Investor Roadshows Held in Europe Last Month

This Year's Fundraising Target Set Higher Than Last Year

Successful Issuance of 600 Million Euro Covered Bond This Year

The Korea Housing Finance Corporation (KHFC) plans to raise approximately 5.9 trillion won in funds overseas this year. The goal is to reduce dependence on the domestic market and diversify funding channels to secure funds more stably, setting a higher target than last year's fundraising scale. The steady issuance so far has increased interest from overseas investors, presenting an opportunity. With active marketing efforts, the corporation successfully completed its first covered bond (dual recourse bond) issuance this year.

According to financial sources on the 18th, KHFC held investor roadshows in Europe from the 16th to the 23rd of last month. They visited four countries?Germany, Luxembourg, London in the UK, and Switzerland?and met with 18 investment institutions. They met with major entities such as PIMCO, the world's largest bond manager; global asset manager Franklin Templeton; the European Investment Bank (EIB); and the Swiss National Bank to share plans for covered bond issuance as well as the political and economic situation in Korea.

At the investor roadshows, KHFC announced plans to raise about 5.9 trillion won overseas this year. The main funding instruments are euro-denominated covered bonds (long-term bonds issued with high-quality assets such as mortgage loans and government bonds held by the issuer as collateral) and dollar-denominated corporate bonds (senior unsecured bonds).

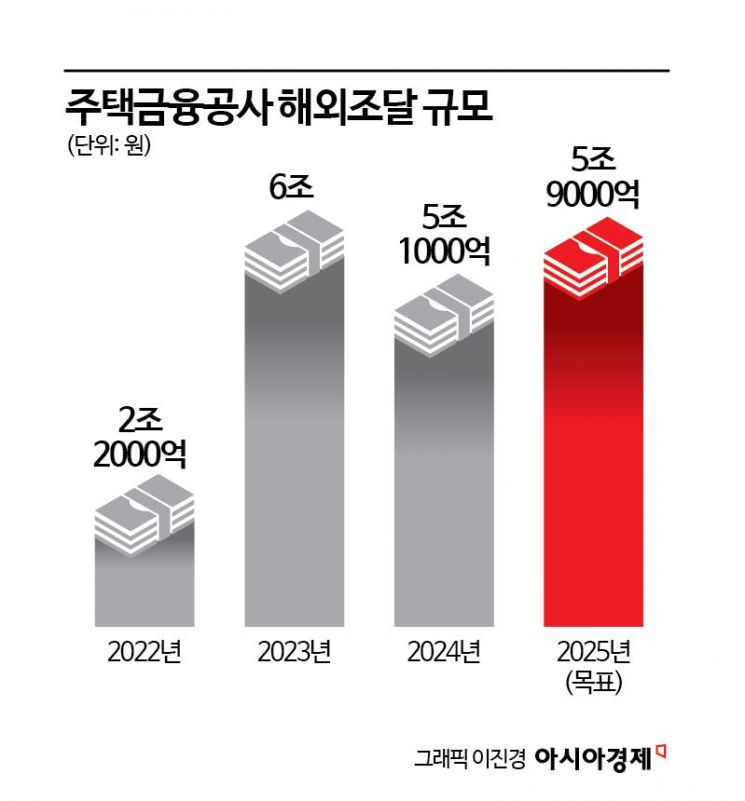

KHFC's overseas fundraising scale was around 2.2 trillion won in 2022, expanded to 6 trillion won in 2023, and maintained at 5.1 trillion won last year. This year, the target is set higher than last year's performance. The total issuance plan for securitized bonds, including overseas issuance, is 20 trillion won, which contrasts with last year's actual issuance of 20.6 trillion won, showing a slight decrease.

KHFC is focusing on overseas fundraising due to the growing demand and the need to expand financial resources, as well as to reduce the burden of issuance in the domestic market. Diversifying funding sources also enhances stability. In particular, covered bonds, which account for more than half of overseas fundraising, allow for raising funds at interest rates lower than domestic market rates. This enables stable procurement of medium- to long-term funds, serving as a source for long-term, fixed-rate mortgage loans. This aligns with the financial authorities' policy to expand long-term, fixed-rate products using covered bonds.

Interest in KHFC's covered bonds is especially rising in the European covered bond market. This is the result of KHFC's consistent issuance and expansion of volume. The credit rating is also the highest grade of 'Aaa' by Moody's, which is higher than KHFC's own rating of Aa2. Despite the unstable political and economic situation in Korea, including emergency measures, KHFC confirmed its market position by successfully issuing a 5-year covered bond worth 600 million euros after the European investor roadshow. The funding interest rate was 2.74%.

KHFC plans to further expand its overseas fundraising market. It is considering new currency issuances such as Formosa bonds (bonds issued in the Taiwan market by foreign institutions in foreign currencies like the US dollar) and pound sterling. Last month, KHFC expanded its overseas presence by opening a London office with President Kim Kyung-hwan in attendance. A KHFC official said, "We plan to issue additional covered bonds in the second half of the year" and added, "We will also strengthen overseas investor marketing in line with the issuance plans."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.