Visiting Korea for the March Shareholders' Meeting Super Week

Attending Major Listed Companies' Shareholders' Meetings and Meeting with Government and Related Organizations

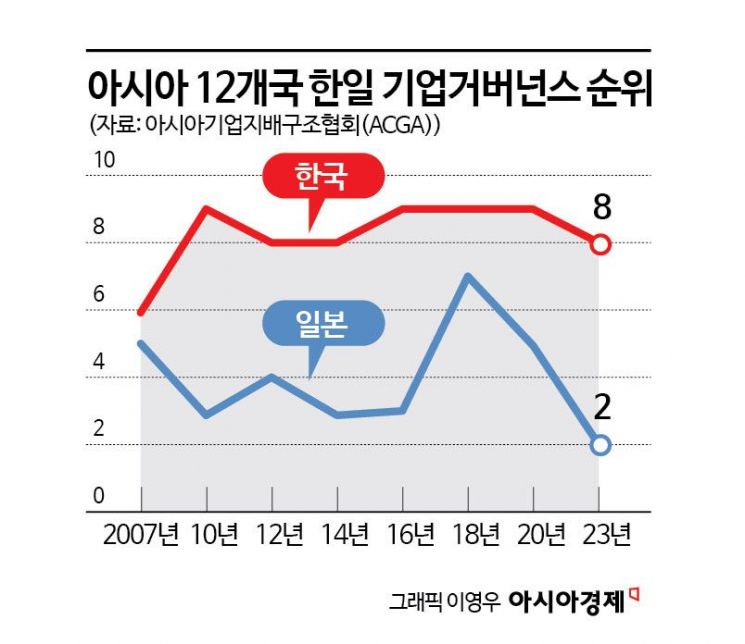

Overseas corporate governance experts, major pension funds, and investment banks (IBs) are set to visit Korea next week in line with the 'Shareholders' Meeting Super Week.' This visit aims to directly assess the achievements and current status of the second year of the 'Corporate Value Enhancement (Value-Up) Program,' while also serving as an effort by global investors to raise their voices regarding Korean companies. The outcomes confirmed during this visit will be reflected in the corporate governance rankings of 12 Asian countries published by the Asian Corporate Governance Association (ACGA) in the future. Attention is focused on whether the government's ambitious move to resolve the Korea discount will lead to an improvement in Korea's ranking (8th in 2023).

According to the financial investment industry on the 18th, the ACGA delegation, composed of global pension funds, IBs, and other overseas institutional investors, will visit Korea next week to meet with the government and related organizations and attend major listed companies' shareholders' meetings. This is the second time the ACGA delegation has visited Korea in March, the regular shareholders' meeting season, rather than at the year-end annual conference, following last year.

This year as well, the schedule is packed with attending shareholders' meetings of listed companies including LG Chem in the morning, and meetings with related organizations such as the Ministry of Economy and Finance, Financial Services Commission, Korea Exchange, National Assembly Legislative Research Office, and the National Pension Service in the afternoon. ACGA has 101 member companies including pension funds, sovereign wealth funds, asset management firms, and IBs from 18 markets worldwide, with member firms managing assets totaling $40 trillion (approximately 57,700 trillion KRW). This year, executives from member firms such as Fidelity are reported to accompany the ACGA secretariat. Last year, representatives from hedge fund Elliott Management, Dutch pension asset manager APG, and Goldman Sachs Asset Management participated.

Industry insiders particularly emphasize the significance of their repeated visit to Korea timed with the March regular shareholders' meeting Super Week. Established in 1999 to improve the Asian corporate governance environment, ACGA is a representative non-profit organization that has long pointed out the Korea discount (undervaluation) issue in the domestic stock market. One official conveyed the atmosphere, saying, "There is strong enthusiasm among overseas investors to directly verify the progress of the corporate value-up program that started last year in Korea."

Moreover, in the context of the rise of shareholder activism in recent years, there is also a signal that investors intend to raise their voices more strongly regarding the actions of domestic companies. They plan to attend major listed companies' shareholders' meetings as shareholders and conduct individual meetings with some companies. The shareholders' meeting Super Week they will visit includes meetings scheduled for LG Chem and Lotte Shopping (24th), LG Electronics and Hana Financial Group (25th), Naver, Kakao, E-Mart, and KB Financial Group (26th), SK Hynix and Youngpoong (27th), and Korea Zinc and SK Innovation (28th).

Namwoo Lee, Chairman of the Korea Corporate Governance Forum, analyzed, "The trend of foreign investors coming directly to Korea to present opinions and ask questions at shareholders' meetings is gradually expanding," adding, "This is an international trend where the efforts to reclaim shareholder rights seen earlier in Japan are spreading to Korea."

ACGA plans to reassess the corporate governance rankings of Asian countries during this visit. In the annual corporate governance evaluation covering 12 Asian countries, Korea ranked 8th in 2023, remaining in the lower tier. Korea's ranking, which was 6th in 2007, has struggled to rise above the 8th to 9th range since then. In contrast, Japan, which served as a benchmark for the value-up program, jumped three places to 2nd in the 2023 report published last year, recognized for its value-up achievements.

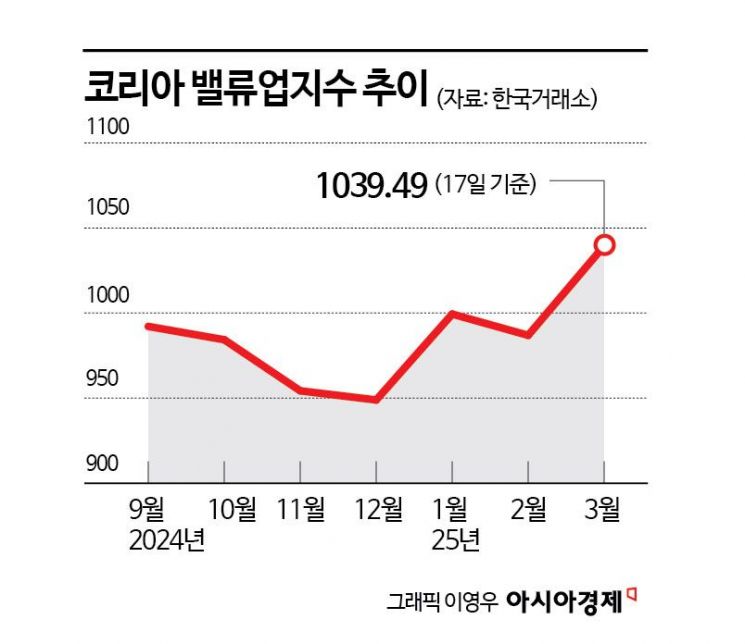

However, among investors, there is also disappointment regarding the value-up policy, which lost momentum amid martial law and impeachment political turmoil. Although more than 100 companies have expressed their intention to participate in the value-up program and disclosed related information, injecting vitality into the domestic capital market, many still evaluate that it is insufficient to resolve the Korea discount. The reasons cited include inadequate shareholder returns and governance issues.

Soyeon Park, a researcher at Shin Young Securities, stated, "One of the key themes that will permeate the domestic stock market this year will be 'governance reform,'" adding, "Not only individual shareholders but also major state institutions consistently emphasize the need for governance improvement." She acknowledged, "Skepticism about the value-up policy cannot be denied," but expressed hope that "the broad trend of companies expanding shareholder return initiatives will continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)