Shareholder Proposals by Small Investors Surge 6.2 Times in 8 Years

KCCI: "Corporate Management Rights Now Under Real Threat"

Case of CEO Replaced by Small Shareholder Coalition

"Capital Markets Act Needs Targeted Amendments"

Since COVID-19, individual investors who have gathered through online platforms are leading shareholder meeting agendas and even driving management changes, signaling the full-fledged emergence of 'shareholder activism.' In response, voices from the corporate sector are calling for legal amendments to protect corporate management rights.

According to the report "Recent Changes and Implications of Shareholder Activism" released by the Korea Chamber of Commerce and Industry (KCCI) on the 24th, shareholder activism has entered a new phase centered on individual investors, as small shareholders' shareholder proposals at domestic listed companies have surged since COVID-19.

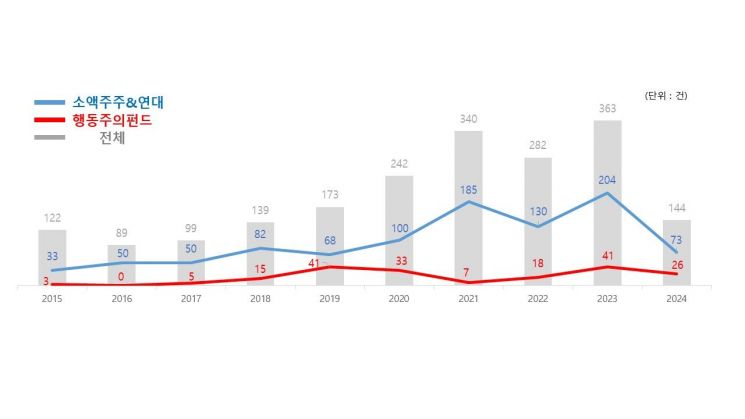

The report shows that small shareholders' shareholder proposals, which were only 33 cases in 2015, surged 6.2 times to 204 cases in 2023. In particular, small shareholders have strengthened the phenomenon of 'single shareholderization' by gathering through online platforms, resulting in a level that practically threatens management rights.

The total number of shareholder proposals has steadily increased from 122 cases in 2015 to 144 cases in 2024, with a notable rise to 363 cases in 2023, tripling compared to 2015. However, in 2024, the number dropped to about half of 2023's figure. The report attributes this to companies' proactive responses such as activating communication between shareholders and management and value-up policies.

Trends in shareholder proposals by minority shareholders, coalitions, and activist funds over the past 10 years, provided by the Korea Chamber of Commerce and Industry

Trends in shareholder proposals by minority shareholders, coalitions, and activist funds over the past 10 years, provided by the Korea Chamber of Commerce and Industry

KCCI classified small shareholders' proposals into three types: ▲profit enhancement type ▲ideological intervention type ▲management takeover type. The profit enhancement type aims to maximize shareholder benefits, such as expanding dividends and strengthening board independence. The ideological intervention type refers to interventions led by civic groups pursuing social values like ESG (environment, social, governance) and corporate democratization. The management takeover type involves private equity funds (PEFs) seeking to realize gains through acquiring management rights or public tender offers.

KCCI explained that the profit enhancement type could cause long-term management deterioration, the ideological intervention type could damage shareholder value, and the management takeover type even entails the risk of leakage of national core technologies.

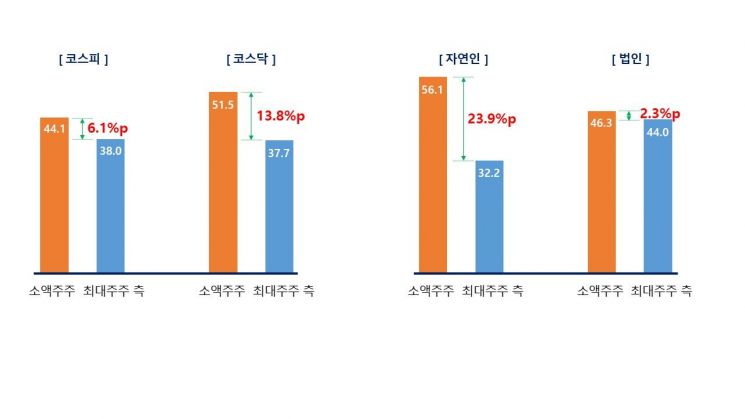

Analyzing 200 listed companies, 100 each from KOSPI and KOSDAQ, KCCI found that the average shareholding ratio of small shareholders was 47.8%, surpassing the 37.8% held by major shareholders and their related parties. Especially in KOSDAQ small and medium enterprises, the small shareholders' shareholding ratio reached 51.5%. When the major shareholder is an individual (natural person), the shareholding gap widened to 23.9 percentage points, and in one out of three cases, the major shareholder's stake was below 30%, raising warnings that stable management rights can no longer be assumed. In fact, last month, the Amicogen small shareholders' coalition secured a 35.7% stake and replaced the founder and CEO.

Minority shareholders vs. major shareholders and related parties' shareholding ratios, provided by the Korea Chamber of Commerce and Industry

Minority shareholders vs. major shareholders and related parties' shareholding ratios, provided by the Korea Chamber of Commerce and Industry

The report pointed out, "Unlike in the past, amid increasing possibilities of hostile mergers and acquisitions (M&A), corporate management rights threats are materializing by taking advantage of value-up policy trends." Accordingly, it emphasized the need to introduce management defense measures at the global standard level, such as dual-class voting rights and poison pills (rights to subscribe for new shares), in Korea as well.

Currently, Korea only allows dual-class voting rights restrictively for venture companies, and poison pills have not been introduced at all. In contrast, countries like the United States, Japan, and France widely utilize these systems.

Kang Seok-gu, head of the KCCI Research Department, said, "Recently, Korea's stock market has seen the gathering of small shareholders through online platforms, creating a unique K-shareholder activism that is not seen abroad and is highly effective in strengthening shareholder rights." He added, "Instead of the Commercial Act, which causes great confusion in the corporate field and could have serious side effects on our economy, it is desirable to make targeted improvements through amendments to the Capital Markets Act."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.