170 billion KRW flows into 2x KOSPI inverse ETF

Nearly -20% return as KOSPI rises 10%

Brokerages forecast KOSPI to reach 3000

Although there are analyses predicting a strong KOSPI this year, individual investors appear to be increasing their bets on a market decline.

This year, as the KOSPI has risen nearly 10%, the year-to-date return of the 'KODEX 200 Futures Inverse 2X' ETF is approaching -20%. Photo by Getty Images

This year, as the KOSPI has risen nearly 10%, the year-to-date return of the 'KODEX 200 Futures Inverse 2X' ETF is approaching -20%. Photo by Getty Images

According to KOSPI on the 21st, individual investors purchased 170.7 billion KRW worth of 'KODEX 200 Futures Inverse 2X' over the past week until the previous day. This was the top net purchase among all exchange-traded funds (ETFs) during that period. Compared to the beginning of the year, the net purchase amount exceeds 347 billion KRW. In contrast, during the same period, foreigners and institutions collectively net bought over 560 billion KRW of the 'KODEX Leverage' ETF, betting on a KOSPI rise.

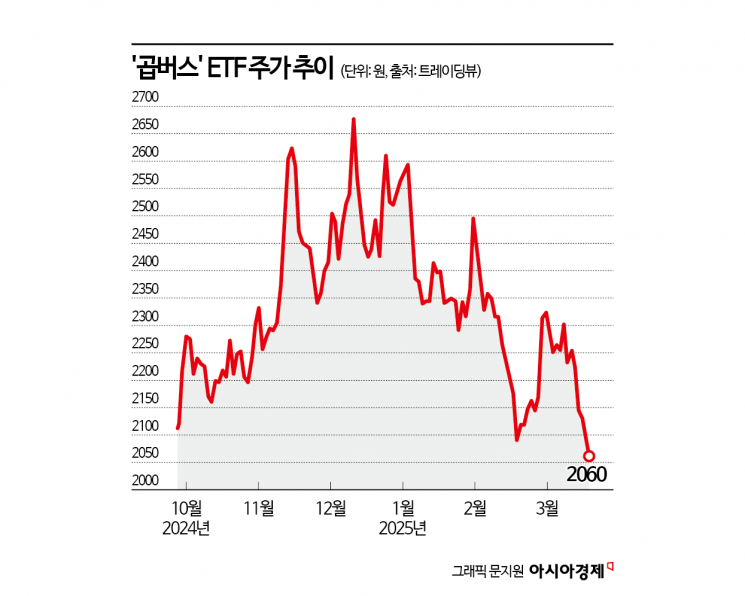

The so-called 'Gopbus (Multiply Inverse)' ETF, 'KODEX 200 Futures Inverse 2X,' tracks the daily return of the KOSPI 200 futures index with a -2x multiplier. It profits when the index falls and incurs losses when it rises. With the KOSPI rising nearly 10% since the start of the year, the ETF’s year-to-date return approaches -20%.

As investors worry, variables that could threaten the domestic stock market, such as the mutual tariff strikes announced by the U.S. for April 2, still remain. The Federal Reserve (Fed) also lowered its U.S. GDP growth forecast for this year from 2.1% to 1.7%, while raising the core Personal Consumption Expenditures (PCE) inflation rate from 2.5% to 2.8%, indicating that concerns about stagflation (rising prices amid economic slowdown) have not been completely dispelled.

However, there are analyses suggesting that even if the KOSPI experiences short-term volatility, it will secure upward momentum in the long term, making it a time to be cautious about excessive bets on index declines. Lee Kyung-min, a researcher at Daishin Securities, said, "Starting with the March Federal Open Market Committee (FOMC), excessive concerns about a U.S. recession and stagflation have significantly eased, and the U.S. stock market is expected to enter a full-fledged technical rebound phase." He added, "During the U.S. stock market rebound, the KOSPI will surpass the 2700 level in March and continue its upward trend toward the first half target of 3000."

Another positive factor is that the prices of KOSPI’s leading stocks are stirring, with Samsung Electronics reclaiming the 60,000 KRW mark for the first time in five months the previous day. Kim Soo-yeon, a researcher at Hanwha Investment & Securities, explained, "Earnings estimates have started to rise mainly in sectors sensitive to the economy and exposed to China, such as semiconductors, IT & home appliances, chemicals including batteries, and retail & distribution." She added, "The annual net profit estimate for this year is 204 trillion KRW, which represents the highest performance ever recorded for the KOSPI."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.