Promotion of Comprehensive Insurance Reform Tasks

Product Improvements Including Death Benefit Securitization

On the 18th, the Financial Services Commission announced that it will implement 74 comprehensive insurance reform tasks, including strengthening internal controls within insurance companies to prevent insurance fraud. It emphasized improving products that encompass the lives of the public, such as implementing the 'death benefit securitization' system from the second half of the year, which allows death benefits to be used in advance during the policyholder's lifetime.

Kim So-young, Vice Chairman of the Financial Services Commission, is presiding over the 4th Insurance Reform Meeting held at the Government Seoul Office in Jongno-gu, Seoul on November 4 last year. Photo by Yonhap News

Kim So-young, Vice Chairman of the Financial Services Commission, is presiding over the 4th Insurance Reform Meeting held at the Government Seoul Office in Jongno-gu, Seoul on November 4 last year. Photo by Yonhap News

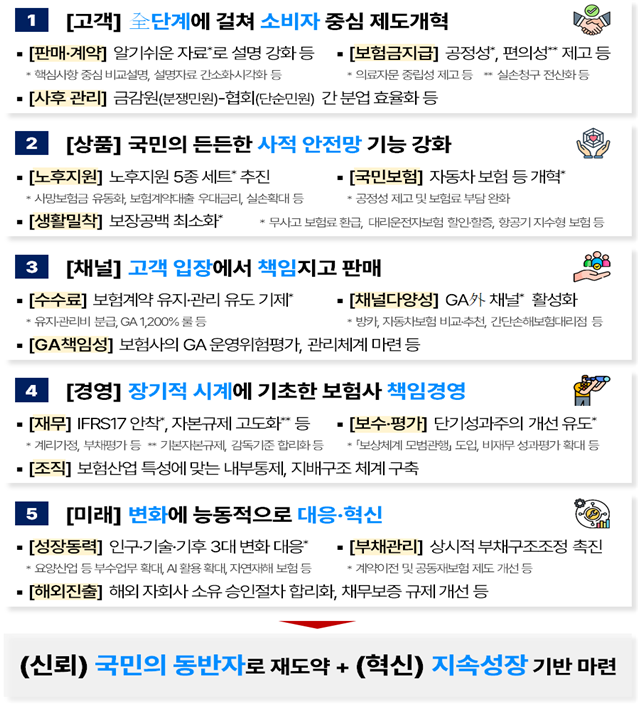

The Financial Services Commission revealed that it has prepared a comprehensive plan consisting of 74 tasks related to consumer-oriented improvements, the new International Financial Reporting Standard (IFRS17), excessive competition, sales commissions, and five major strategies.

The five major strategies are ▲ consumer-centered system reform at all stages of insurance ▲ product improvements encompassing the lives of the public ▲ strengthening accountability of sales channels ▲ renewal of insurance company management and culture ▲ response to change and innovation.

Looking at the tasks by strategy, first, consumer product explanation materials and disclosure systems will be reorganized. To prevent incomplete sales at the contract conclusion stage, information provision will be expanded, including product contract retention rates and disciplinary history of agents.

Through improvements in the medical advisory system and claims adjustment system, the speed of insurance benefit payments to consumers will be increased. The Financial Supervisory Service will focus on dispute complaints by reorganizing the complaint handling process. Approximately 7,000 simple complaints will be transferred to associations.

Product improvements such as the five-item old-age support set will be undertaken. The death benefit securitization system will be implemented. Policyholders will be able to receive about 100~190% of their paid premiums as an annuity while leaving insurance benefits behind.

Preferential interest rates will be offered for insurance policy loans to elderly policyholders. Providing a 10bp (1bp=0.01 percentage point) preferential interest rate can save about '33 billion KRW + α' in interest. The enrollment age for elderly and medically vulnerable individuals in indemnity insurance will be raised from 70 and 75 years to 90 years, and the coverage age will be extended from 100 to 110 years.

The automobile insurance system will be improved to reduce annual premiums by about 3%. Through the indemnity insurance system, the average treatment cost per minor injury patient will be reduced by about 890,000 KRW.

Pregnancy and childbirth coverage will be expanded to cover about 200,000 pregnant women annually. A discount and surcharge system for substitute driver insurance has been introduced, enabling 3,489 substitute drivers to enroll in insurance. Joint fire insurance subscriptions have increased, allowing 1,853 markets and about 270,000 stores nationwide to additionally subscribe to fire insurance.

The sales commission system will be reorganized. By establishing maintenance commissions (3~7 years) and expanding disclosures, insurance contract maintenance will be encouraged. The 1200% rule for corporate insurance agencies (GA) has been applied. The 1200% rule is a regulation that limits the commission paid to agents within one year after an insurance contract to not exceed 1200% of the monthly premium.

Responsibility for incomplete sales will be strengthened and internal controls will be established, centered on GAs. A risk assessment system for GA operations and a management system for delegated tasks will be newly introduced, assigning responsibility for delegated management to insurance companies. Tasks such as sales commission reform will be finalized after collecting opinions through briefings and other means.

The Car Insurance Comparison Recommendation Service 2.0 is scheduled to be launched this month.

Efforts will be made to renew insurance company management culture. To establish IFRS17, an actuarial assumption calculation methodology will be developed. Improvements will be made to the surrender value reserve and contingency reserve systems. Insurance company product committees will be given responsibility to autonomously manage the entire product development and sales process.

Three major internal control strengthening tasks for insurance companies will be pursued: standard internal control standards, guidelines for preventing financial accidents in insurance companies, and internal control regulations for preventing insurance fraud. For the first time in the financial industry, a 'model practice for executive compensation systems' will be introduced to improve short-term performance orientation.

A basic capital regulatory ratio will be introduced to qualitatively enhance insurance company capital. To promote continuous liability management by insurance companies, the criteria for contract transfer classification will be detailed.

To boost growth momentum for insurance companies, expansion of business scope will be permitted. The scope of subsidiaries and ancillary businesses related to nursing care and the pet industry will be expanded. Tontine and low-surrender-value annuity insurance will be introduced. After introduction, the annuity amount is expected to increase by about 40%.

Insurtech innovation services such as artificial intelligence (AI) and big data will be supported. Index-type weather insurance will be activated, and improvements to natural disaster coverage products will be reviewed.

The Financial Services Commission stated that 23 (31%) of the 74 tasks are already underway. To ensure reform tasks take root in the field, the 'Insurance Reform Inspection Team' centered on associations and insurance companies will continuously monitor task implementation status.

Legislative measures related to system improvements will be focused on until the end of the year. Unconfirmed tasks will also have follow-up measures established through short-term research projects and consultations with related agencies. Unconfirmed tasks include reviewing the introduction of specialized sales companies, activating the use of data for customized product development, revitalizing small-amount short-term insurance companies, and reviewing special profit regulation improvements.

Kim So-young, Vice Chairman of the Financial Services Commission, emphasized, "We ask all members, including insurance companies and GAs, to participate in insurance reform for the industry's leap forward," adding, "Insurance reform is only complete when the public can feel its effects."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.