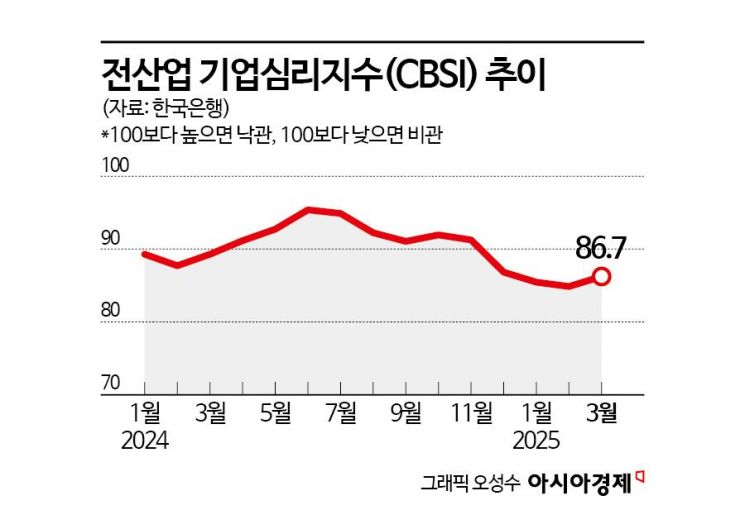

March CBSI Rises to 86.7, Up 1.4 Points

Manufacturing Boosted by Strong Exports, Non-Manufacturing by Increased Real Estate Transactions

April Outlook: Worsening Expected Due to U.S. Reciprocal Tariff Concerns

Corporate sentiment improved for the first time in five months. The manufacturing sector's business conditions improved due to strong exports in semiconductors, wireless communications, and automobiles, and the non-manufacturing sector, including construction, also saw a better mood as real estate transactions increased along with seasonal factors. However, corporate sentiment for next month is expected to worsen in both manufacturing and non-manufacturing sectors due to concerns over reciprocal tariffs from the Trump administration.

According to the "March Business Survey Results and Economic Sentiment Index (ESI)" released by the Bank of Korea on the 26th, the Composite Business Survey Index (CBSI) for all industries this month was 86.7, up 1.4 points from the previous month. Although this shows an improvement after five months, it still did not reach the level of December last year (87.3), when corporate sentiment worsened due to the emergency martial law situation. The CBSI is a corporate sentiment indicator calculated using major indices from the Business Survey Index (BSI). A value above 100 indicates that corporate expectations about the economic situation are more optimistic than in the past, while a value below 100 indicates pessimism.

The manufacturing CBSI recorded 91.9, an increase of 1.8 points from the previous month. Financial conditions and business conditions were the main factors driving the rise. Manufacturing performance improved mainly in metal processing, petroleum refining·coke, and automobiles. Metal processing was influenced by increased demand from front industries such as defense and automobiles. Petroleum refining and coke saw increased profitability due to improved refining margins in Singapore. Automobiles showed improvement due to increased domestic sales following a 30% cut in individual consumption tax and increased exports from early shipments before tariffs.

The non-manufacturing CBSI also rose by 1.2 points to 82.9. Business conditions and financial conditions were the main factors for the increase. Non-manufacturing performance improved mainly in real estate, transportation and warehousing, and arts·sports and leisure-related services. Real estate saw increased sales as apartment transactions rose following the lifting of land transaction permit zones in Seoul last month. Transportation and warehousing benefited from increased sales due to more business days and expanded air passenger demand. Arts, sports, and leisure-related services were influenced by seasonal factors such as increased golf course sales and improved casino business due to an influx of Japanese tourists amid a stronger yen.

Many companies expected the business climate to worsen in both manufacturing and non-manufacturing sectors next month. The April CBSI forecast showed manufacturing declining by 1.2 points from the previous month to 89.9, and non-manufacturing dropping by 3.4 points to 82.4. Next month, manufacturing is expected to worsen mainly in electronic, video, communication equipment, electrical equipment, and automobiles. Non-manufacturing is expected to decline mainly in wholesale and retail, information and communications, and construction sectors.

Lee Hye-young, head of the Economic Sentiment Survey Team at the Bank of Korea's Economic Statistics Department 1, said, "Concerns about reciprocal tariffs from the Trump administration were reflected in the worsening CBSI outlook for next month." She added, "However, while industries heavily affected by tariffs such as automobiles and semiconductors responded that exports would be negatively impacted, sectors like petroleum refining, chemicals, displays, and shipbuilding expected some positive spillover effects, showing mixed reactions. Since responses vary by industry when reciprocal tariff issues arise, we need to monitor the situation further." Meanwhile, construction improved this month due to seasonal factors and warmer weather, but is expected to worsen next month due to ongoing difficulties affecting financial conditions.

The Economic Sentiment Index (ESI), which combines the Business Survey Index (BSI) and the Consumer Sentiment Index (CSI), recorded 87.2, down 3.0 points from the previous month. The seasonally adjusted cyclical component was 87.3, a decrease of 1.0 point from the previous month.

This survey was conducted from the 11th to the 18th of this month, targeting 3,524 corporate entities nationwide. There were 3,308 respondents, with 1,858 from manufacturing and 1,450 from non-manufacturing sectors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.