Luxury Platform Ballan Fails to Settle Payments on the 24th

This Time, Suspected Preparation for Corporate Rehabilitation

Ballan Tells Sellers: "Settlement Schedule to Be Announced on the 28th"

Silicon Two Decides to Invest 15 Billion KRW in Ballan

Luxury platform Ballan, which recently caused a seller payment settlement issue, is suspected of preparing for corporate rehabilitation (court receivership). On the 24th, Ballan announced that it would notify the settlement schedule and amount by the 28th and proceed with payment due to a re-examination of the settlement system, but all employees have started working from home, and even CEO Choi Hyung-rok has lost contact.

If Ballan files for corporate rehabilitation, internal funds will be frozen and repayments will be made according to the rehabilitation plan, meaning sellers will not receive settlement payments immediately. The industry is concerned about a 'second Timef incident.'

Operating losses, which were 6.3 billion KRW in 2020, expanded to 19 billion KRW in the following year and 37.9 billion KRW in 2022. This was due to a significant increase in marketing expenses as competition among luxury platforms intensified. Balan used Kim Hye-soo as an advertising model on TV and online channels. Screenshot from Balan's YouTube advertisement.

Operating losses, which were 6.3 billion KRW in 2020, expanded to 19 billion KRW in the following year and 37.9 billion KRW in 2022. This was due to a significant increase in marketing expenses as competition among luxury platforms intensified. Balan used Kim Hye-soo as an advertising model on TV and online channels. Screenshot from Balan's YouTube advertisement.

Luxury Platform Ballan Delays Seller Payment Settlements...Suspected Preparation for Corporate Rehabilitation

According to the distribution industry on the 27th, Ballan failed to pay the settlement amounts promised to sellers on the 24th. The reason given was that errors were found while reviewing previously paid settlement data.

At that time, a Ballan official said, "We found parts that were overpaid to sellers and are trying to organize and inform them all at once," adding, "The non-payment of settlements is not expected to be prolonged; the re-settlement work will be completed by the 26th, and the settlement amounts will be announced by partner company on the 28th."

However, suspicions have arisen that Ballan has been preparing for corporate rehabilitation procedures. It is said that Ballan has appointed an agent to apply for the commencement of rehabilitation procedures and is preparing documents to proceed with the rehabilitation process. Regarding this, a Ballan official said, "We are checking," but added, "However, since decision-making is centered on the CEO, the details are not yet understood."

This occurred shortly after Ballan secured an investment of 15 billion KRW from Silicon Two. Ballan has already received 7.5 billion KRW from Silicon Two, but it is uncertain whether this will be paid to sellers. Once the corporate rehabilitation process begins, all debts are frozen, and the court appoints a manager (if not appointed, the company management) to oversee fund management and business operations. If Ballan reaches an agreement with creditors on the rehabilitation plan, repayments and company operations will proceed according to that plan.

On the 25th, Ballan's sellers visited the headquarters demanding payment of sales proceeds, but Ballan requested them to wait until the 28th. A luxury industry insider said, "It is difficult to enter the company," and added, "It is uncertain whether the announcement of the settlement schedule and amount by the 28th will be effective."

Ballan, Never Profitable Even Once...Complete Capital Erosion

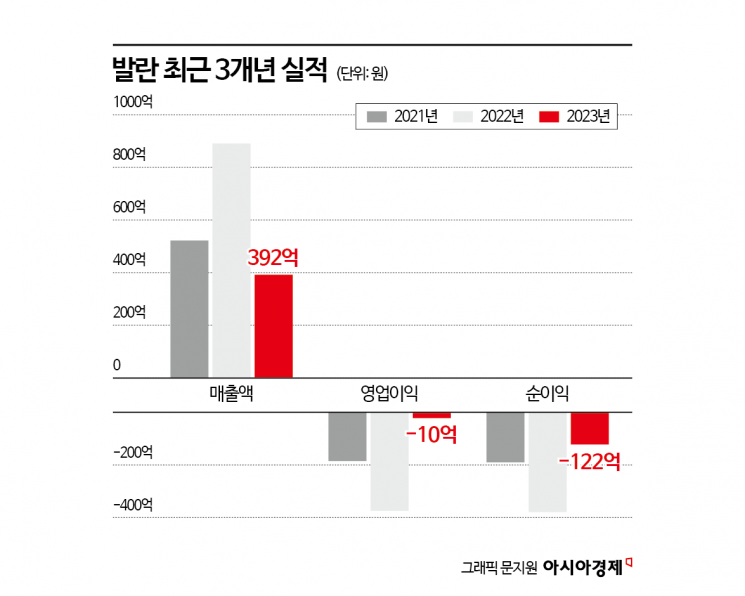

Founded in 2015, Ballan's scale expanded rapidly as luxury consumption surged during the COVID-19 period. Sales increased from 24.3 billion KRW in 2020 to 52.2 billion KRW in 2021, doubling, and further rose to 89.1 billion KRW in 2022, an increase of 30 billion KRW.

