Balan Announces Settlement Schedule, but Sellers Remain Skeptical

"Working to Resolve Settlement Issues," Says CEO Choi, but No Concrete Solutions

Headquarters Quiet on Site Visit

Mailbox Overflowing with Investor and Bank Documents

"All Employees Working from Home Since the 26th, Elevator Access Suspended"

On March 28, Choi Hyungrok, CEO of Balan, stated, "Once again, I apologize for not being able to repay the trust and affection you have shown Balan so far."

On this day, through a notice posted on the Balan Partner Center, CEO Choi announced that the company would finalize a plan for settlement payments by the end of this week and arrange a meeting next week to directly explain the details to sellers.

He continued, "We are taking the current situation very seriously and are doing our utmost to resolve it responsibly," adding, "We are considering various measures to resolve the settlement issue and normalize our services."

Balan Announces Settlement Schedule 'D-day'... Affected Sellers Say, "We Won't Rule Out a Class Action"

Luxury goods platform Balan caused a settlement delay incident on the 24th, and although CEO Choi issued an official statement after five days, the sellers' response remains cold. Balan cited a settlement system error as the reason and stated that it would announce the settlement schedule and specific amounts by today, but failed to provide concrete details.

One affected seller lamented, "The claim that the settlement system is experiencing errors is a lie, and the promise to announce the settlement schedule is also false," adding, "I don't even know if CEO Choi will actually meet with the shareholders in person."

Affected sellers believe that CEO Choi's notice is merely a 'stalling tactic.' They claim that Balan is postponing the settlement date by giving various excuses, just as in the TMON and WEMAKEPRICE (T-MEP) incidents. As a result, sellers are expressing their intention to respond collectively, including filing lawsuits. Sellers who have suffered damages are sharing their situations and discussing joint action through an open KakaoTalk chatroom.

On the first floor of Balan headquarters, a sign reading "All Balan Employees Work from Home on the 10th Floor" was left alone. Photo by JaeHyun Park.

On the first floor of Balan headquarters, a sign reading "All Balan Employees Work from Home on the 10th Floor" was left alone. Photo by JaeHyun Park.

Industry insiders remain uncertain whether Balan will actually make the settlement payments as scheduled, even if the company announces a settlement date. One luxury goods industry official revealed, "There are ongoing rumors that Balan will file for corporate rehabilitation procedures within the next day or two." It is reported that Balan has already appointed a legal representative and is preparing the necessary documents to initiate rehabilitation proceedings. If Balan files for corporate rehabilitation, company funds will be frozen and repayments will be made according to the rehabilitation plan, meaning sellers will not be able to receive their settlement payments immediately. This is why the industry is concerned about a 'second T-MEP incident.' However, CEO Choi did not make any specific mention of corporate rehabilitation in his notice.

Mail Piling Up in the Mailbox... Increase in Returned Packages

The mailbox on the 10th floor, where Balran's headquarters is located, was filled with various mail. Photo by JaeHyun Park.

The mailbox on the 10th floor, where Balran's headquarters is located, was filled with various mail. Photo by JaeHyun Park.

On the morning of March 28, the area in front of Balan's headquarters in Gangnam-gu, Seoul, was quiet. The mailbox on the 10th floor, where Balan's headquarters is located, was filled with various mail. Newspapers from the past three days were stuffed inside, along with documents from investors and banks. Through the glass, the parcel locker could be seen stacked like Tetris with packages addressed to "Balan." A delivery worker encountered on site in the morning explained, "About eight packages arrived from Italy this week, and three to four of them are being returned. Normally, it's only one or two per month, so this is unusually high."

Because it was during the morning rush hour, employees from other companies with access cards hurried into the building. In front of the information desk, located in the center of the building, a sign reading "All Balan Employees Work from Home on the 10th Floor" was left alone, and on the desk, an A4 sheet was prepared for visitors to write their visit time, company name, name, and contact information. The information desk staff said, "Until the 25th, Balan employees came to respond in person, but since the 26th, only the sheet has been left and all employees have switched to working from home. Currently, the elevator to the 10th floor is also blocked off."

CEO Choi explained in the notice that remote work was implemented to ensure a safe working environment for employees. For this reason, until the afternoon of the previous day, sellers visited the headquarters requesting to meet with responsible staff, but it appears they had to leave empty-handed after only leaving their name, affiliation, and phone number on the sheet.

Did Balan Fail to Establish a Settlement System?

Amid growing interest in whether settlement payments will be made, suspicions have arisen that Balan failed to properly establish a settlement system even after the T-MEP incident.

According to the Electronic Financial Transactions Act, platforms or distributors that mediate or handle settlements must register as a payment gateway (PG) service provider. If a company is not registered as a PG provider, it must not manage settlement funds directly and must deposit the settlement funds with a PG company.

