Bank of Korea Financial Stability Report

427,000 Vulnerable Self-Employed Borrowers... Up by 31,000

"Support Policies Should Be Differentiated According to Repayment Ability and Willingness"

As the economic downturn delays the recovery of income for self-employed individuals, loan delinquency rates remain high, particularly among vulnerable borrowers. The Bank of Korea pointed out that support policies such as financial assistance, debt restructuring, and rehabilitation support should be tailored according to the repayment ability and willingness of individual self-employed borrowers.

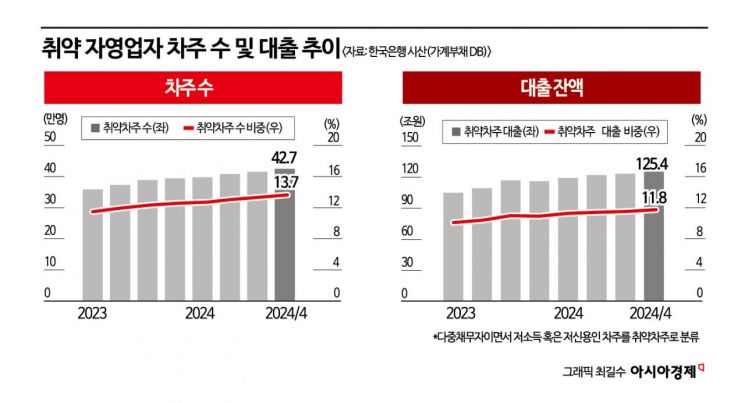

According to the Bank of Korea's Financial Stability Report on the 27th, the number of 'vulnerable self-employed borrowers'?those who are low-income or have low credit among multiple debtors?reached 427,000 at the end of last year, an increase of 31,000 from 396,000 at the end of the previous year. This accounts for 13.7% of all self-employed individuals. Although the number of multiple-debt self-employed individuals decreased by 22,000 compared to the previous year-end, the number of low-income and low-credit borrowers increased by 21,000 and 47,000 respectively. Loans to vulnerable self-employed individuals also rose by 9.6 trillion KRW, from 115.7 trillion KRW at the end of 2023 to 125.4 trillion KRW at the end of last year (11.8% of total self-employed loans).

The delinquency rate on self-employed loans also approached the long-term average level before COVID-19 (1.68% average from 2012 to 2019), raising warning signs. Since the second half of 2022, the number of delinquent self-employed borrowers has steadily increased, pushing the delinquency rate on self-employed loans up to 1.67%. Although the delinquency rate slightly decreased compared to the previous quarter due to an increase in the resolution of non-performing loans by financial institutions at year-end, the delinquency rate remains high, especially among non-bank lenders (3.43%) and vulnerable self-employed borrowers (11.16%).

Amid domestic and international adverse factors such as economic recession and sluggish domestic demand, the number of store closures among small business owners is rapidly increasing. On the 26th, vacant stores lined up in a commercial area densely populated with shops in Sinchon, Seoul. Accordingly, the amount of closure compensation paid to small business owners exceeded 1.3 trillion won this year, marking an all-time high. Photo by Jo Yongjun

Amid domestic and international adverse factors such as economic recession and sluggish domestic demand, the number of store closures among small business owners is rapidly increasing. On the 26th, vacant stores lined up in a commercial area densely populated with shops in Sinchon, Seoul. Accordingly, the amount of closure compensation paid to small business owners exceeded 1.3 trillion won this year, marking an all-time high. Photo by Jo Yongjun

The rise in the delinquency rate among self-employed borrowers is largely attributed to a decline in their debt repayment capacity due to high loan interest rates and income reductions caused by the sluggish service industry. Before COVID-19, the delinquency rate on self-employed loans followed a trend similar to loan interest rates. Despite the rise in loan interest rates from 2021 to 2022, the delinquency rate remained low due to government measures such as principal and interest repayment deferrals for self-employed individuals affected by COVID-19 and the rapid recovery of the service industry after the pandemic. Although loan interest rates began to decline in mid-2023, the continued sluggishness in the service industry led to an upward trend in the delinquency rate on self-employed loans.

It has been analyzed that since COVID-19, delinquent self-employed borrowers have experienced increased debt burdens as their income decreased while loans increased. The average income of self-employed individuals decreased to 41.31 million KRW at the end of 2022 and slightly increased to 41.57 million KRW at the end of last year. However, due to structural factors such as a high proportion of self-employed individuals and the continued sluggishness in the service industry, income has yet to recover to pre-COVID-19 levels (42.42 million KRW at the end of 2019). In particular, delinquent self-employed borrowers saw their average income decline from 39.83 million KRW at the end of 2020 to 37.36 million KRW at the end of last year, while their average loan amount increased to 229 million KRW at the end of last year, up from 205 million KRW at the end of 2020, indicating a worsening situation.

A Bank of Korea official stated, "Support policies for self-employed individuals will be more effective if financial assistance, debt restructuring, and rehabilitation support are applied differentially according to the repayment ability and willingness of each self-employed borrower." The official added, "For borrowers who are repaying their debts normally, selective support for operating and financial costs should be provided, while delinquent and closed borrowers should receive debt restructuring through a fresh start fund. For self-employed individuals wishing to restart, policies such as employment and re-entrepreneurship support need to be promoted."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.