Operating losses, which were 6.3 billion KRW in 2020, expanded to 19 billion KRW in the following year and 37.9 billion KRW in 2022. This was due to a significant increase in marketing expenses as competition among luxury platforms intensified. Balan used Kim Hye-su as an advertising model for TV and online channels.

Operating losses, which were 6.3 billion KRW in 2020, expanded to 19 billion KRW in the following year and 37.9 billion KRW in 2022. This was due to a significant increase in marketing expenses as competition among luxury platforms intensified. Balan used Kim Hye-su as an advertising model for TV and online channels.

However, profitability declined every year. Operating losses of 6.3 billion KRW in 2020 expanded to 19 billion KRW in 2021 and 37.9 billion KRW in 2022. This was due to increased marketing costs amid fierce competition among luxury platforms. Ballan used Kim Hye-soo as a TV and online channel advertising model. Although the audit report for this year has not yet been released, it is expected that losses continued.

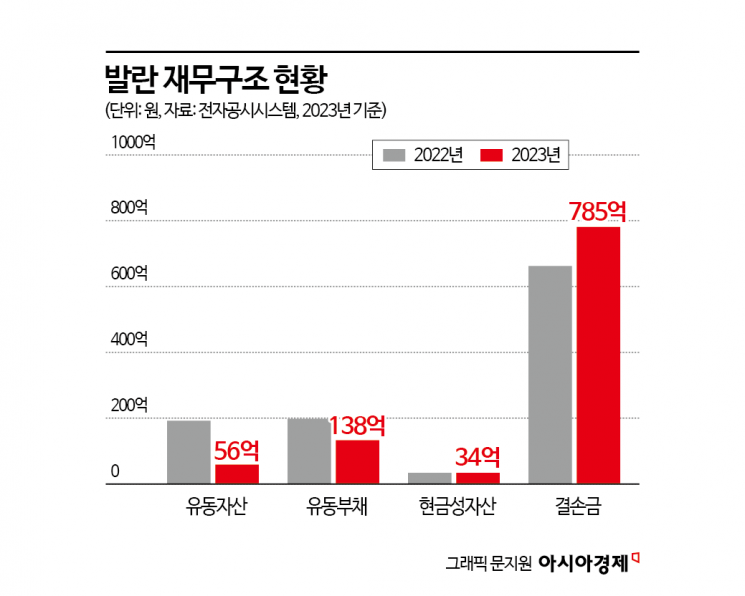

As a result, Ballan's financial structure deteriorated. As of 2023, Ballan's total capital was negative 7.7 billion KRW, less than its capital stock of 470 million KRW, indicating complete capital erosion. Deficits have ballooned to 78.5 billion KRW.

The amount of liquid assets that can be converted to cash within one year was 5.6 billion KRW in 2023, sharply down from 19.2 billion KRW the previous year. During this period, cash equivalents amounted to only 3.4 billion KRW. Current liabilities maturing within one year reached 13.8 billion KRW, prompting Ballan to desperately seek investment last year.

Why Did Silicon Two, With 86 Billion KRW Treasury, Invest in Ballan?

Last month, Ballan secured an investment of 15 billion KRW from Silicon Two. This was the first investment in two years and four months since October 2022. Silicon Two is a company that helps small and medium-sized K-beauty brands expand globally by utilizing global logistics and distribution networks.

Silicon Two appears to have decided to invest in Ballan as its cash equivalents increased significantly due to the K-beauty boom last year. Silicon Two's cash equivalents (excluding accounts receivable and short-term other financial assets) reached 86 billion KRW last year, a 400% increase compared to 17.2 billion KRW in 2023.

Ballan's largest shareholder is CEO Choi Hyung-rok, holding 37.64% of shares, and Naver (7.98%) is the second-largest shareholder. Other major investors alongside Silicon Two include Lee & Han, Shinhan Capital, Woori Venture Partners, Kolon Investment, Company K Partners, and Korea Growth Investment Corporation.

On the 28th of last month, Silicon Two paid half of the investment amount, 7.5 billion KRW. The remaining 7.5 billion KRW is scheduled to be paid monthly on the 1st of each month from November 1 this year to May 1 next year, provided that certain transaction conditions are met. The convertible bond has a 0% coupon rate and a 4% maturity interest rate. The conditions set by Silicon Two are: ▲ For the previous two consecutive months, the proportion of direct purchase sales (directly purchased products) in monthly sales must be 50% or more ▲ For the previous two consecutive months, operating profit must be positive.

Silicon Two seems to have bet on Ballan's growth potential. According to materials released by Ballan on the 10th of this month, Silicon Two's global logistics and marketing know-how will be applied to the global mall 'Ballan.com' to expand the business. Silicon Two appears to have judged that combining luxury fashion could expand the business scope.

However, just over a month later, Ballan caused a payment settlement non-payment incident and suspicions of filing for corporate rehabilitation, leaving Silicon Two apparently unable to hide its embarrassment. A Silicon Two official said, "We are thoroughly checking the matter internally," and added, "We ask for your understanding as it is difficult to provide specific answers immediately."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)