'10-20%' Tariff Rate Likely Under Reciprocal Tariffs

Tariff Act Section 338 Could Allow Up to 50%

Non-Tariff Barriers Like In-App Payments May Also Be Considered

Affected Companies Expanding U.S. Production

Analysis suggests that if the Donald Trump administration imposes reciprocal tariffs, the tariff burden on domestic companies could increase by 10-20%. President Trump has announced that starting April 2, reciprocal tariffs will be applied at the same level as tariffs imposed by other countries. Considering that 25% tariffs are already in effect on items such as automobiles and steel, the tariff burden on domestic companies exporting to the U.S. would exceed 40%. President Trump also warns that cloud security certification systems and electric vehicle subsidy discrimination could become targets for tariffs.

According to the 2024 Business Environment Report by the American Chamber of Commerce in Korea (AMCHAM) and analyses by trade experts on the 31st, the institutional and regulatory burdens experienced by U.S. companies in Korea are estimated to have a tariff-equivalent effect of up to 15-20%.

International organizations and major countries' trade authorities analyze these burdens by comparing the lost sales or additional costs incurred by companies due to such regulations against the total market size, assessing the extent of the burden as if it were a tariff. If the U.S. uses this as a basis for imposing tariffs, it is expected to lead to trade friction.

Han Areum, Senior Research Fellow at the Korea International Trade Association, stated, "Negotiations may unfold where a single tariff rate is proposed by country and non-tariff barriers are demanded to be lowered based on that standard."

The AMCHAM report points out Korea's Cloud Security Assurance Program (CSAP) as a representative non-tariff barrier that makes it difficult for foreign companies to enter the public market. According to the industry, obtaining certification takes 6 months to a year and costs between 1 billion and 3 billion KRW to meet technical requirements. The public cloud market is dominated by domestic companies holding 80% of the market, and it is argued that CSAP blocks entry by U.S. companies such as Amazon Web Services (AWS) and Microsoft (MS). Considering the total market size of 1.5 to 2 trillion KRW, the lost opportunity for U.S. companies is estimated at about 300 billion KRW, which can be interpreted as a tariff effect of 15-20%.

Discrimination in electric vehicle subsidies is also pointed out as causing price distortions that effectively act as tariffs. Domestic electric vehicles receive subsidies ranging from 5 million to 8 million KRW, while imported electric vehicles often receive only 1 million to 3 million KRW. For example, the Kia EV6 can receive up to 5.8 million KRW in subsidies, but the Tesla Model Y receives about 1.69 million KRW. Considering that vehicle prices average between 50 million and 80 million KRW, the subsidy gap corresponds to about 7-10% of the vehicle price. Accordingly, some imported car companies claim that the subsidy difference acts as a practical price barrier, restricting their entry into the domestic market.

The Chemical Substances Registration and Evaluation Act (Chemicals Act) is also one of the non-tariff barriers criticized by the U.S. According to the AMCHAM report, foreign companies face high entry barriers due to complicated procedures and requirements to submit corporate confidential information when registering new chemical substances. Although the government-notified registration fee for new chemical substances is about 200,000 KRW, the industry explains that additional costs such as preparing toxicity test data and professional consulting during the registration process can amount to tens of millions to hundreds of millions of KRW per company. Some companies argue that the registration cost burden is large compared to the unit price of the substance, amounting to 5-10% or more of the product price. This is analyzed as effectively equivalent to a tariff effect.

In-app payment regulations are also identified as factors affecting the profitability of U.S. companies. Google has lowered its commission from the previous 30% to 26% by allowing external payments. However, the 4 percentage point reduction in commission results in about a 13% decrease in revenue based on previous earnings. The Personal Information Protection Act and the obligation to designate a domestic agent are also repeatedly mentioned. Foreign companies must locate servers domestically and operate separate legal teams and personnel, leading to additional operating costs. This is also evaluated as an element that brings indirect high tariff effects.

Joo Won, Head of Economic Research at Hyundai Research Institute, explained, "Although it will be difficult for the U.S. Trade Representative (USTR) to comprehensively investigate all elements in a short time, various regulations could be used as cards during negotiations."

