Ramen Leads as Top Export Item, Driven by Surging Demand in Japan

Food Companies Achieve Record Overseas Sales, With Orion and Samyang Foods at the Forefront

K-Food continues to create a sensation in the global market in the first quarter of this year. During this period, K-Food exports are expected to achieve record-high figures, with strong sales centered on ramen and snacks in overseas markets, leading to favorable performance for related food companies.

According to the Ministry of Agriculture, Food and Rural Affairs on the 26th, the provisional export amount of K-Food Plus from January to the 22nd was $2.67 billion, a 7.5% increase compared to the same period last year. K-Food Plus encompasses agricultural products and related industries (such as smart farms, agricultural machinery, and veterinary medicines).

Agricultural product exports amounted to $2.21 billion, up 7.2% year-on-year. Among these, processed food exports reached $1.89 billion, growing 7.2%, while fresh food exports were $320 million, increasing by 0.4%.

Ramen, the 'Top Agricultural Product Exporter'... Rapid Increase in Exports to Japan

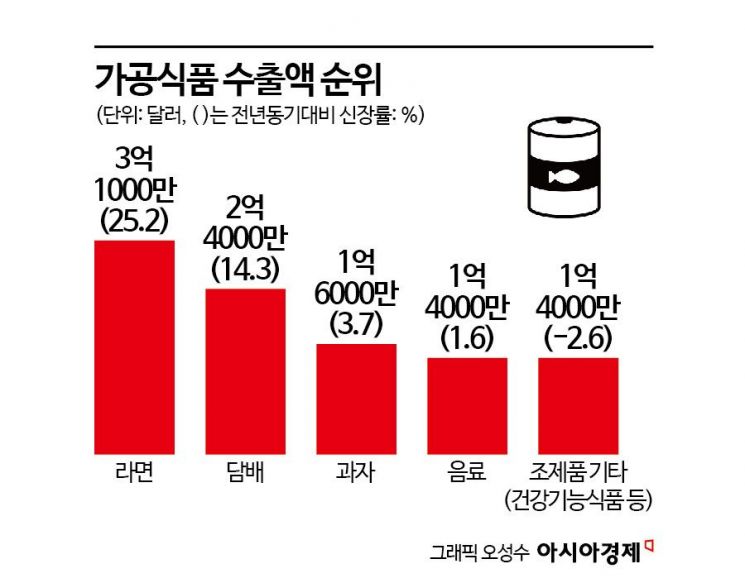

Ramen maintained its position as the 'top agricultural product exporter.' Ramen exports amounted to $310 million, a 25.2% increase. Tobacco exports followed with $240 million, up 14.3% year-on-year, and snacks exported about $160 million, growing 3.7%.

Among fresh foods, exports of chicken ($24 million) and grapes ($14 million) showed strong growth, increasing by 14.5% and 40.8%, respectively. The main export destinations for chicken and grapes are Vietnam and Taiwan.

The major agricultural product export countries were led by the United States with $469.92 million, accounting for 17.6% of the total, maintaining its position as the top market. This was followed by Japan ($365.79 million, 13.7%), China ($338.09 million, 12.7%), and the European Union ($190 million, 7.1%). Japan, which was third last year, rose to second place due to increased exports of key items such as ramen and snacks.

Food Industry Shows Strong Performance in Overseas Markets

Domestic food companies are also continuing their strong performance overseas. Orion's sales from January to February reached 614.2 billion KRW, a 6.2% increase compared to the same period last year. Among these, sales in China accounted for 260.2 billion KRW, or 42.4% of the total. This was followed by Korea (204.3 billion KRW), Vietnam (107.2 billion KRW), and Russia (42.5 billion KRW).

The Chinese subsidiary saw a 200% surge in shipments compared to the previous year, mainly through snack distribution channels. Jelly products like 'Almaengi Jelly (Guozuguoxin)', potato chips 'Swing Chip (Haoyouchu)', and snacks 'Goraebab (Haoduoerwei)' showed strong sales. Sales during the holiday season (November 2023 to February 2024) increased by 13.5% year-on-year, marking double-digit growth.

The company explained, "By placing Lunar New Year promotional products in stores from late October last year, we secured shelf space in advance and focused on securing dedicated small and medium-sized retailers in growth channels such as snack shops, online, and convenience stores." They added, "Despite continued increases in major raw material prices such as cocoa and oils, operating profit achieved high growth due to reduced advertising expenses and leverage effects from increased sales."

KT&G's first-quarter sales and operating profit (estimated by FN Guide) are expected to reach 1.4069 trillion KRW and 273.3 billion KRW, respectively, representing increases of 8.8% and 15.5% year-on-year. Overseas cigarette (cigarette) sales remain a key growth driver this year, following last year. Last year, KT&G achieved its highest-ever performance in overseas sales, recording sales of 1.4501 trillion KRW, a 28% increase from the previous year. KT&G ranks as the fifth-largest company in the overseas tobacco market. The company expanded its export markets from being concentrated in the Middle East to 135 countries, with 60% of total sales currently generated overseas.

Nongshim is seeing increased sales of ramen and snacks in Japan. In the 40 billion yen Japanese spicy ramen market, Shin Ramyun holds about a 25% market share. Nongshim aims to raise sales of its new local brand to around 20 billion yen by next year. The Japanese subsidiary's sales have grown at an average annual rate of about 16% over the past five years.

Samyang Foods is also continuing its growth trend, with overseas sales accounting for more than 77% of total sales. Particularly notable is its performance in the U.S. market. Following entry into all Walmart stores, it is expanding its presence in major distribution channels such as Costco, Kroger, and Target. Among the Buldak Bokkeum Myun series, 'Carbo Buldak' accounts for about 50% of total U.S. exports, followed by 'Original Buldak' (23%), 'Nuclear Buldak' (6.5%), 'Cheese Buldak' (5%), and 'Cream Carbo' (5%). A Samyang Foods official said, "The Buldak brand's position is solidifying in the U.S., and as mainstream distribution channels continue to expand, demand is expected to keep increasing. Once the Milyang Plant 2, scheduled for completion in June, begins full operation, we will be able to accelerate sales growth in the U.S."

Daesang's kimchi brand 'Jongga' is also strengthening its position in the U.S. market. Daesang reported that Jongga's U.S. export amount from January to February increased by 10.0% compared to the same period last year. A Daesang official explained, "Since last year, not only seasoned kimchi but also young radish kimchi have been stocked and sold in all Costco stores in the U.S. The increase in product weight for seasoned kimchi also positively impacted performance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.