Homeplus to Settle Public Interest Bond Payments by Month-End

Doubts Persist Over Ability to Pay Partner Companies

Official Letter Promises Full Repayment of Receivables on the 14th

Seoul Milk Temporarily Suspends Product Supply Starting the 20th

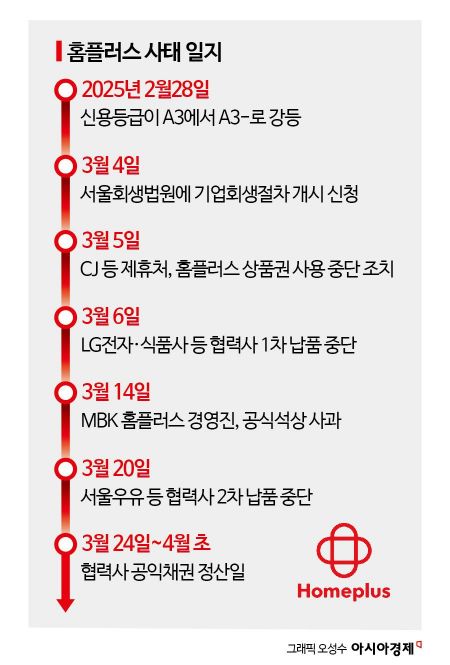

Concerns over unsettled payment for supplies from Homeplus, which has entered corporate rehabilitation proceedings, are resurfacing. Although Homeplus is intensifying promotional events and fighting desperately to secure cash, doubts about its ability to pay for goods remain. Some partner companies have taken preemptive defensive measures to enhance the safety of their receivables. Industry insiders view next week as a critical turning point, considering the bond maturity dates that will fully come due from the end of this month.

According to the distribution industry on the 21st, Homeplus must pay partner companies the settlement amount for public interest bonds incurred last month starting at the end of this month. In corporate rehabilitation procedures, commercial receivables are classified into rehabilitation claims and public interest claims based on the time of occurrence. Using March 4, the start date of the rehabilitation procedure, as the reference, rehabilitation claims and public interest claims are divided around 20 days before and after. Outstanding payments from January to February 11 of this year are classified as rehabilitation claims, while those incurred after February 12 are classified as public interest claims. Homeplus’s settlement cycle is 40 to 60 days.

Earlier, on the 14th, Cho Ju-yeon, CEO of Homeplus, sent an official letter to partner companies stating that "all commercial receivables will be fully repaid." The letter included that "regardless of the rehabilitation procedure, all Homeplus operations are running normally, and there is no impact on contract fulfillment or payment of transaction funds with partner companies." It also provided detailed payment plans for each partner company.

However, Homeplus sought understanding from large corporate partners regarding the repayment schedule of rehabilitation claims, citing the practical difficulty of paying all claims at once. CEO Cho requested, "We are prioritizing and sequentially paying small business owners and micro-enterprises, and ask large corporate partners to wait until May." It is reported that large corporate partners expressed reluctance to this request.

A partner company official explained, "After the rehabilitation began and payment for supplies did not come in, when product supply was halted, Homeplus pre-deposited between 500 million and 2 billion KRW of unpaid public interest claims per partner company," adding, "Although supply has resumed, the situation remains unstable, so we are providing goods within set limits."

The advance payments received by partner companies amount to less than one-fifth of one month’s payment (5 billion to 15 billion KRW). Partner companies reportedly communicated to Homeplus that they have set monthly supply volume limits and will temporarily suspend supply if the limit is exceeded. Previously, LG Electronics, Ottogi, Paldo, Dongseo Food, Samyang Foods, and Lotte Chilsung Beverage temporarily halted supply to Homeplus starting from the 6th but later resumed.

Some partner companies are requesting conditions such as shortening the payment cycle for supplies to Homeplus. Among those with difficult negotiations, some have already postponed supply schedules. Seoul Milk Cooperative decided to temporarily suspend product supply starting the day before.

Partner companies are concerned about the possibility of a vicious cycle repeating, as experienced immediately after the corporate rehabilitation application, involving partner company withdrawals and shortages of goods for sale. However, it is not an easy choice for partners to completely stop supplying Homeplus, as halting supply risks not only sales decline but also severing existing business relationships.

A partner company official said, "There is a high possibility that supply volume will gradually decrease depending on the situation, but if supply is stopped long-term, partners will suffer significant losses, so they must be cautious." Another official explained, "Various conditions related to payment are being proposed by each partner company, which may increase Homeplus’s costs for inventory procurement," adding, "Ultimately, partners are caught in a dilemma between stopping supply and continuing."

Homeplus stated that as of the 13th, it holds approximately 160 billion KRW in cash and daily cash inflows from operations, so there is no problem with paying the remaining commercial receivables. The amount of commercial receivables paid as of the previous day, disclosed by Homeplus, is 386.3 billion KRW. Homeplus is putting all efforts into securing cash by extending the large-scale discount event "Homeplun," which started at the end of last month to celebrate its 28th anniversary. With the full-scale payment of public interest claims beginning at the end of this month, market attention on Homeplus’s cash management ability is expected to intensify.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.