Refined Reciprocal Tariffs

Industry-Specific Announcements for Automobiles, Pharmaceuticals, Semiconductors, and Lumber Likely to Be Delayed

No Exemption Clauses for Individual Countries or Industries Expected Unlike First Term

Recession Fears Spread on Wall Street

The U.S. reciprocal tariff policy set to be implemented on April 2 is expected to take a more sophisticated form than initially anticipated, according to a report by the U.S. Wall Street Journal (WSJ) on the 23rd (local time). Although President Donald Trump appeared to impose tariffs on the entire world and industries, it is highly likely that the so-called 'Dirty 15'?countries with trade surpluses against the U.S.?will be the primary targets.

WSJ cited an administration official saying that tariffs by industry sectors such as automobiles, pharmaceuticals, semiconductors, and lumber are unlikely to be announced on April 2. The official told WSJ, "The White House plans to announce reciprocal tariffs on that day, but the specific plans are still fluid." Instead, tariffs are expected to be imposed targeting countries with trade surpluses against the U.S. Bloomberg News also reported that the approach will be more 'targeted' rather than a comprehensive tariff offensive against the entire world.

Key U.S. officials have previously provided clues to infer the target countries through media interviews. Treasury Secretary Scott Baesant said in an interview with Fox News on the 18th, "There are countries we call the 'Dirty 15,' and they impose significant tariffs on the U.S.," adding, "These countries also have important non-tariff barriers." The 'Dirty 15' refers to approximately 15% of countries that have consistently shown imbalanced trade relations with the U.S.

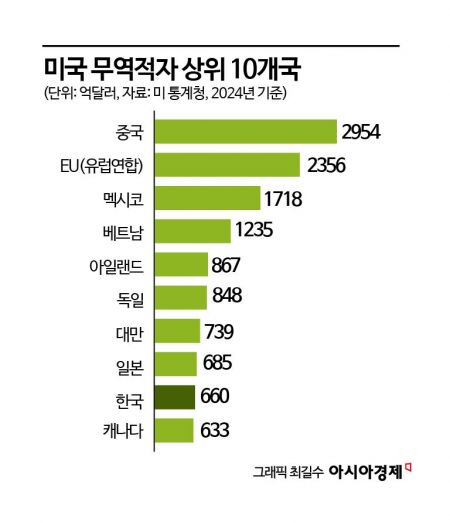

As of 2024, South Korea ranks 9th among countries with trade surpluses against the U.S. when including the European Union (EU), and rises to 8th when excluding the EU. Notably, South Korea is also included in the list of countries mentioned by the U.S. Trade Representative (USTR) in the Federal Register last month, making it a likely tariff target. The USTR requested opinions from U.S. industries and agencies regarding countries with trade imbalances with the U.S. The announcement mentioned G20 countries as well as Australia, Brazil, Canada, China, the EU, India, Japan, Korea, Mexico, Russia, and Vietnam.

Unlike during Trump's first term, the prevailing view is that exemptions for individual countries or industries should not be expected. WSJ conveyed that industry insiders who discussed sector-specific tariffs with the White House expressed pessimism about exemption clauses. USTR Representative Jamison Greer said, "We gave too many exemptions during the first term," and Commerce Secretary Howard Lutnick also reportedly conveyed that exemptions should not be expected, according to WSJ. During Trump's first term, South Korean steel companies accepted a quota system limiting steel exports to the U.S. in exchange for exemption from the 25% tariff.

President Trump also raised market expectations by mentioning 'tariff flexibility' again on the 21st but reaffirmed that the principle of 'reciprocity' remains unchanged. When asked by reporters at the White House whether tariff exemptions would be considered, Trump replied, "Many people ask me if exceptions can be made. But if I make an exception for one, I have to do it for others as well." He then referred to the one-month delay of tariffs on automobiles from Mexico and Canada following requests from the U.S. auto industry, stating, "I do not change," but added, "Flexibility is an important word. There will be flexibility, but basically it is reciprocity."

Meanwhile, on Wall Street, concerns about an economic recession due to tariff increases are spreading ahead of the reciprocal tariff implementation on April 2. The dollar index, which measures the value of the U.S. dollar against six major currencies, has fallen 4.4% through the 21st this year. The S&P 500, a representative U.S. stock market index, declined 3.6% during the same period. Bob Mitchell, Chief Global Bond Strategist at JP Morgan Asset Management, diagnosed, "Market participants are turning their eyes away from the dollar and beginning to diversify dollar-denominated assets into other markets and currencies," adding, "The market is generally saying that dollar exceptionalism has peaked."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.