Faster New Drug Approvals

and Expanded Incentives for Talent Recruitment

China's pharmaceutical and biotechnology industry demonstrated its 'pharmaceutical rise' last year by launching 48 new drugs. The country is targeting the pharmaceutical and biotech sectors as future growth engines and attempting quantitative expansion domestically, with responses indicating that the competitiveness and qualitative growth patterns in the global market have also changed compared to before.

According to the Korea Bio Association on the 27th, China's National Medical Products Administration (NMPA) approved the marketing of 48 first-in-class new drugs last year across about 20 therapeutic areas including oncology, neurological diseases, and anti-infectives. This is the highest number of approvals in the past three years. Previously, the NMPA approved 21 and 40 new drugs in 2022 and 2023, respectively. Among the 48 new drugs, 17 received marketing approval through priority review pathways, and 11 were conditionally approved. Additionally, 13 drugs under clinical trials were included and approved as 'breakthrough therapies.'

The rise of China's pharmaceutical and biotech industry is attributed to bold policy changes led by the government. Since 2011, China has designated the pharmaceutical and biotech industry as a core future industry group in its economic development plans. Corporate tax for pharmaceutical and biotech companies was reduced by 40%, lowering the previous 25% rate to around 15%. The review period for IND (Investigational New Drug) applications was drastically shortened from over a year to 60 days, significantly reducing drug approval times.

China has expanded access to new drugs by introducing a series of expedited approval systems, including priority review in 2015, conditional approval in 2017, designation of urgently needed imported foreign drugs in 2018, and innovative therapy designation in 2020. Notably, priority review shortened the review period from 200 working days to 130 days. For urgent clinical needs and drugs approved overseas, the review period was reduced to 70 days.

To attract talent, China operates a 'Talent Program' that supports relocation expenses for professionals working abroad, guarantees high salaries, and provides comprehensive incentives including startup funding support. The Chinese government estimates that tens of thousands of pharmaceutical and biotech researchers and scientists have migrated to China through this program. Combined with the regulatory authority's (NMPA) expedited approvals, the speed of new drug development has become exceptional. In contrast, South Korea currently lacks corporate tax reductions or talent attraction incentive programs that would encourage research and development (R&D) investment.

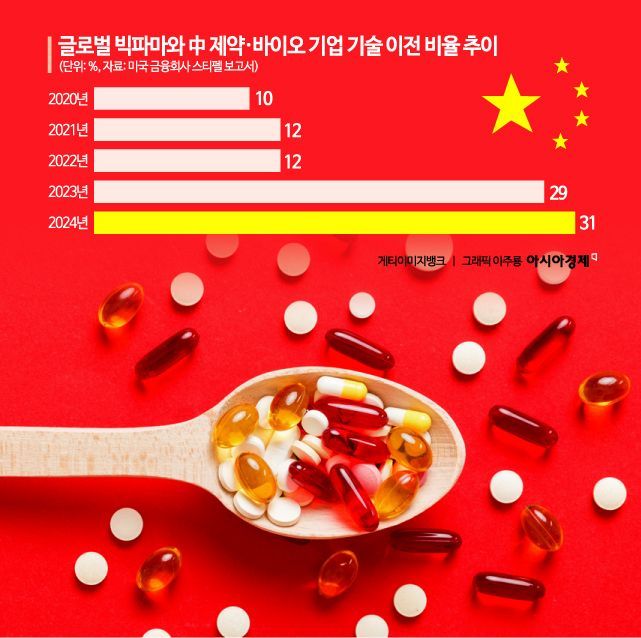

China's pharmaceutical and biotech industry is showing remarkable growth, with an average annual growth rate of 9.5% and ranking second globally in new drug development pipelines. According to a report released earlier this year by the U.S. financial firm Stifel, transactions with Chinese companies accounted for one-third of global pharmaceutical licensing deals last year. The share of contracts involving Chinese pharmaceutical and biotech companies increased consecutively over three years: 12% in 2022, 29% in 2023, and 31% in 2024. China is transforming from the 'world's factory' into a 'global new drug development hub.'

Research competitiveness has also dramatically improved. According to the Life Sciences Competitiveness Indices (LSCIs) report recently published by the UK Life Sciences Nation, China's share of medical paper citations was 24% in 2023, ranking second after the United States at 31.6%. A high citation share indicates a high qualitative level of research papers. This share has increased about fourfold in 12 years from 6.2% in 2011. In contrast, South Korea's share has stagnated at 3.1% as of 2023 for over a decade.

Lee Gwansoon, Chair of the Future Vision Committee of the Korea Bio Association, said at the Bio Association Innovation Forum on the 21st, "China's pharmaceutical and biotech industry has laid a solid foundation and achieved results through extensive policy support by the state, similar to South Korea's economic development five-year plans in the 1970s. Benchmarking cases such as industrial structural improvements are necessary." He added, "Especially as an imbalance in talent supply and demand is expected, it is a time when government-led roles are needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.