Focusing on Contract Projects to Minimize Risk

Specializing in Regional Housing Associations for a Stable Profit Structure

Last year, amid a downturn in the construction industry that led even major construction companies to turn to losses or see a sharp decline in profits, Seohee Construction, ranked 18th in construction capability evaluation, secured profits in the 200 billion KRW range. It is the construction company that has built the most churches in Korea, and since 2010, it has maintained its growth by focusing on regional housing association contract projects.

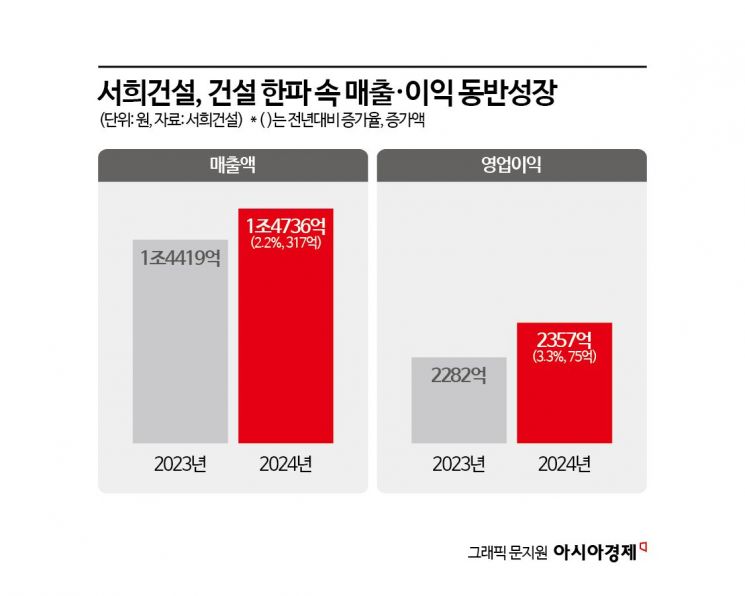

According to the Financial Supervisory Service on the 27th, Seohee Construction recorded sales of 1.4736 trillion KRW and an operating profit of 235.7 billion KRW last year. These amounts represent increases of 2.2% (31.7 billion KRW) and 3.3% (7.5 billion KRW) respectively compared to the previous year.

◆ Seohee Construction’s Performance Celebration = The operating profit margin was 16%, and net profit was 159.3 billion KRW, up 25.7% (32.6 billion KRW) from 126.7 billion KRW the previous year. This contrasts with major construction companies that experienced negative growth due to the real estate slump. Among the top 10 construction companies, only 2 out of 7 that disclosed their business reports as of this date saw an increase in operating profit last year. Hyundai Construction turned to a loss. DL E&C’s operating profit fell by 18% to 270.9 billion KRW. POSCO E&C recorded a sharp 69% drop to 61.8 billion KRW.

Seohee Construction focuses on the contract method, where it only undertakes construction from external clients such as associations or public institutions, rather than the self-development method where it buys land and is responsible for sales. The development is handled by the association or public institution, and Seohee Construction only handles construction, which ensures high business stability. Regardless of whether sales go well or not, the construction fee is received, so there is almost no loss due to unsold units. It is especially specialized in regional housing association apartments. Construction starts after recruiting more than 80% of association members and only after securing the land.

Thanks to these characteristics, stable performance defense was possible even amid increasing market uncertainty. In fact, more than 97% of Seohee Construction’s sales last year came from contract construction. Of these, building construction accounted for 89.2%, civil engineering 8.07%, and plant construction 0.06%.

Seohee Construction originally gained its name through church construction. Starting with Pohang Central Church in 1999 and up to Joyful Church in 2014, it built 40 churches nationwide. It was the construction company that built the most churches among domestic construction companies. Then, in the 2010s, it shifted its focus to regional housing association projects and maintained a strategy focused on completion feasibility and stability rather than short-term profits.

◆ Strengthening Fundamentals from Church Construction to Regional Housing = The scale of orders has steadily increased. Seohee Construction secured 5 new orders worth about 979.1 billion KRW last year. As of the end of the year, the order backlog reached 1.9228 trillion KRW. Major clients include regional associations in Ganghwa, Pyeongtaek (2 locations), Daegu, and POSCO. These five clients accounted for 37% of total sales (on a separate basis).

Cash flow has also greatly improved. Construction receivables, money billed but not yet received, decreased by 48.7% from a year ago to 124 billion KRW, and as a result, cash flow from operating activities more than tripled to 242.8 billion KRW. Total liabilities fell by 18% (128.4 billion KRW) to 566.8 billion KRW compared to a year ago, enhancing financial stability.

Cost management is also a strength. Seohee Construction’s cost of sales ratio (the proportion of cost to sales) last year was 79%, showing resilience even in a high-price environment that is challenging for large companies. The company explained, "This is the result of selectively securing orders for projects with low risk but high profitability and stability."

Adjusting some on-site personnel also contributed to reducing the burden of cost of sales. Employee salaries included in the cost of sales last year were 54.3 billion KRW, about 2.3 billion KRW less than the previous year (56.6 billion KRW). However, labor costs included in selling and administrative expenses increased. Labor costs for headquarters and other management departments recorded 40.8 billion KRW, about 3.8 billion KRW more than the previous year. A Seohee Construction official said, "The contract structure is such that personnel from completed construction sites move to other sites, so some personnel decreased."

However, unbilled construction amounts increased by about 32%, from 78.4 billion KRW to 103.5 billion KRW. This means that money for construction performed but not yet invoiced to clients has increased. While this can be seen as a temporary billing delay, if caused by construction schedule delays or prolonged settlement negotiations, it could signal liquidity risk.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.