No Hee-young, Former Brand Strategy Advisor for CJ Group

Key Figure Behind the Success of Brands Like Olive Young, Bibigo, and Market O

"Olive Young Ran at a Loss for 10 Years, Some Even Suggested Selling"

"Enhanced Appeal Through Renovation Efforts"

No Hee-young, CEO of the Food and Beverage Research Institute, revealed the secret to CJ Olive Young's success. CEO No previously served as a brand strategy advisor for CJ Group, successfully leading numerous brands such as Olive Young, Bibigo, and Market O.

No Hee-young, CEO of the Food and Beverage Research Institute. Screenshot from the YouTube channel Geunson No Hee-young

No Hee-young, CEO of the Food and Beverage Research Institute. Screenshot from the YouTube channel Geunson No Hee-young

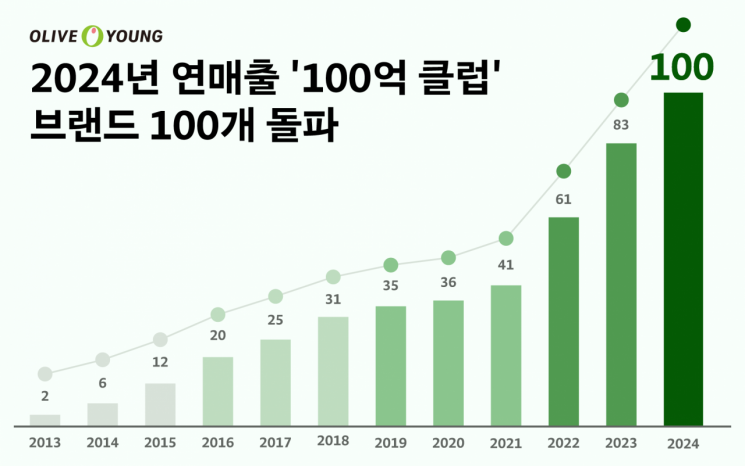

Recently, CEO No mentioned the branding secrets of CJ Olive Young on her YouTube channel 'Big Spender No Hee-young.' CJ Olive Young is a leading domestic H&B (Health & Beauty) platform, having joined the 4 trillion KRW sales club last year. According to the Financial Supervisory Service's electronic disclosure system, CJ Olive Young's sales last year reached 4.7899 trillion KRW, a 24% increase from 3.8611 trillion KRW the previous year, marking a record high. Net profit for the same period also rose about 35% to 470.2 billion KRW.

CEO No said, "Olive Young existed when I joined CJ as an advisor. Olive Young started in 1999," adding, "Now Olive Young has become the number one brand. Overseas tourists no longer go to duty-free shops but shop at Olive Young as a daily routine."

She continued, "People think Olive Young suddenly succeeded and made a fortune, but it was a brand that went through a lot of hardship in its own way," and "It struggled for about 10 years after its establishment, including running at a loss. Olive Young was always out in the market."

Foreign customers leaving the store after shopping for K-Beauty at Olive Young's 'Myeongdong Town'. Photo by Olive Young

Foreign customers leaving the store after shopping for K-Beauty at Olive Young's 'Myeongdong Town'. Photo by Olive Young

CEO No said, "Although it is called H&B now, back then its position was neither a pharmacy nor a general store," and "Also, pharmacies have very strong power to prevent selling certain products like medicines. In foreign countries, you can buy medicine at Boots (a UK drugstore), but in Korea, products like Tylenol still cannot be sold at Olive Young."

She explained that at the time, low-priced road shop brands like Missha were growing, and door-to-door sales were active, limiting the products Olive Young could sell. CEO No said, "There was really nothing to sell. We sold things like nail clippers," and "The store design was also unattractive."

Therefore, CEO No focused on making Olive Young a "space people want to enter." She said, "I proposed renovation to the chairman," adding, "We changed the plain signboard by tilting it for better visibility and replaced it with large windows to make the interior and exterior lighting contrast stand out." Following this, Olive Young saw an increase in franchise rates, achieving successful renovation results.

She cited the opening of a 200-pyeong (approximately 660 square meters) store in Myeongdong, Seoul, as a turning point for Olive Young. She said, "We wanted to showcase Olive Young's grandeur," and "We created an experience space inside the store where customers could try products. We even provided shampoo services." She added, "Although common now, having a faucet in the middle of the store was surprising at the time," and "We also created a perfume box, a space to spray perfume, making Olive Young a testing ground for all beauty content."

CEO No emphasized that properly understanding competitors and business areas had a significant impact on success. She said, "Olive Young could not compete with pharmacies or cosmetics companies," and "Starting with body products and perfumes was effective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.