Some Companies, Including SanDisk, Announce Price Increases

Foreign Media: "Samsung Electronics and SK Hynix Expected to Raise Prices"

High Price Volatility in NAND... Inventory Accumulation Sentiment at Play

Industry: "Too Early to Judge a Full Demand Recovery"

Recently, the prices of commodity memory have slightly rebounded, but the semiconductor industry views this as a result of production cuts and inventory accumulation sentiment. Since supply adjustment has a significant impact, it is too early to consider this a full-fledged 'demand recovery.' Companies plan to maintain profitability through selective responses rather than premature price adjustments.

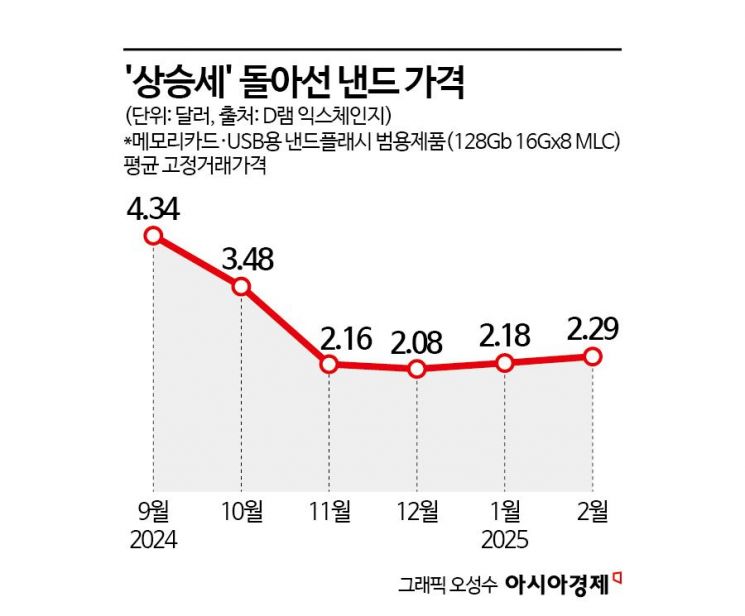

According to the semiconductor industry on the 21st, commodity memory prices are showing signs of rebound. The average fixed transaction price of PC D램 commodity products (DDR4 8Gb 1Gx8), compiled by DRAMeXchange, was $1.35 last month, the same as the previous month. After falling 20.59% in November last year, it has maintained a flat trend for three consecutive months. NAND flash prices had declined for four consecutive months since September last year but began to rebound from January this year. The average fixed transaction price of NAND flash commodity products for memory cards and USBs (128Gb 16Gx8 MLC) rose 4.57% to $2.18 in January and increased again by 5.29% to $2.29 last month.

Commodity memory supply was adjusted as Samsung Electronics, SK Hynix, and Micron began production cuts from the second half of last year. Additionally, the rapid growth of the artificial intelligence (AI) industry has increased demand for data centers and AI server storage, impacting the NAND market. In particular, China's iguhwanshin (replacement of old with new) policy appears to have contributed to the recovery in smartphone and PC demand.

According to foreign media reports, some companies have already started raising NAND prices. US-based SanDisk decided to increase NAND prices by about 10% starting next month, and Ztai, the retail brand of China's YTMC, also notified distributors of at least a 10% price increase from April. Taiwan's Digitimes forecasted that Samsung Electronics and SK Hynix would soon join the price hike trend.

However, the semiconductor industry is cautious about interpreting the upward shift in commodity memory prices as a 'demand recovery.' Since the supply glut has not been resolved, there is a high possibility that this is just a 'temporary rebound.'

Especially, NAND is a product with more volatile demand than D램. When supply increases, prices are likely to plunge sharply, so companies adjust production to reduce inventory burdens. It is analyzed that this production cut movement may have triggered purchasing sentiment to secure additional inventory when prices were low.

A semiconductor industry official said, "Looking at recent fixed transaction price trends, there has been some rebound, but it is difficult to see it as a recovery," adding, "The price increase trend appeared as some companies began production cuts, but it is too early to judge that inventory adjustment has been sufficiently completed."

In the domestic semiconductor industry, it is expected that NAND price trends will show volatility for the time being depending on major customers' order increases or changes in the production cut stance. Major semiconductor companies such as Samsung Electronics and SK Hynix are closely monitoring this trend and plan to maintain a 'profitability-focused' operational stance for the time being.

An industry insider said, "We have consistently focused on profitability since the downturn," adding, "Although production cuts will gradually normalize market inventory, it is still too early to make changes."

Another industry insider said, "NAND prices briefly rose due to supply adjustments in the first quarter of last year, but prices fell again in the second half when supply expanded amid a lack of demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.