Last Year’s High-Risk Household Financial Debt at 72 Trillion Won, Regional Risks Growing

Vulnerable Self-Employed Borrowers Number 427,000... Debt Reaches 125 Trillion Won

"Support Measures Should Be Applied Differently Depending on Repayment Capacity and Willingness"

The Bank of Korea warned that amid sluggish economic growth conditions and increasing domestic and international uncertainties, preparations must be made for potential insolvencies centered on the real estate market situation. In particular, if the downturn in regional real estate worsens, there is a risk of a sharp increase in insolvencies not only among project financing (PF) sites and construction companies but also among 'high-risk households' with deteriorating debt repayment capacity, which requires caution.

According to the Bank of Korea's Financial Stability Report on the 27th, as of the end of last year, household credit stood at 1,927.3 trillion won, increasing by 0.7% from the previous quarter, mainly due to housing-related loans (11.7 trillion won). The proportion of vulnerable borrowers increased from 6.6% at the end of Q3 last year to 6.9% at the end of Q4, and the proportion of potentially vulnerable borrowers also rose from 17.5% to 17.6%. Vulnerable borrowers refer to multiple debtors who are either low-income (bottom 30%) or have low credit (credit score 664 or below), while potentially vulnerable borrowers are those close to the characteristics of vulnerable borrowers. The bank delinquency rate continued to rise from 0.36% at the end of Q3 last year to 0.38% at the end of Q4. For non-bank institutions, the delinquency rate decreased from 2.17% to 2.07%, influenced by year-end non-performing loan cleanups.

The Bank of Korea pointed out that under high uncertainty and sustained low growth, the volatility of financial market price variables is likely to increase in the event of domestic and external shocks. It also noted ongoing concerns about the deterioration of soundness in financial institutions with a high proportion of vulnerable sectors as insolvencies increase. Recently, housing prices in some areas of Seoul and the metropolitan area have been rising rapidly again and spreading to other regions, indicating the need to be cautious about the possibility of a renewed expansion in household debt growth, which had previously stabilized. Lee Jong-ryeol, Deputy Governor of the Bank of Korea, said, "The market says that real estate transaction volumes have paused and stabilized following the recent expansion of the Land Transaction Permission System (Toheoje), but it is still too early to obtain accurate data," adding, "Household debt ratios remain high compared to major countries, and if the rapid rise in housing prices in some preferred areas such as Seoul spreads to other regions, the increase in housing-related loans could expand again."

Last Year’s High-Risk Household Financial Debt at 72 Trillion Won, Regional Risks Growing

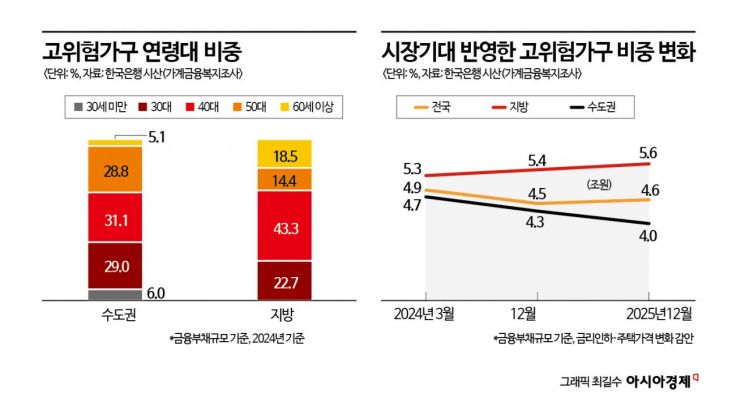

Concerns were especially raised about the widening polarization as the decline in regional housing sale prices continues. Housing prices, which constitute a significant portion of household assets mainly in regional areas, are falling, potentially increasing the debt repayment burden of high-risk households in those regions. Last year, the number of high-risk households in South Korea was estimated at 386,000. High-risk households are those with a debt service ratio (DSR) exceeding 40% and a debt-to-asset ratio (DTA) exceeding 100%, evaluating debt repayment capacity comprehensively by considering household assets and liabilities.

Last year, high-risk households accounted for 3.2% of households holding financial debt. The financial debt held by these households amounted to 72.3 trillion won, representing 4.9% of total household debt. Although the number and financial debt proportion of high-risk households decreased compared to 2023 (3.5% and 6.2%, respectively), when interest rates rose sharply, they remain at a high level compared to 2022. In terms of household numbers, they exceed the long-term average from 2017 to 2024 (3.1%). Households lacking repayment capacity in either DSR or DTA indicators account for 26.5% (3.18 million households), holding 34.8% (512 trillion won) of total financial debt.

