Budget Formulation for Next Year Begins

Variables Include Presidential Election and Supplementary Budget Timing

Plugging Leaks in Mandatory Spending

Cutting Discretionary Spending by Over 10%

Saved Resources to Be Focused on "Industrial and Trade Support"

to Respond to Technological Hegemony

Tax Reduction Rate for National Taxes Again Exceeds the Legal Limit

The government is tightening next year's public spending by re-examining mandatory expenditures, which had previously been left untouched. Following this year's approach, it has set a policy to cut discretionary spending by more than 10%. With the fiscal demand for securing new growth engines expected to surge amid a deteriorating revenue base, the government is signaling a strong commitment to a high-intensity expenditure restructuring to significantly reduce spending. The funds saved will be intensively invested in supporting advanced industries such as semiconductors and biotechnology, as well as in responding to the changing global trade environment. However, given the possibility of an early presidential election depending on the Constitutional Court's ruling on the impeachment of President Yoon Suk Yeol and other future political developments, there are predictions that volatility in next year's budget formulation process will be considerable.

Democratic Party lawmakers held a press conference urging "immediate impeachment" in front of the Constitutional Court in Jongno-gu, Seoul on the 21st. 2025.03.21 Photo by Yoon Dongjoo

Democratic Party lawmakers held a press conference urging "immediate impeachment" in front of the Constitutional Court in Jongno-gu, Seoul on the 21st. 2025.03.21 Photo by Yoon Dongjoo

Budget Formulation for Next Year Begins... Variables Include Presidential Election and Supplementary Budget Timing

On the 25th, the government finalized and approved the "2026 Budget Formulation and Fund Management Plan Guidelines" at a Cabinet meeting presided over by Han Ducksoo, Acting President and Prime Minister. Confirming the budget formulation guidelines is the first step in preparing next year's budget. Based on these guidelines, each government ministry submits its budget requests to the Ministry of Economy and Finance by the end of May. The Ministry then coordinates with relevant ministries and local governments, gathers public input between June and August, formulates the budget proposal, and submits it to the National Assembly by September 2.

Given the possibility of an early presidential election due to President Yoon Suk Yeol's impeachment ruling, the process of formulating next year's budget is expected to face many variables. This is because it will be difficult to ignore potential changes in the political environment when ministries prepare their budget requests and during the full-scale budget formulation process. In addition, if a supplementary budget to counter the economic downturn is actively pursued, the government may face a situation where it must prepare both the main budget and a supplementary budget for next year simultaneously.

Plugging Leaks in Mandatory Spending, Cutting Discretionary Spending by Over 10%

The government has announced that it will include mandatory expenditures, which have largely been left untouched, as targets for restructuring. This means it will embark on a high-intensity fiscal diet that considers reducing not only discretionary spending but also mandatory expenditures such as welfare and personnel costs, which are determined by law. When ministries request budgets for mandatory expenditures, they will be required to estimate medium- and long-term needs and, if necessary, actively devise measures to maximize efficiency and prevent wasteful spending.

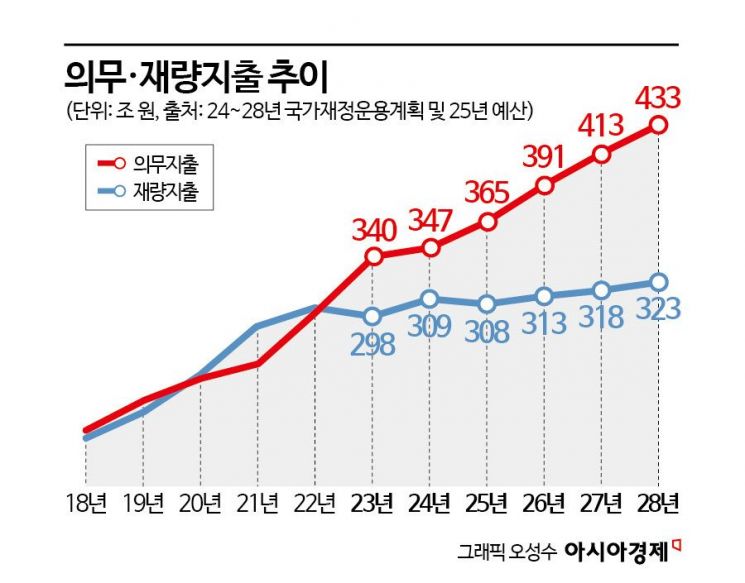

There have been ongoing concerns about the sustainability of public finances due to a weakened revenue base from slowing growth and increased mandatory spending driven by an aging population. According to the government's Medium-Term Fiscal Expenditure Plan (2024-2028), the average annual growth rate of mandatory spending is 5.7%, far outpacing the total expenditure growth rate of 3.6%. A Ministry of Economy and Finance official stated, "The growth rate of mandatory spending is now faster than that of total expenditures. We believe that extraordinary expenditure restructuring, including a review of mandatory spending, is necessary to maintain fiscal sustainability."