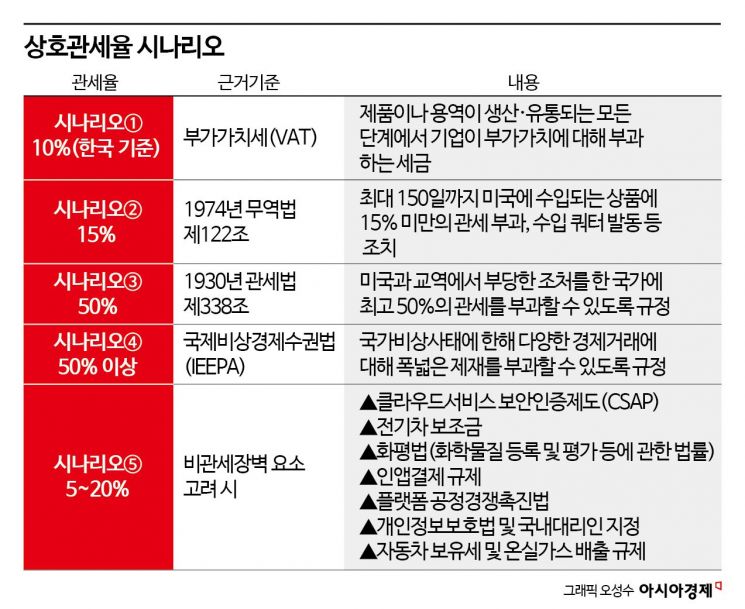

Experts propose various tariff scenarios. It is widely expected that Korea will be included in the upcoming 'Dirty 15' list that the U.S. may announce soon. In particular, a tariff method based on value-added tax (VAT) is considered the most likely scenario. Korea's VAT rate is 10%, which is higher than the U.S. average sales tax rate of 6.6%. The reciprocal tariff level is likely to be set between 10-20%. Joo predicted, "Reciprocal tariffs are likely to adopt the VAT standard, with Korea at 10% and Europe around 20%."

Additionally, under Section 122 of the Trade Act of 1974, the U.S. can set tariffs below 15% or import quotas for up to 150 days on imports, so it cannot be ruled out that this could be used as a basis for reciprocal tariffs.

Previously, the first Trump administration used 'Super 301' (Section 301 of the U.S. Trade Act) to impose high tariffs of 10-50% on various countries' products. This provision is likely to be used again as a basis for trade pressure during Trump's second term. In the worst case, retaliatory tariffs of up to 50% are possible under Section 338 of the Tariff Act of 1930, and the use of the International Emergency Economic Powers Act (IEEPA) based on a national emergency has also been mentioned.

A research fellow said, "President Trump directly mentioned Korea in his congressional speech, and Korea has been frequently mentioned in recent statements by cabinet officials. It is difficult to completely rule out the possibility of tariff imposition."

Companies are preparing measures to minimize shocks considering the possibility of reciprocal tariffs. LG Electronics has prepared a production base for refrigerators and ovens in Tennessee, USA, planning to switch production to the U.S. if the Mexican plant is hit by tariffs. LG Electronics CEO Cho Joo-wan stated, "If tariffs are enacted, we have prepared the site to immediately produce refrigerators and ovens at the Tennessee plant in the U.S."

Hyundai Motor Group announced a $31 trillion KRW investment plan in the U.S. over four years on the 24th, in the presence of President Trump. They have expanded their overseas government relations organization and increased lobbying personnel in the U.S. to over 40 to respond.

In the steel industry, which is already subject to high tariffs, POSCO established a Global Trade Policy Team directly under Chairman Jang In-hwa and is considering investment in U.S. commercial plants. Hyundai Steel plans to invest 8.5 trillion KRW to build an electric furnace steel mill in Louisiana, USA. Located near Hyundai Motor's Alabama plant and Kia's Georgia plant, it is expected to reduce logistics costs.

According to statistics from the Korea International Trade Association, the U.S. trade deficit with Korea has increased for five consecutive years: $16.6 billion in 2020, $22.7 billion in 2021, $28 billion in 2022, $44.4 billion in 2023, and $55.7 billion in 2024.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)