Securities Stocks Gain Strength as Defensive Plays This Year

Mirae Asset Securities Surpasses 10,000 KRW for First Time in 4 Years

Alternative Trading System Launch and Resumption of Short Selling Boost Market Activity

Brokerage Revenue of Securities Firms Expected to Increase

Stocks of securities companies have emerged as defensive stocks and have shown strength this year. Mirae Asset Securities, the leading securities stock, surpassed 10,000 KRW for the first time in four years. With a favorable environment created by the launch of an alternative trading system and the resumption of short selling, it is expected that securities stocks will continue to play a defensive role amid domestic and international uncertainties.

According to the Korea Exchange on the 27th, Mirae Asset Securities closed at 10,100 KRW, up 180 KRW (1.81%) from the previous session. During the day, it rose to 10,200 KRW, marking a 52-week high. This is the first time Mirae Asset Securities' stock price has exceeded 10,000 KRW since June 2021. On the same day, Kiwoom Securities also rose 2.07%, increasing more than 18% since the beginning of the year.

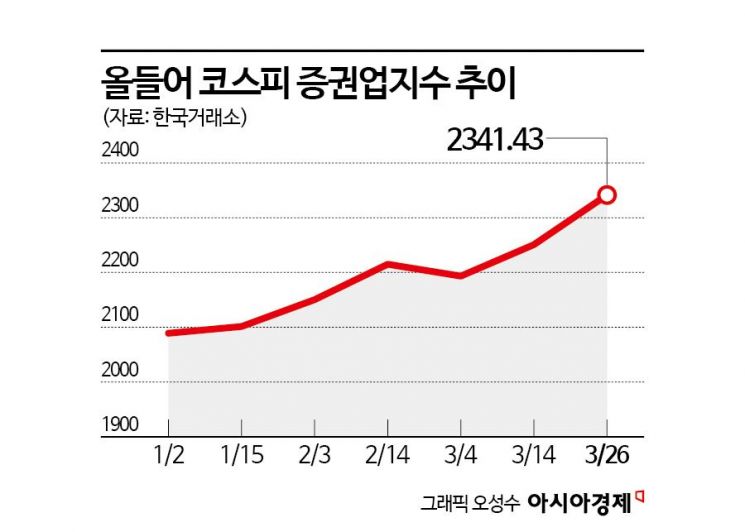

Securities stocks have continued to show strength as defensive stocks despite increased market volatility due to domestic and international uncertainties this year. The KOSPI Securities Industry Index has risen 11.67% this year. During the same period, the KOSPI rose 10.19%.

With a favorable environment created for the securities industry, expectations for earnings growth of securities firms are increasing. Yoon Yudong, a researcher at NH Investment & Securities, said, "Although market volatility has increased due to domestic and international political uncertainties since the beginning of the year, securities stocks will continue to play a defensive role. With major events in the trading market such as the launch of the alternative trading system and the resumption of short selling, short-term interest from market participants is expected to expand, and in the mid-to-long term, brokerage revenue contribution from increased trading volume is anticipated."

NextTrade, Korea's first alternative trading system, was launched on the 4th and is gradually expanding the number of tradable stocks. From the end of this month, trading will be possible for a total of 800 stocks, including 380 KOSPI stocks and 420 KOSDAQ stocks. Researcher Yoon said, "Along with the increase in the number of tradable stocks, trading volume will also expand. Considering the speed of trading volume increase according to the number of stocks, it is expected to reach up to 15% of the total stock market trading volume, which is the current regulatory cap. Considering the total stock trading volume over the past month, this amounts to approximately 2.8 trillion KRW."

With the resumption of short selling from the end of this month, it is expected that foreign investors' inflow will increase. Researcher Yoon said, "From the perspective of securities firms, attention should be paid to the activation of trading due to expanded market participation rather than the direction of the index. Looking at past cases, the re-entry of foreigners employing long-short strategies led to an increase in the proportion of foreign trading, and this time, a similar pattern is expected to accompany an increase in trading volume."

Overseas stock investment, which led the earnings growth of securities firms last year, is expected to continue its growth this year. Baek Doosan, a researcher at Korea Investment & Securities, said, "The overseas stock business division is expected to grow an additional 20% this year, driving overall brokerage growth. Regarding this, the expected pre-tax profit growth rate for each securities firm is around 3-4%." He added, "Despite the recent adjustment in the U.S. stock market, as of the 19th of this month, the cumulative net purchase amount of overseas stocks by individuals and general corporations is 10.4 billion USD, still exceeding the net purchase amount of domestic stocks at 4.9 trillion KRW."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.