Savings Bank Delinquency Rate Hits 8.52%, Highest in 9 Years

Two Consecutive Years of Losses for the First Time in a Decade

Due to the fallout from non-performing real estate project financing (PF) loans, the delinquency rate of savings banks soared to its highest level in nine years last year. Concerns over poor performance also grew as losses were recorded for two consecutive years.

Savings Bank Delinquency Rate at 8.52%, Highest in 9 Years

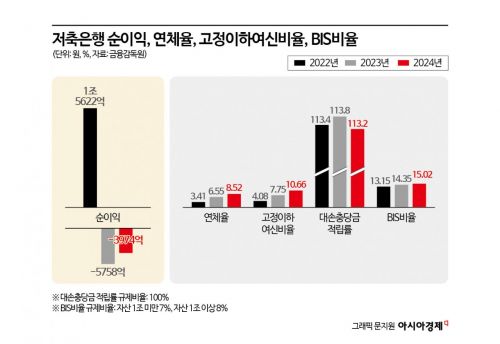

According to the provisional figures of the "2024 Savings Banks and Mutual Finance Cooperatives Business Performance" announced by the Financial Supervisory Service (FSS) on the 21st, the delinquency rate of 79 domestic savings banks was 8.52%, up 1.97 percentage points from 6.55% at the end of the previous year. According to the FSS Financial Statistics Information System, this is the highest since 9.2% at the end of 2015.

The overall delinquency rate was pushed up by a sharp rise in corporate loan delinquency rates to 12.81% due to non-performing real estate PF loans. This is an increase of 4.79 percentage points from 8.02% at the end of the previous year. The delinquency rate for household loans fell by 0.48 percentage points compared to 5.01% at the end of the previous year.

Savings banks recorded a net loss of 397.4 billion won last year, marking losses for two consecutive years. The deficit narrowed by 178.4 billion won (31%) compared to the previous year (575.8 billion won). This is the first time in 10 years since 2014 that losses have been recorded for two consecutive years. During the savings bank crisis, the deficit amounts were 34.9 billion won in 2011, 383.1 billion won in 2012, 682.3 billion won in 2013, and 308.9 billion won in 2014.

The non-performing loan (NPL) ratio, which relates to "bad loans," also hit a record high of 10.66%, up 2.91 percentage points from 7.75% at the end of the previous year. Generally, in the secondary financial sector such as savings banks and mutual finance, an NPL ratio below 5% is considered good, and below 3% is considered excellent.

A full survey of FSS statistics since 2018 shows the NPL ratios as 5.1% in 2018, 4.7% in 2019, 4.2% in 2020, 3.4% in 2021, 4.08% in 2022, 7.75% in 2023, and 10.66% last year.

The upward trend is also prominent on a quarterly basis. Since the FSS began announcing quarterly average NPL ratios for savings banks in the fourth quarter of 2015 (10.24%), the NPL ratio reached an all-time high of 11.53% in the second quarter of last year.

However, the Basel Committee on Banking Supervision (BIS) capital adequacy ratio, a standard for capital soundness evaluation, rose by 0.67 percentage points to 15.02% from 14.35% the previous year. It increased by 1.87 percentage points compared to 13.15% in 2022. This is well above the regulatory ratio of 7-8%. Although net losses reduced capital by 200 billion won (1.3%), the reduction of risk-weighted assets by 6.2 trillion won (5.7%) due to decreased loans led to an increase in the BIS ratio.

Mutual Finance Profits Decline, Asset Quality Deteriorates

Last year, profits from mutual finance cooperatives such as credit, Nonghyup, fisheries, and forestry cooperatives decreased, and asset quality worsened.

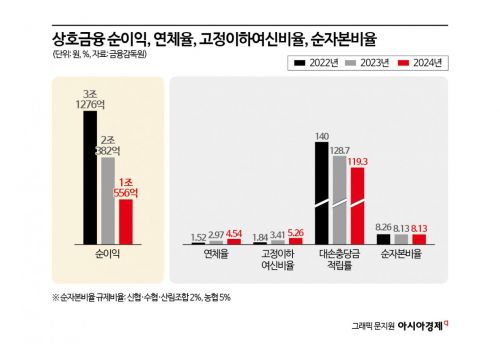

The delinquency rate for mutual finance in 2024 was 4.54%, up 1.57 percentage points from 2.97% the previous year. Compared to 1.52% in 2022, it surged by 3.02 percentage points. The upward trend was steep, rising more than 1.5 percentage points annually. The NPL ratio recorded 5.26%, nearly doubling compared to 1.52% in 2022 and 3.41% the previous year.

Net profit was 1.0556 trillion won, sharply down from 3.1276 trillion won in 2022 and 2.0382 trillion won the previous year. Mutual finance also maintained a sound net capital ratio. Last year’s net capital ratio was 8.13%, the same as the previous year and similar to 8.26% in 2022. This is more than double the regulatory ratios of 2-5% (2% for credit, fisheries, and forestry cooperatives, 5% for Nonghyup).

An FSS official stated, "At the end of last year, the delinquency rates of savings banks and mutual finance rose overall due to delayed economic recovery and a slump in the real estate market, weakening borrowers’ debt repayment ability," adding, "While savings banks recorded net losses for two consecutive years with slight improvement, mutual finance net profits decreased compared to the previous year due to increased bad debt expenses."

The FSS plans to enhance sector soundness by encouraging the sale of real estate PF distressed assets through auctions and voluntary sales.

An FSS official emphasized, "This year, we will continue to promote soundness improvement by disposing of non-performing assets through auctions, voluntary sales, and other means in preparation for ongoing domestic and external economic uncertainties," adding, "We will increase loss absorption capacity through sufficient provisioning for bad debts, capital expansion, and proactive liquidity management."

A representative from the Korea Federation of Savings Banks said, "We plan to promptly dispose of non-performing real estate PF assets through auctions and voluntary sales of projects classified as significant or at risk based on business feasibility evaluations," adding, "We will establish a subsidiary to purchase and manage savings bank NPLs to create a permanent and rapid resolution channel."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)