Hit Record Highs on US 'Stargate' Hopes, Now Trending Downward

Bubble Fears Emerge as Microsoft Halts Data Center Expansion

Steady Power Demand Fuels Optimism for Performance Improvement

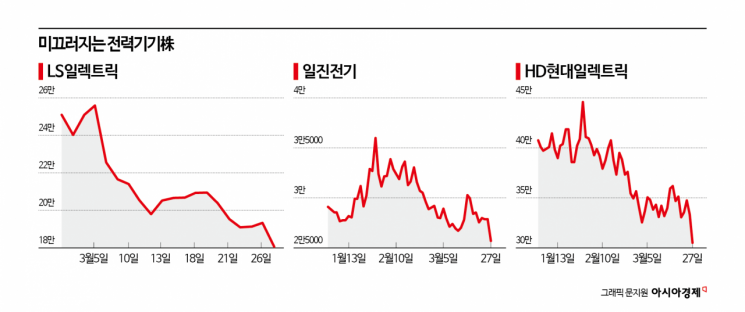

Power equipment companies, once spotlighted as beneficiaries of the US AI infrastructure project 'Stargate,' are now slipping. The bubble concerns around AI infrastructure are gaining traction as the major player Microsoft (MS) slows down its data center investments.

According to the Korea Exchange on the 28th, the domestic electrical equipment sector fell 6.35% the previous day, marking the largest drop among all sectors. Among 28 stocks in the sector, 24 saw their prices decline. The biggest loser was HD Hyundai Electric (-8.71%). Since hitting its yearly high following the White House's announcement of a $500 billion (about 718 trillion KRW) AI infrastructure investment plan in January, the stock has plunged about 32%. Iljin Electric (-7.69%), Hyosung Heavy Industries (-6.93%), and LS ELECTRIC (-6.52%) followed. ETFs such as PLUS Global AI Infrastructure (-6.18%) and KODEX US AI Power Core Infrastructure (-5.63%) also showed notable weakness.

The stock price weakness was triggered by news that MS, the world's second-largest cloud service provider, halted data center expansions. On the 26th (local time), through global investment bank TD Cowen, it was revealed that MS stopped new data projects totaling 2 gigawatts (GW) in the US and Europe, freezing investment sentiment among domestic power equipment companies that were potential beneficiaries. Two gigawatts is equivalent to the power consumption of 1.5 to 2 million households.

MS explained that it adjusted its pace because the existing data center capacity was sufficient to meet customer demand. However, concerns about a bubble persist as MS had canceled data center lease contracts with private companies last month. Recently, Joseph Tsai, chairman of Alibaba Group's board, publicly criticized the bubble in data center expansions.

However, there are counterarguments that the bubble concerns in data centers are exaggerated. Despite MS's slowdown, the data center market's growth trend remains intact. Minjae Lee, a researcher at NH Investment & Securities, stated, "Major US utility companies have proposed a mid-to-long-term capital expenditure of $840 billion (about 1231 trillion KRW) from 2025 to 2029, a 16% increase compared to the previous year," adding, "The focus of power equipment investment is shifting from replacing aging facilities to responding to increased data center loads."

While big tech companies maintain steady data center capital expenditures (CAPEX), the decline in domestic power equipment stocks could be an opportunity for bargain buying. For example, LS ELECTRIC is expected to reflect increased orders for distribution panels and transformers for US data centers starting this year. The researcher said, "The company has a track record of supplying distribution and sub-distribution panels to domestic high-tech companies where stable power supply is critical, so it should have no difficulty supplying data centers with similar loads," raising the target stock price from 280,000 KRW to 310,000 KRW.

HD Hyundai Electric, which has strengths in ultra-high voltage transformers, is also expected to see mid-to-long-term performance improvements. The researcher noted, "Based on a 3-4 year order backlog and two expansion plans announced through 2025, the impact of tariffs is limited due to local US factories," forecasting operating profits steadily increasing to 873.8 billion KRW, 949.9 billion KRW, and 1.033 trillion KRW from 2025 to 2027.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)