Nvidia Drops 3% After AI Conference Disappointment

Samsung Electronics and SK Hynix Rise Over 1%, Showing Decoupling

"Index Expected to Rise if Semiconductors Regain Leadership"

KOSPI's 'dual engines,' Samsung Electronics and SK Hynix, are dispelling concerns about a semiconductor crisis. Their resilience despite the stock price decline of AI leader Nvidia is bolstering the scenario of a rebound in the domestic stock market.

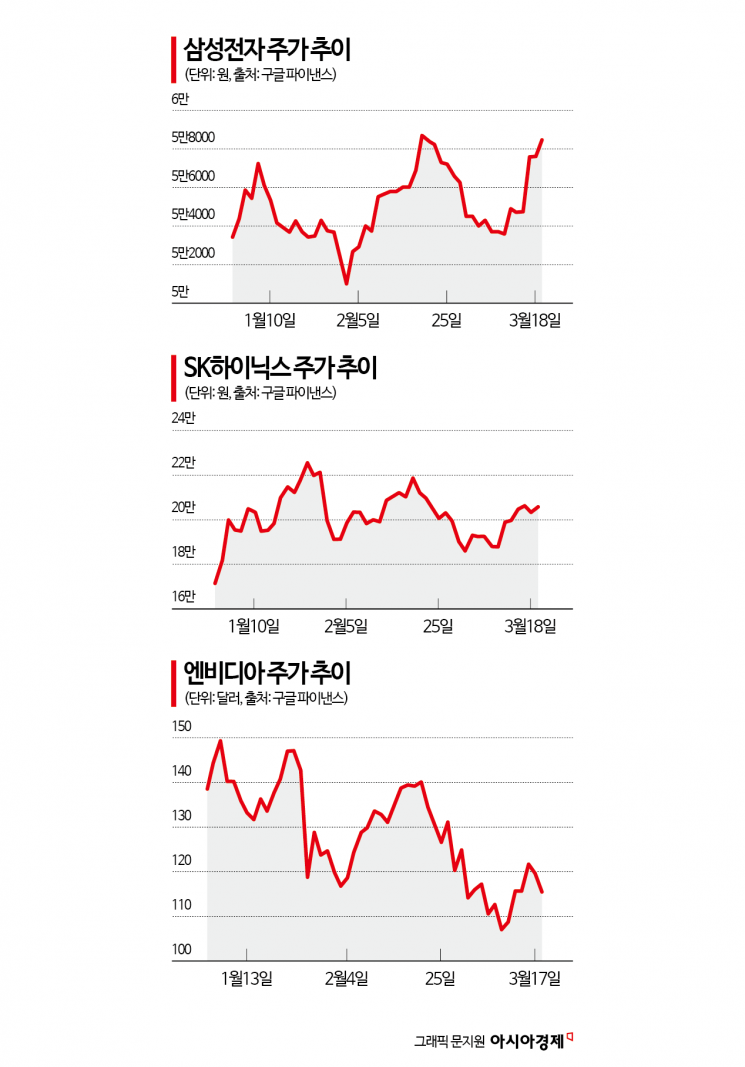

According to the Korea Exchange on the 20th, Samsung Electronics closed at 58,500 KRW, up 1.56% (900 KRW) from the previous day. While individual investors sold shares worth 478.3 billion KRW, foreign and institutional investors net bought 278.3 billion KRW and 133.8 billion KRW respectively, driving the stock price. SK Hynix, which had fallen as much as -1% during the day, also showed strong momentum and closed at 205,500 KRW, up 1.23% (2,500 KRW).

Despite Nvidia's stock price sinking into a slump, Korea's semiconductor 'top two' attracted buying interest. Nvidia's stock fell 3.4% on the 18th (local time) due to disappointment at the AI conference, but on the same day, SK Hynix drew market attention by announcing the world's first sample supply of 'High Bandwidth Memory (HBM)4 12-layer.' Samsung Electronics, which held its shareholders' meeting under Chairman Lee Jae-yong's 'do or die' determination, lagged behind in HBM3E (5th generation) but expressed a strong will not to repeat mistakes with HBM4 (6th generation), stimulating investor sentiment.

With Samsung Electronics and SK Hynix reportedly reducing NAND flash production due to recent oversupply, attention is also focused on earnings improvement as US-based SanDisk decided to raise NAND prices by more than 10% starting next month. Park Kang-ho, a researcher at Daishin Securities, explained, "While decoupling from the US stock market is expected to continue, the semiconductor industry's bottoming out and expectations for improvement in the second half are reflected in the rising stock prices of Samsung Electronics and SK Hynix. Expectations for semiconductor recovery centered on memory (DRAM and NAND flash) are increasing this year." Morgan Stanley, which ignited the 'semiconductor winter' theory, recently raised the target prices for Samsung Electronics and SK Hynix to 70,000 KRW and 230,000 KRW respectively.

There is analysis that if semiconductor leaders such as Samsung Electronics and SK Hynix reclaim their leading stock status, it will also strengthen the rebound in the domestic stock market. Lee Woong-chan, a researcher at iM Securities, emphasized, "The domestic stock market is currently setting aside the US correction and is seeing increasing trust in semiconductor sectors such as Samsung Electronics following a rally in defense industry stocks due to Europe's increased defense spending. When semiconductors are strong, the index rises."

It is also evaluated that they have developed resilience against the resumption of short selling, which is considered a variable. Ko Young-min, a researcher at Daol Investment & Securities, diagnosed, "The impact on semiconductor leaders such as Samsung Electronics and SK Hynix during the resumption of short selling on the 31st is expected to be neutral. This is because sector supply and demand imbalances are not as significant as last year, and valuation pressure is not severe."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.