Simple Payment Usage Approaches 1 Trillion Won per Day

Electronic Financial Companies Lead the Market

Prepaid-Based Remittance Services and Payment Gateways Also See Growth

Last year, the scale of domestic simple payment usage nearly reached 1 trillion won per day on average.

According to the '2024 Electronic Payment Service Usage Status' announced by the Bank of Korea on the 20th, the usage scale of simple payment (simple payment) services last year was an average of 30.72 million transactions and 959.4 billion won per day, increasing by 12.3% and 9.6% respectively compared to the previous year.

Simple payment is a method of payment that uses information such as credit cards and bank accounts stored on a smartphone and allows easy payment through simple authentication methods such as passwords, fingerprints, or facial recognition.

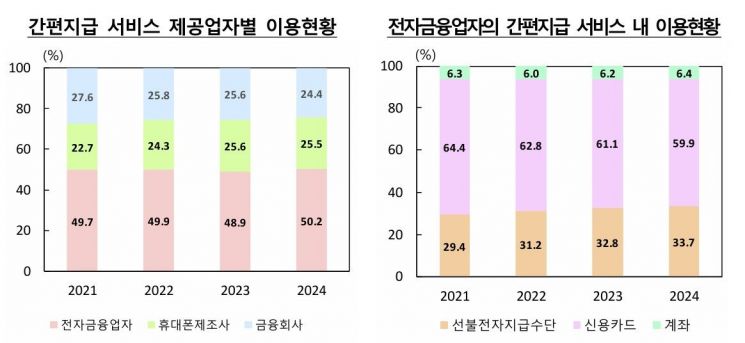

Looking at the usage amount of simple payments by providers, electronic financial companies such as KakaoPay and NaverPay accounted for the highest proportion at 50.2%. It rose to 49.9% in 2022, then fell to 48.9% in 2023, but the share expanded again last year, exceeding half. In particular, the usage share based on prepaid funds steadily increased from 31.2% in 2022 to 33.7% last year.

The share of mobile phone manufacturers such as Samsung Pay and Apple Pay remained in the 25% range, from 25.6% in 2023 to 25.5% last year. The average daily number of simple payment transactions and amount for mobile phone manufacturers last year were 9.254 million transactions and 244.28 billion won, respectively, increasing by 7.6% and 9.1% compared to the previous year.

The share of financial companies such as KB Pay and Shinhan SOL Pay shrank from 25.6% to 24.4% during the same period. The average daily number of simple payment transactions by financial companies last year was 3.452 million, a 3.7% decrease from the previous year. The transaction amount was 233.75 billion won, a 4.4% increase.

The usage scale of prepaid-based simple remittance services last year was an average of 7.21 million transactions and 912 billion won per day, increasing by 13.4% and 17.4% respectively compared to the previous year. This increase was influenced by the rise in simple remittances using services such as Toss, NaverPay, and KakaoPay.

Credit card payment agency services are also on the rise. Last year, the usage scale of electronic payment gateway (PG) services (daily average) was 29.36 million transactions and 1.3676 trillion won, increasing by 12.9% and 11.3% respectively compared to the previous year. Among PG services, credit card payment agency, which accounts for 76% of the transaction amount, increased by 8.3% compared to the previous year, while other payment agencies such as prepaid electronic payment methods and gift certificates also increased significantly by 54.3%. A Bank of Korea official explained, "This is due to prepaid operators expanding usage locations and benefits to activate the use of their own prepaid electronic payment methods."

Prepaid electronic payment method services refer to paying or remitting commercial transaction fees, transportation fares, etc., with prepaid funds charged in advance through account linkage and other means. As the growth trend of simple payments and remittances continues, the usage scale of this service (daily average) also increased last year to 33.17 million transactions and 1.1664 trillion won, up 12.2% and 16.2% respectively from the previous year.

Meanwhile, as of the end of last year, the total number of electronic payment service providers was 215, an increase of 15 companies compared to one year earlier. There were 191 electronic financial companies and 24 financial companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)