Plant Division Leads in Profitability with 81.1% Cost Ratio

Workforce and Executives Restructured Around Plant Sector

"If We Secure SMR Leadership, the Company Will Be Completely Transformed"

DL E&C is accelerating its 'structural reform' by reducing the proportion of its housing business and increasing its plant business. This change is clearly noticeable in both sales and workforce. The market also predicts that the growth of the plant sector will determine DL E&C's corporate value in the future.

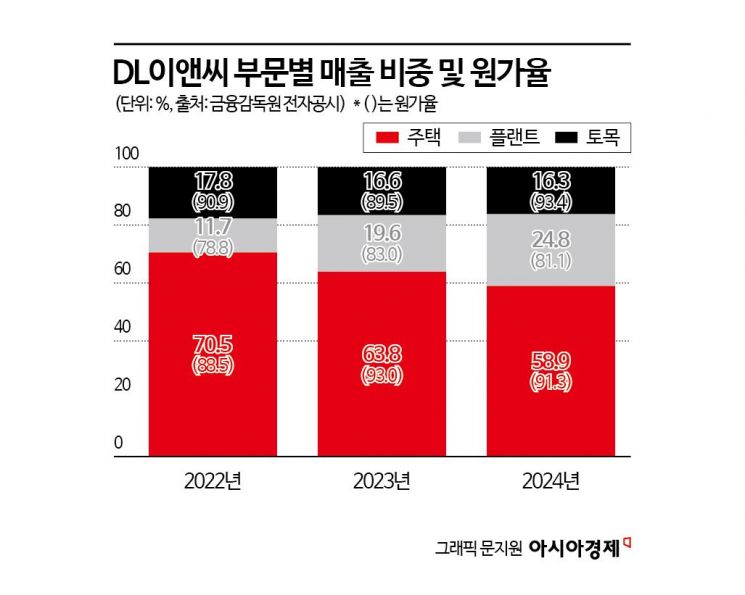

According to DL E&C's 2024 business report disclosed on the Financial Supervisory Service's electronic disclosure system on the 18th, the proportion of housing business sales last year was 58.9%. This marks a continued decline from 70.5% in 2022 and 63.8% in 2023. On the other hand, the plant business proportion doubled over two years, rising from 11.7% in 2022 to 24.8% last year. The civil engineering business proportion remained at a similar level as previous years, at 16.3%.

Recouping Profitability through Plants... The Only Division with Increased Employees

DL E&C is a representative construction company that compensates for the sluggish housing business, its main sector, through the growth of its plant business. Looking at last year's operating profit by division, the plant sector recorded 269.8 billion KRW, housing 195.5 billion KRW, and civil engineering 42.8 billion KRW. Although housing sales still account for the largest share, the plant sector surpassed housing in operating profit due to its cost ratio. The plant cost ratio is 81.1%, meaning that if the construction cost is 1 million KRW, the cost is just over 810,000 KRW. This is the lowest among the three business divisions. The housing cost ratio is 91.3%, and civil engineering is 93.4%.

Changes are also detected in DL E&C's employee composition. As of the end of last year, the plant division had 1,232 regular employees, the highest among business divisions. Compared to 2023 (1,164 employees), this is a 5.8% increase. The plant division is the only business unit with increased personnel. Not only employees but also executives in the plant sector are increasing. Among the six newly promoted managing directors in this year's regular personnel reshuffle, three were assigned to plant-related roles. In contrast, the traditionally largest housing division saw a 14.8% decrease in regular employees, from 1,266 in 2023 to 1,079 in 2024. Including civil engineering and support divisions, DL E&C's total workforce (including temporary staff) was 5,589, down 2.0% from 5,706 in 2023.

The Market's Focus Shifts to Next-Generation Growth Engine SMR

Small Modular Reactors (SMRs) are gaining attention as the next-generation energy source. Unlike large reactors that produce over 1000MW of power, SMRs generate less than 300MW and are designed as modular units by integrating major components. They offer higher safety than traditional large nuclear power plants, require less installation space, and have simpler design and operation procedures, reducing the likelihood of malfunctions. In an era of explosive growth in AI technology and the widespread adoption of electric vehicles, which have led to a surge in global electricity demand, Korea hopes to secure a leading position in the global market through the development of Korean-style SMR technology. The photo shows officials busily working at the Innovative Small Modular Reactor Technology Development Project Group in Yuseong-gu, Daejeon. Photo by Kang Jin-hyung.

Small Modular Reactors (SMRs) are gaining attention as the next-generation energy source. Unlike large reactors that produce over 1000MW of power, SMRs generate less than 300MW and are designed as modular units by integrating major components. They offer higher safety than traditional large nuclear power plants, require less installation space, and have simpler design and operation procedures, reducing the likelihood of malfunctions. In an era of explosive growth in AI technology and the widespread adoption of electric vehicles, which have led to a surge in global electricity demand, Korea hopes to secure a leading position in the global market through the development of Korean-style SMR technology. The photo shows officials busily working at the Innovative Small Modular Reactor Technology Development Project Group in Yuseong-gu, Daejeon. Photo by Kang Jin-hyung.

DL E&C's changes are analyzed not as a simple business portfolio adjustment but as a strategic transformation to become a global integrated engineering, procurement, and construction (EPC) company. It is seeking new growth engines in the plant market to overcome the domestic market stagnation. The market is particularly focusing on the small modular reactor (SMR) business as DL E&C's future growth engine. KB Securities researchers Moonjun Jang and Minchang Kang stated, "DL E&C is cooperating with X-energy, which is leading the competition for the standardization of 4th generation SMRs," adding, "It is important to note that DL E&C has been collaborating with X-energy as an EPC partner from the early stages." They also added, "If SMR standardization progresses, DL E&C can continuously benefit from subsequent projects."

In 2023, DL E&C invested 20 million USD in convertible bonds of X-energy, a US SMR developer. They are jointly promoting SMR projects with X-energy in Norway, Indonesia, and other countries. DL E&C also signed a partnership with Canadian nuclear company Terrestrial Energy. SMRs refer to small reactors with an electric output of 300 MW or less. It is a next-generation nuclear power technology that modularizes major equipment for factory production. The related market size is expected to reach 600 trillion KRW by 2035. A DL E&C official said, "It is no exaggeration to say that we are at the world’s top level in SMR," adding, "If we can secure the market, we will transform into a completely different company."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.