The Bank of Korea assessed that the DSR of high-risk households in South Korea is 75.0% (median), and the DTA is 150.2%, indicating a significant deterioration in debt repayment capacity in terms of income and assets. The median DSR and DTA of high-risk households in regional areas are 70.9% and 149.7%, respectively, not significantly different from those in the metropolitan area (78.3% and 151.8%). However, the proportion of household heads aged 60 or older among high-risk households in regional areas (18.5%) is higher than in the metropolitan area (5.1%), suggesting a relatively weaker income base.

The decline in housing prices could increase the number of high-risk households. The Bank of Korea estimated the proportion of high-risk households (based on financial debt) in regional and metropolitan areas by reflecting interest rate and housing price fluctuations and housing price forecasts. As of the end of last year, the proportions were 5.4% and 4.3%, respectively. By the end of this year, the gap in high-risk household proportions between regional (5.6%) and metropolitan (4.0%) areas is expected to widen to 1.6 percentage points. Deputy Governor Lee pointed out, "It is necessary to closely monitor related trends and the effectiveness of government response measures to prevent the expansion of insolvency risks, especially among high-risk households in regional areas."

Vulnerable Self-Employed Debt Increases by 10 Trillion Won to 125 Trillion Won...Selective Support Needed

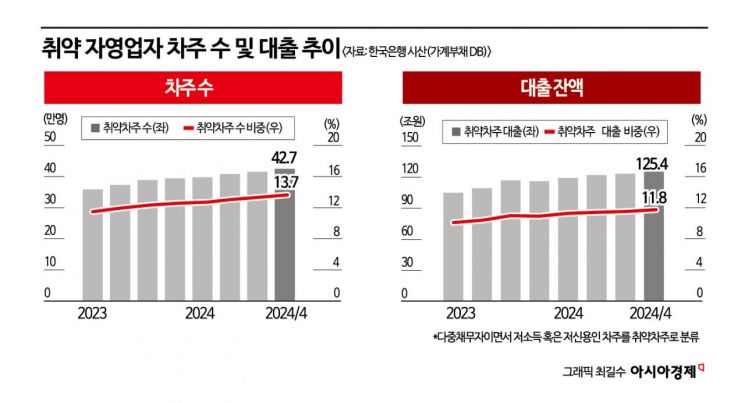

The polarization among self-employed individuals is also at a serious level. Due to the economic downturn delaying income recovery for the self-employed, loan delinquency rates remain high, especially among vulnerable borrowers. The number of 'vulnerable self-employed borrowers,' defined as multiple debtors who are either low-income or low-credit, reached 427,000 at the end of last year, an increase of 31,000 from 396,000 at the end of the previous year. This accounts for 13.7% of all self-employed individuals. Although the number of multiple-debt self-employed individuals decreased by 22,000 compared to the previous year, the number of low-income and low-credit borrowers increased by 21,000 and 47,000, respectively. Loans to vulnerable self-employed borrowers also rose by 9.6 trillion won, from 115.7 trillion won at the end of 2023 to 125.4 trillion won at the end of last year (11.8% of total self-employed loans).

The delinquency rate on self-employed loans has also approached the long-term average level before COVID-19 (1.68% average from 2012 to 2019), raising warning signs. The number of delinquent self-employed borrowers has steadily increased since the second half of 2022, pushing the delinquency rate on self-employed loans up to 1.67%. Although the delinquency rate slightly decreased from the previous quarter due to increased year-end cleanup of non-performing loans by financial institutions, it remains high, especially among non-bank institutions (3.43%) and vulnerable self-employed borrowers (11.16%).

The rise in delinquency rates among the self-employed is largely due to reduced debt repayment capacity caused by high loan interest rates and income declines from sluggish service sector conditions. The average income of self-employed individuals decreased to 41.31 million won at the end of 2022 and slightly increased to 41.57 million won at the end of last year. However, due to structural factors such as a high proportion of self-employed individuals and continued service sector downturn, income has not yet recovered to pre-COVID-19 levels (42.42 million won at the end of 2019). Particularly, delinquent self-employed individuals saw their average income drop from 39.83 million won at the end of 2020 to 37.36 million won at the end of last year, while their average loan increased to 229 million won at the end of last year from 205 million won at the end of 2020, indicating worsening conditions.

Deputy Governor Lee said, "Support policies for the self-employed should be applied differentially according to individual self-employed persons' repayment capacity and willingness, including financial support, debt adjustment, and rehabilitation assistance, to be more effective." He added, "For borrowers who are repaying debts normally, selective support for business and financial costs is needed, while for delinquent and closed borrowers, debt adjustment through a fresh start fund and employment and re-entrepreneurship support for those wishing to restart should be pursued."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.