Bank of Korea Releases "March 2025 Consumer Survey Results"

Consumer Confidence Index at 93.4, Down 1.8 Points from Previous Month

April Political Developments and "Super Tariff Day" Remain Key Variables

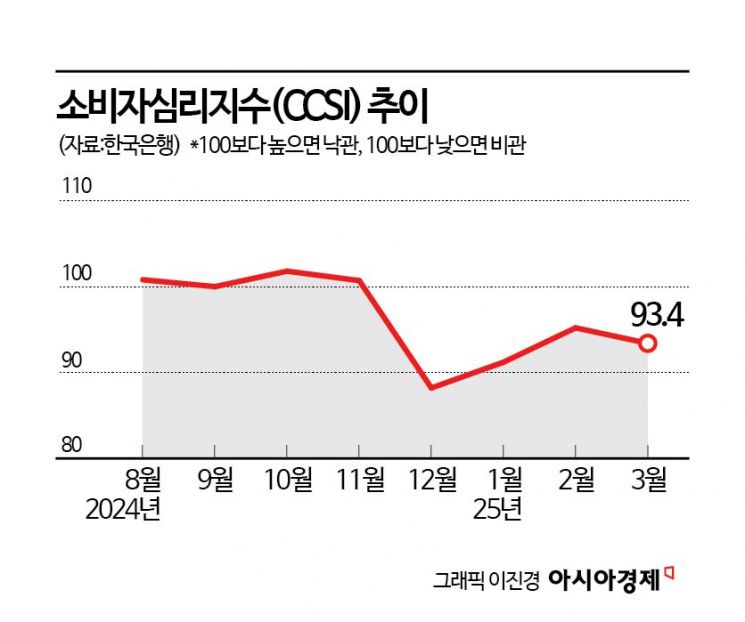

The Consumer Confidence Index (CCI), which comprehensively reflects consumer sentiment about the economic situation, declined again in March. After plummeting during the state of emergency at the end of last year, consumer sentiment showed signs of recovery over the first two months of this year but struggled to surpass the baseline value and turned downward again this month. Amid ongoing domestic and international uncertainties, concerns over weakened growth due to sluggish domestic demand and a slowdown in export growth negatively impacted consumer sentiment.

March CCSI at 93.4, down 1.8 points... "Recovery in Q1 still uncertain"

According to the 'March 2025 Consumer Survey Results' released by the Bank of Korea on the 25th, the Consumer Confidence Index (CCSI) for this month stood at 93.4, down 1.8 points from the previous month. This marks the first decline in three months. The downturn was influenced by sluggish domestic demand, a slowdown in export growth, and concerns over weakening economic growth. Persistent domestic political uncertainties, along with the ongoing 'push and pull' tariff policies of the new U.S. administration under Donald Trump, also contributed to the deterioration of consumer sentiment.

The CCSI is a sentiment indicator calculated using six major indices that make up the Consumer Survey Index (CSI). The long-term average is set at a baseline value of 100; values above 100 indicate optimism compared to the long-term average, while values below 100 indicate pessimism.

Until November last year, the CCSI consistently remained above 100, maintaining an optimistic trend. However, it sharply dropped to 88.2 in December due to the state of emergency. It showed signs of recovery in January and February this year but only improved by 3 and 4 points respectively compared to the previous months, remaining below the baseline. Lee Hye-young, head of the Economic Sentiment Survey Team at the Economic Statistics Division 1, said, "After the sharp drop in December last year, the index showed recovery in January and February but fell again in March. It has continuously stayed below the long-term average since the emergency, so overall, consumer sentiment in the first quarter of this year is still unfavorable."

Even if some domestic and international uncertainties are resolved next month, the degree of consumer sentiment recovery will vary depending on the direction and intensity of those changes. Lee added, "Not only domestic political situations but also the tariff policies of the Trump administration will influence the resolution of uncertainties. In particular, regarding tariffs, the outcome of the mutual tariff imposition on April 2, known as the 'Super Tariff Day,' and its impact on South Korea will affect whether the CCSI recovers."

Interest Rate Outlook Drops 7 Points... Impact of Base Rate Cut and Commercial Bank Rate Declines

Looking at the sectors, the Interest Rate Outlook CSI (92) fell sharply by 7 points, marking the largest decline since an 8-point drop in January last year. Lee explained, "The base interest rate cut influenced the reduction in commercial banks' spread rates from late February to early March, which affected related sentiment." The Employment Opportunity Outlook CSI (72) also decreased by 2 points compared to the previous month.

The Housing Price Outlook CSI (105) rose by 6 points from the previous month, influenced by the expanded price increase in the Seoul area following the lifting of land transaction permit zones last month. Lee said, "The land transaction permit zones were re-designated this month. While the extent remains to be seen, measures such as household debt management plans were also introduced, so we expect the impact to appear with some delay."

The Wage Level Outlook CSI (117) fell by 1 point compared to the previous month.

Regarding perceptions of the economic situation, the Future Economic Outlook CSI (70) dropped by 3 points from the previous month, reflecting the slowdown in export growth and downward revisions of growth forecasts. The Current Economic Situation CSI (55) remained unchanged from the previous month. Starting at 69 in early last year and maintaining levels in the low 70s, the Current Economic Situation CSI sharply fell to 52 in December last year and has since remained around the 50 mark.

Regarding household financial conditions, the Current Living Conditions CSI (87) remained unchanged for four consecutive months, while the Living Conditions Outlook CSI (92) decreased by 1 point from the previous month. The Household Income Outlook CSI (96) and Consumption Expenditure Outlook CSI (104) fell by 1 point and 2 points respectively compared to the previous month.

Household saving sentiment worsened, but sentiment regarding debt conditions slightly improved. The Current Household Saving CSI (93) remained unchanged from the previous month, but the Household Saving Outlook CSI (96) dropped by 1 point. However, the Current Household Debt CSI (100) and Household Debt Outlook CSI (99) rose by 1 point and 2 points respectively compared to the previous month.

The expected inflation rate for the next year remained at 2.7%, unchanged from the previous month, as consumer price inflation slowed but living cost increases expanded. The expected inflation rates for three and five years ahead also remained steady at 2.6%. The main items expected to influence consumer price inflation over the next year were agricultural, livestock, and fishery products (50.5%), public utility charges (48.8%), and industrial products (31.2%). Compared to the previous month, the response shares for industrial products (up 7.3 percentage points) and agricultural, livestock, and fishery products (up 3.8 percentage points) increased, while the share for petroleum products decreased by 17.1 percentage points.

This survey was conducted from the 11th to the 18th of this month, targeting 2,500 urban households nationwide (2,313 responses).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.