Total Performance and Management Fees Down 30% Year-on-Year Last Year

More Than Half of VCs Paid Dividends...

TS Investment Decides on Dividend Despite Net Loss

Last year, as both the investment and exit markets froze simultaneously, the overall performance of listed venture capital (VC) firms declined compared to the previous year. However, despite the challenging business environment, more than half of the listed VCs paid dividends. A total of six VC executives received total compensation exceeding 2 billion KRW.

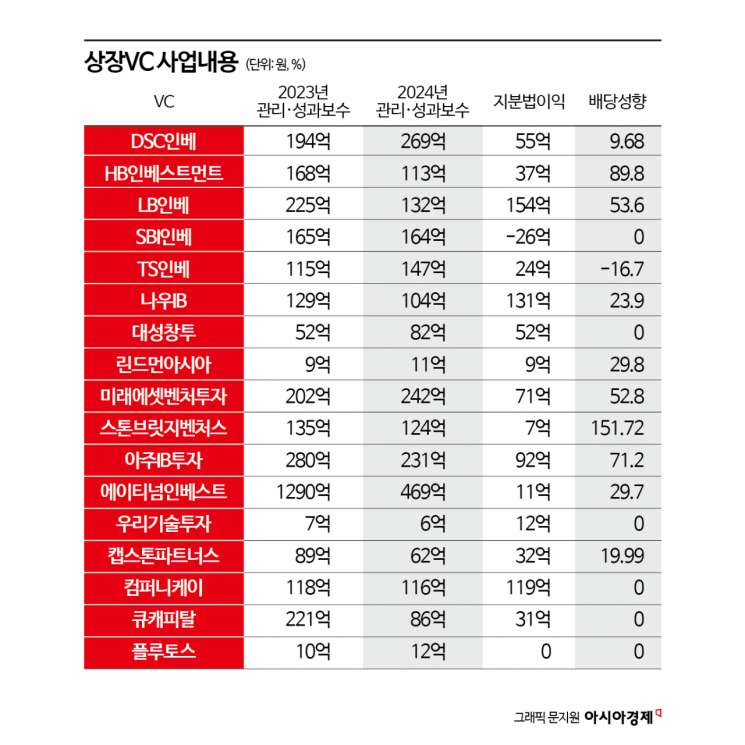

According to the VC industry and the Financial Supervisory Service's electronic disclosure system on the 31st, among 17 listed VCs last year, 11 saw a decrease in the combined amount of performance and management fees compared to the previous year. VCs receive performance fees when the venture investment funds they manage achieve returns above a certain benchmark. Management fees are compensation for managing the fund itself. Among the 19 listed VCs, SV Investment, which has a different fiscal year period, and M Venture, which requested an extension for submitting its business report, were excluded from the analysis.

Those with increased combined performance and management fees compared to the previous year included Daesung Changtu (57.69%), DSC Investment (38.66%), TS Investment (27.83%), Lindeman Asia (22.22%), Plutos (20%), and Mirae Asset Venture Investment (19.8%). Conversely, Atnum Investment (-63.64%), Q Capital (-61.09%), and LB Investment (-41.33%) experienced declines. However, Atnum Investment and others had reflected a large-scale performance fee (113 billion KRW) in their results due to the liquidation of funds managed in 2023, which acted as a base effect. Looking solely at last year's performance, Atnum Investment's combined performance and management fees totaled 46.9 billion KRW, ranking first among all listed VCs. Following were Mirae Asset Venture Investment with 24.2 billion KRW and Aju IB Investment with 23.1 billion KRW. The total combined performance and management fees of listed VCs decreased by 30.48%, from 340.9 billion KRW in 2023 to 237 billion KRW last year.

The equity method gains, representing the value of venture fund shares held by VCs, generally showed an upward trend. LB Investment (15.4 billion KRW), Now IB (13.1 billion KRW), and Company K (11.9 billion KRW) recorded equity method gains in the 10 billion KRW range. Equity method gains refer to an accounting treatment where an investment company recognizes its share of the profits of the companies it has invested in, proportional to its ownership stake. Notably, Mirae Asset Venture Investment's equity method gains increased significantly from 3.1 billion KRW the previous year to 7.1 billion KRW, and Q Capital also rose from 1.6 billion KRW to 3.1 billion KRW. In contrast, SBI Investment recorded an equity method loss of 2.6 billion KRW.

Last year, a total of six executives at listed VCs received total compensation exceeding 2 billion KRW. Each listed company must disclose up to five employees who received compensation of 500 million KRW or more in their business reports. The highest-paid individual was Kim Je-uk, Vice President of Atnum Investment, who received 7.9 billion KRW, including approximately 7.4 billion KRW in bonuses and 400 million KRW in salary. Vice President Kim was known as the highest-paid executive in the listed VC industry, with total compensation of 28.3 billion KRW in 2022 and 21.1 billion KRW the following year. Others who received compensation exceeding 2 billion KRW included Lee Jeong-hoon, CEO of Woori Technology Investment (2.8 billion KRW), Shin Gi-cheon, CEO of Atnum Investment (2.8 billion KRW), Kwon Kyung-hoon, Chairman of Q Capital (2.2 billion KRW), Kim Eung-seok, CEO of Mirae Asset Venture Investment (2.2 billion KRW), and Kim Young-hoon, CEO of Daesung Changtu (2 billion KRW).

Meanwhile, more than half of the listed VCs paid dividends last year. Stonebridge Ventures showed the highest dividend payout ratio (total dividends relative to net income), paying dividends exceeding net income with a payout ratio of 151.72%. Typically, VCs are reluctant to pay dividends due to high volatility in operating results, but with increasing shareholder demands for profit sharing, VCs have shown more shareholder-friendly behavior.

Additionally, HB Investment (89.8%), Now IB (23.9%), Aju IB Investment (71.2%), LB Investment (53.6%), Mirae Asset Venture Investment (52.8%), Atnum Investment (29.7%), and DSC Investment (9.68%) also maintained shareholder-friendly approaches. Notably, TS Investment paid dividends despite recording a net loss, resulting in a dividend payout ratio of -16.7%. However, six companies?Woori Technology Investment, Daesung Changtu, SBI Investment, Q Capital, Company K, and Plutos?did not pay dividends.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)