However, it appears that Balan did not deposit settlement funds with a PG company. At a meeting with sellers on the 25th, Balan reportedly explained that it had been making settlement payments through Hyphen Corporation, and that the recent settlement payment error was also related to Hyphen Corporation.

However, Hyphen Corporation maintains that it was not involved in Balan's settlement payments. A Hyphen Corporation representative stated, "We only provide the infrastructure and are not directly involved in settlement funds," adding, "We have no knowledge of the actual details related to merchant settlements."

Last year, in response to criticism that platforms' settlement systems lacked transparency following the T-MEP incident, Balan stated, "Partner settlement funds are managed through a separate internal account, and all transactions are transparently recorded," and added, "We are developing settlement agency services with a PG company to ensure transparent and stable management of settlement funds."

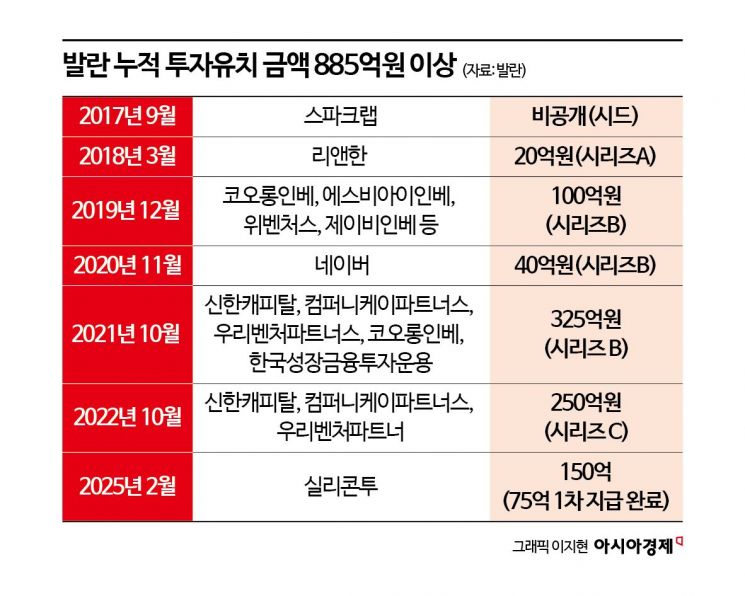

Received 7.5 Billion KRW from SiliconTwo a Month Ago... Total Investment Raised About 90 Billion KRW

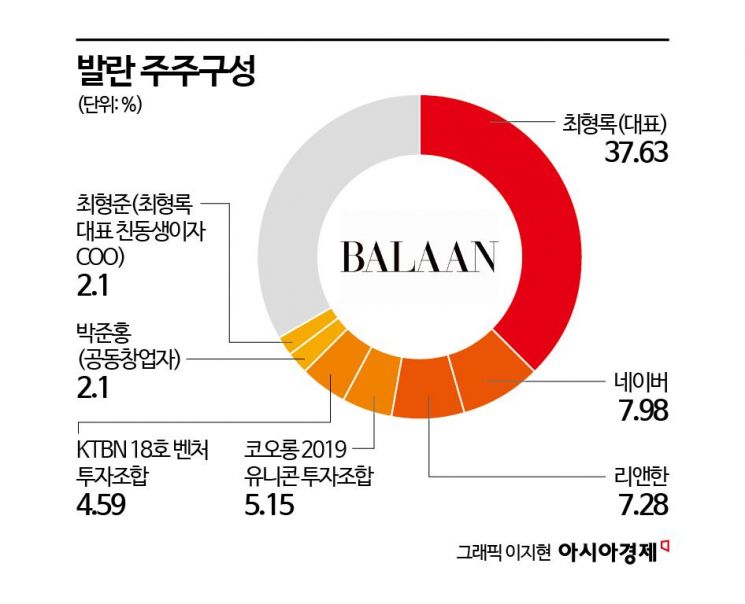

It is estimated that investors in Balan will also suffer significant losses. Since 2017, Balan has received investments totaling about 90 billion KRW up until last month. Naver (7.98%) is the second-largest shareholder, and other major investors include Li & Han, Shinhan Capital, Woori Venture Partners, Kolon Investment, Company K Partners, Korea Growth Investment Corporation, and SiliconTwo.

A representative from one of Balan's investors commented, "Compared to when things were going well, the value of our stake has shrunk to about one-tenth," but added, "Since the company has not yet filed for corporate rehabilitation, it is difficult to comment on specifics."

SiliconTwo, which invested about 15 billion KRW, has expressed its dismay over the current situation. SiliconTwo is a company that helps small and medium-sized K-beauty brands expand globally by leveraging global logistics and distribution networks. It is said that SiliconTwo decided to bet on Balan's growth potential to expand into luxury fashion. At the shareholders' meeting the previous day, a SiliconTwo representative stated, "Communication with Balan's management has not been smooth, so we will announce our position through a public disclosure in the future," and added, "We invested because of the prospect of expanding into luxury fashion overseas."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.