Record-high Overseas Net Profit Last Year... All Overseas Subsidiaries in the Black

Strong Performance Helps Reclaim 'Leading Bank' Status After Six Years

This Year's Target: 1 Trillion KRW... "Aiming to Make History"

Advancing Business through Digital Finance Expansion in Vietnam

Considering Further Expansion into Uzbekistan, Africa, and More

Shinhan Bank is setting its overseas net profit target at 1 trillion KRW this year, aiming to solidify its position as a 'global powerhouse.' The bank is strengthening its business fundamentals in key countries such as Vietnam, Japan, and Kazakhstan, while also considering additional expansion into countries like Uzbekistan. Based on this, Shinhan Bank aims to maintain its 'leading bank' status, which it reclaimed after six years.

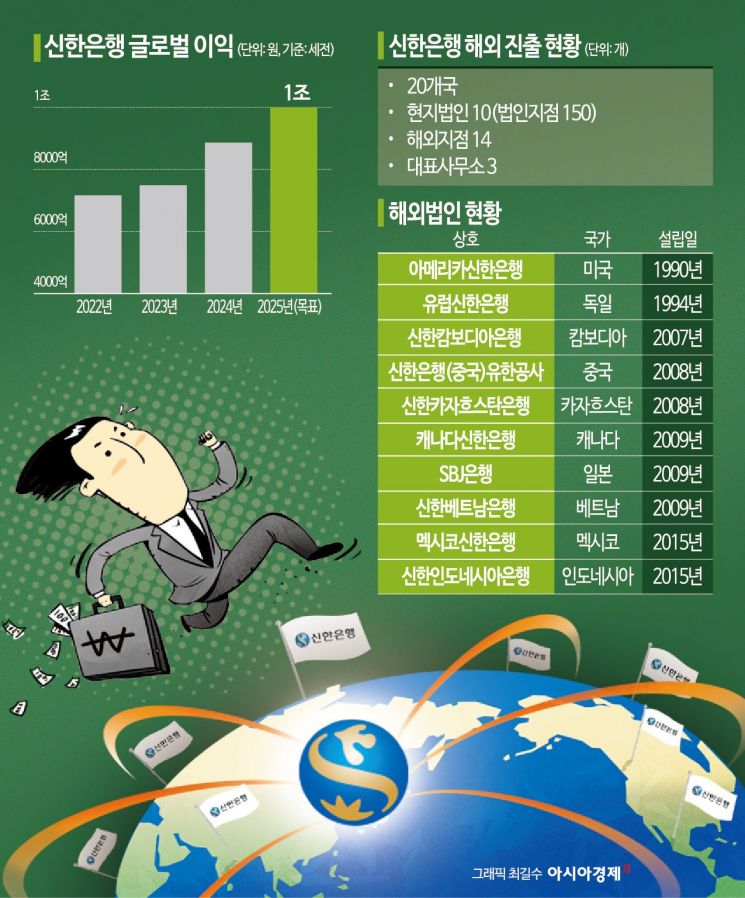

According to the financial industry on the 24th, Shinhan Bank has internally set its overseas net profit target at 1 trillion KRW for this year. A senior internal official stated, "We have set a target of 1 trillion KRW before tax and shared it with employees," adding, "We have the determination to achieve this within the next one to two years." Overseas net profit steadily increased from 716.7 billion KRW (before tax) in 2022 to a record high of 886.6 billion KRW last year.

Achieving an overseas net profit of '1 trillion KRW' is a formidable challenge for domestic banks. Although aiming globally to diversify revenue streams and shed the label of being a 'frog in a well,' actual performance still falls significantly short of domestic earnings. No commercial bank in Korea has yet surpassed 1 trillion KRW in overseas net profit.

Shinhan Bank's declaration of the '1 trillion KRW' figure is interpreted as a strong commitment to its global business. The bank's confident overseas business performance has been the foundation for this. Shinhan Bank's overseas net profit not only recorded an all-time high last year but was also the highest among commercial banks. The performance of its Vietnam branch alone (264 billion KRW) rivals the total overseas net profit of other banks. Last year, all 10 overseas subsidiaries posted profits.

Buoyed by strong performance, Shinhan Bank reclaimed the 'leading bank' position as the top annual performer after six years. Raising this year's target to 1 trillion KRW is also seen as a determination to further increase profits and firmly maintain the number one spot. Reducing dependence on the domestic market and enhancing global competitiveness are closely related to 'value-up' (corporate value enhancement).

Shinhan Bank's basic plan is to increase net profit by advancing the businesses of its existing key subsidiaries in Vietnam, Japan, and Kazakhstan. A senior internal official said, "The most important task is how to further advance the resources we already have."

In Vietnam, the bank has expanded its business by increasing branches but plans to extend its reach into digital finance, including non-face-to-face services. Shinhan Bank Vietnam was the first in the Vietnamese banking sector to launch a non-face-to-face loan product, marking its initial step. In Japan, a traditional stronghold, the bank is diversifying revenue by handling both retail and corporate finance comprehensively.

Besides the two main pillars, Shinhan Vietnam Bank and Japan's SBJ Bank, Kazakhstan is also considered a key country. Shinhan Kazakhstan Bank led overseas performance improvement by surpassing 100 billion KRW in net profit last year. The Russia-Ukraine war led to an increase in companies engaging in rerouted trade through Kazakhstan, benefiting the bank. Shinhan Bank's challenge is to maintain the improved performance trend achieved with difficulty. The bank plans to grow the market by increasing local corporate loans based on its expanded capital strength.

Additional expansion countries are also under continuous review. Shinhan Bank currently operates in 20 countries. It has established subsidiaries in 10 countries, including the United States, Japan, and China. The most recent was Indonesia in 2015. The bank has overseas branches in 9 countries with 14 branches, the last of which was established in 2016. Since 2020, the only new offices opened were in Hungary and the U.S. state of Georgia.

Shinhan Bank is currently exploring possibilities for expansion into Central Asia and Africa. Uzbekistan is a strong candidate in Central Asia. A senior internal official said, "Uzbekistan has a large population and a high birth rate, indicating sufficient growth potential. Bank privatization is also underway," adding, "We need to study what kind of business we can conduct there and assess its growth potential." The bank is also monitoring domestic companies' movements following the U.S. administration's tariff policies and is considering expanding its branches within the U.S.

Shinhan Bank is also reviewing additional equity investments in overseas banks, which it first ventured into last year. The bank acquired a 10% stake (about 240 billion KRW) in Credila, India's leading student loan bank, in April last year, generating equity-method income of 4.017 billion KRW within eight months. This year, equity-method income is expected to increase to around 10 billion KRW. Notably, Credila is aiming for an initial public offering (IPO) around April to May this year. If successful, the investment could be recovered within a year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.