Discretionary spending, which can be adjusted at the government's discretion, will also be cut by more than 10%. In the process of formulating the 2025 budget, the government will apply a 10% reduction rate, cutting discretionary spending by about 24 trillion won. This marks the third consecutive year of expenditure restructuring at the 20 trillion won level. The Ministry of Economy and Finance stated, "We plan to strengthen preliminary reviews for new budget requests to check for similarities or overlaps with tax expenditures. For projects with chronically poor performance, we will seek ways to improve outcomes and enhance budget feedback."

Saved Resources to Be Focused on 'Industrial and Trade Support' to Respond to Technological Hegemony

In its National Fiscal Management Plan announced last August, the government projected a 4.0% increase in next year's budget. If this rate is maintained, total expenditures for next year will reach approximately 704.2 trillion won.

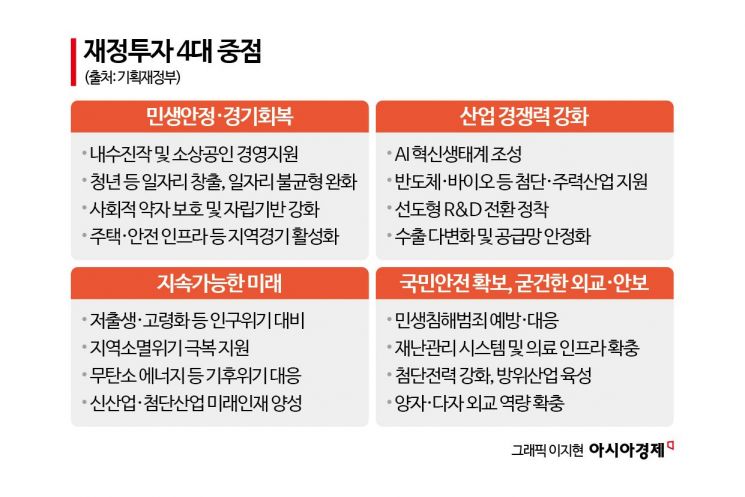

The government has decided to prioritize "strengthening industrial competitiveness" in this year's budget formulation. It plans to focus investments on nurturing high-tech industries such as artificial intelligence (AI), promoting industrial restructuring in sectors like semiconductors, and supporting export and supply chain stabilization amid intensifying global technological competition. The Ministry of Economy and Finance explained, "To support the strengthening of industrial competitiveness, we will foster an AI innovation ecosystem, support advanced and key industries such as semiconductors and biotechnology, and prioritize the allocation of resources to export diversification and supply chain stabilization in response to growing trade uncertainties."

Together with industrial competitiveness, the government identified four core areas: stabilizing people's livelihoods, economic recovery, a sustainable future, and national security and robust diplomacy. It will expand support for small business owners and youth job creation to stabilize livelihoods and promote economic recovery. A ministry official noted, "While the four priority investment directions are similar to this year's budget guidelines, the focus on strengthening industrial and trade competitiveness in response to global technological hegemony sets this year apart."

Tax Reduction Rate for National Taxes Again Exceeds the Legal Limit

At the Cabinet meeting, the government also approved the "2025 Basic Plan for Tax Expenditures." Tax expenditures refer to taxes that the government forgoes collecting. While budget expenditures provide direct support through spending, tax expenditures achieve similar effects by reducing tax burdens. The projected amount of national tax reductions for this year is 78 trillion won, an increase of 6.6 trillion won from last year's 71.4 trillion won.

As a result, the national tax reduction rate-the proportion of tax reductions relative to total national tax revenue-is expected to reach 15.9% this year, exceeding the legal limit of 15.6%. Last year, the rate was 16.3%, surpassing the legal ceiling of 14.6%. A Ministry of Economy and Finance official explained, "The 1.7 percentage point excess over last year's limit was due to a decrease in national tax revenue and a structural increase in expenditures. This year, the limit is also expected to be exceeded due to increased tax expenditures aimed at supporting economic dynamism and recovery of the real economy."

According to the National Finance Act, the national tax reduction rate must not exceed the average of the previous three years plus 0.5 percentage points. However, this will mark the third consecutive year that the limit has not been observed. The official added, "We will actively review and adjust tax expenditures that are unnecessary or have achieved their performance goals, so that the reduction rate can decline in the medium to long term through a virtuous cycle of growth and tax revenue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)