Loan Loss Provision Coverage Ratios of Domestic Banks Excessively High

Cited as a Factor Restricting Growth

Need to Lower Coverage Ratios and Increase Investment in Risk Assets

There have been criticisms that the loan loss provision coverage ratio (CR) accumulated by major domestic banks to prepare for crises is excessively high compared to major banks in other countries, which is actually hindering growth.

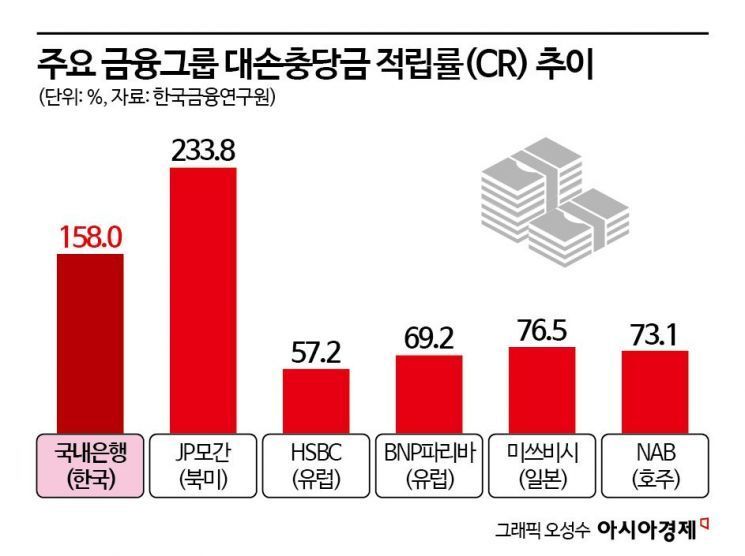

According to the report titled "International Comparison and Implications of Loan Loss Provision Coverage Ratios of Domestic Bank Groups" by the Korea Institute of Finance on the 18th, as of the end of 2023, the CR of seven domestic bank groups was about 158%, significantly higher than the global major bank groups' average of 97.4%. The seven bank groups are KB, Shinhan, Hana, Woori, BNK, JB, and DGB.

The CR is a ratio that indicates the extent to which a financial company has set aside loan loss provisions to cover non-performing loans. It shows how much loan loss provisions a financial company has accumulated to prepare for non-performing loans such as classified loans and is an important indicator used to evaluate a financial company's ability to absorb credit losses.

The CR of domestic banks surveyed by the institute from 2017 to 2023 consistently appeared higher compared to global bank groups. For European banks, HSBC's CR was only 57.2% as of 2023, and BNP Paribas was about 69.2%, which is much lower than that of major Korean banks. Japan's Mitsubishi UFJ Bank had 76.5%, Sumitomo Mitsui Bank 79.9%, and Australia's National Australia Bank only 73.1%.

In the United States, JP Morgan had an exceptionally high CR of 233.8%, and Bank of America had 179.6%, higher than Korea. The report explained that this was due to major U.S. banks accumulating tens of trillions of won in provisions to prevent crises during the COVID-19 pandemic. Woojin Kim, Senior Research Fellow at the Korea Institute of Finance, evaluated, "The increase in CR among U.S. bank groups during the COVID-19 period was mainly due to the confirmation and accumulation of related provisions as the number of irrecoverable borrowers rapidly increased due to unforeseen events."

However, except for the U.S., the CR indicators of major banks in other countries are considerably lower than those of domestic banks. This is analyzed to be because domestic banks adopt a conservative approach to handling non-performing loans, setting aside provisions of 1% for household loans and 0.85% for corporate loans even for loans classified as normal.

Domestic banks tend to improve asset soundness by early selling or writing off non-performing loans to subsidiaries or external agencies capable of debt collection rather than actively promoting corporate rehabilitation while holding non-performing loans. In contrast, overseas banks tend to manage these loans internally, which is also analyzed as a reason for the CR difference.

The report pointed out that even considering the differences in domestic and overseas practices, the excessive loan loss provision accumulation of domestic bank groups compared to the global average weakens the level of available internal capital, hindering group growth and reducing dividend capacity, which may run counter to the contemporary spirit of enhancing corporate value (value-up). Above all, it emphasized that while it helps clear past non-performing loans, it is difficult to proactively prevent the potential occurrence of non-performing loans.

Senior Research Fellow Kim stated, "During deteriorating business conditions, supervisory authorities can stabilize the soundness of bank groups by strengthening CR management," but added, "Investors may not agree with the approach of pouring large-scale costs to block waves that are unlikely to occur." He further added, "For the sustainable growth of domestic financial groups, it is necessary to shift management strategies to a medium-risk, medium-return business model with somewhat higher expected returns rather than excessive loan loss provision accumulation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.