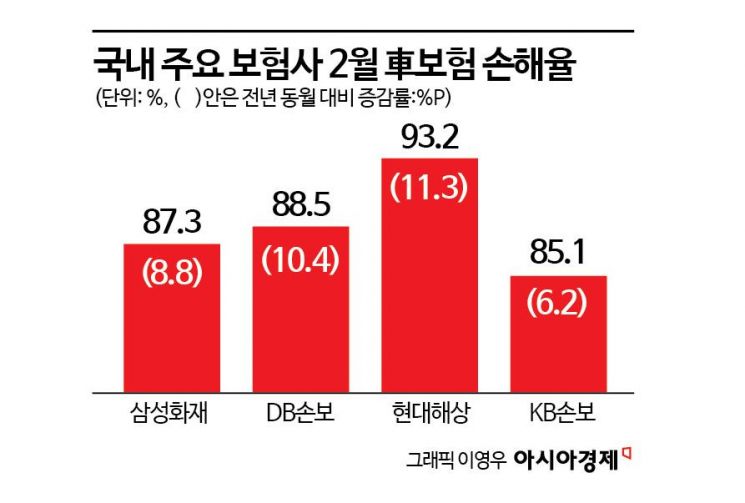

Strengthening data on minor injury patients included in injury risk analysis reports is expected to help prevent financial leakage in automobile insurance. Last year, the Big 4 insurers (Samsung Fire & Marine Insurance, DB Insurance, Hyundai Marine & Fire Insurance, and KB Insurance) paid 1.3048 trillion KRW in medical expenses to minor injury patients from car accidents, a 7.2% increase compared to the previous year. The increase in insurance payments to minor injury patients, combined with premium reductions and repair cost increases, has recently caused a sharp rise in automobile insurance loss ratios. The Big 4 insurers’ automobile insurance loss ratio last month averaged 88.5%, up 9.2 percentage points from 79.3% in the same month last year.

Recently, the government also announced a reform plan to prohibit future medical expenses for minor injury patients with a high proportion of "nai-ronhwanja" (malingerers). Future medical expenses are a type of settlement payment where insurers estimate and prepay anticipated future treatment costs at the time of settlement with the victim. The intention is to prevent minor injury patients from feigning illness to receive large settlement amounts. The government also requires minor injury patients who wish to undergo long-term treatment exceeding eight weeks to submit additional documents to insurers. Once the reform plan is fully implemented, insurers can review the documents and, if they judge the justification for additional treatment to be low, suspend insurance payment guarantees to the patient. The institute’s current study is expected to be used as evidence when insurers suspend payment guarantees.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.