Korea Eximbank Overseas Economic Research Institute

"2025 Export Environment Outlook Survey for Export Companies"

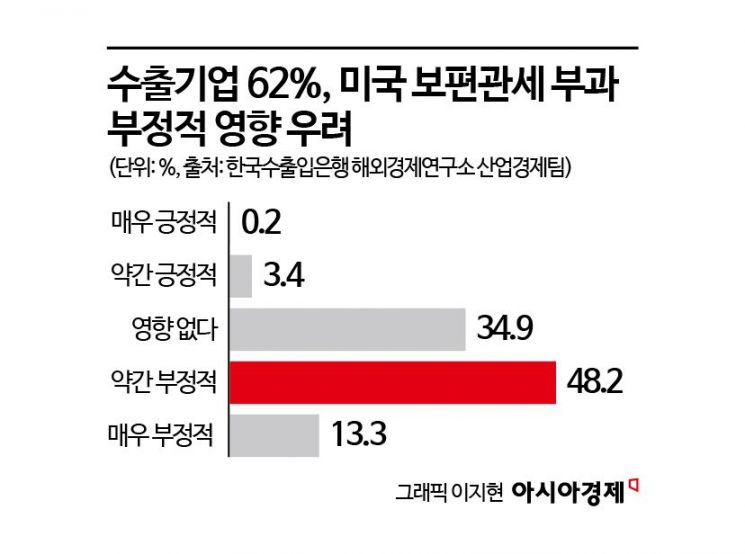

62% Expect Negative Impact

Automobile, Textile, Steel, and Machinery Sectors Are 'Sensitive'

Low Expectations for Export Growth

Average Breakeven Exchange Rate at 1,370 KRW

As the Trump administration's universal tariff policy began on the 12th with a 25% tariff on steel and aluminum, Korean export companies expressed concerns about negative impacts. They also viewed the export environment unfavorably, forecasting an average export growth rate of just around 1% for this year.

According to the "2025 Export Environment Outlook Survey for Export Companies" published on the 17th by the Korea Eximbank's Overseas Economic Research Institute, export companies responded in this manner. The survey targeted 502 export companies (53 large enterprises and 449 SMEs) across 10 industries (including machinery, automobiles, and electrical electronics) with exports exceeding $500,000 (approximately 727.8 million KRW).

If the U.S. universal tariffs are fully imposed, 13.3% of export companies said they would be very negative about export activities, and 58.2% said slightly negative, totaling 61.6% expecting adverse effects. Large enterprises were slightly more likely than SMEs to anticipate negative impacts. Among large enterprises, 9.4% responded very negatively and 52.8% slightly negatively, totaling 62.3%. Among SMEs, 13.8% responded very negatively and 47.7% slightly negatively, totaling 61.5% expecting negative effects.

By industry, the proportion expecting negative impacts was high in automobiles (80.8%), textiles (71.4%), steel (64.9%), and machinery (64.3%). Particularly, the "very negative" opinions were highest in the automobile and machinery sectors at 22.2% and 18.3%, respectively. Regionally, negative outlooks were high for the U.S. (83.1%), the Middle East (66.7%), and Latin America (65.1%), but export companies to other regions also expected impacts. The institute analyzed that although only about 30% of respondent companies have the U.S. as their main export market, "the impact of parts and materials exports and the presence of companies exporting to various regions cause the universal tariff imposition to have a broader ripple effect," adding, "actual universal tariff imposition is expected to inevitably cause export losses."

Negative views also appeared in export growth forecasts. Among export companies, 23.3% expected export value to increase compared to the previous year, while 18.3% expected a decrease. 58.4% anticipated export levels to remain the same as the previous year. The average export growth rate among respondents was only 1.2% (0.3% for large enterprises and 1.3% for SMEs), indicating a weak growth outlook. Specifically, the average decrease rate was -17.9%, and the average increase rate was 19.1%.

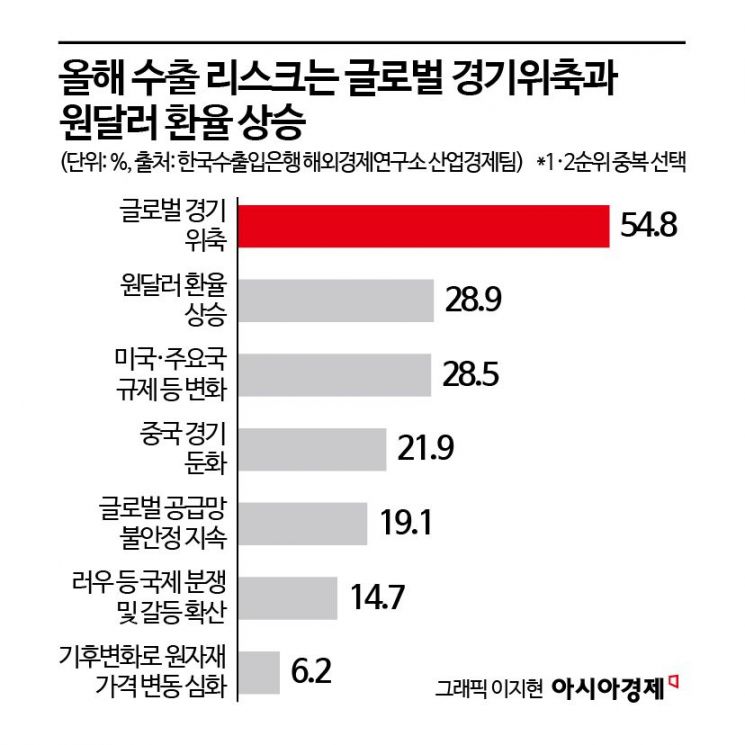

Regarding the most negative factors affecting exports this year, export companies most frequently cited "global economic contraction." The proportion of companies naming "global economic contraction" as a top risk (combined first and second rank) was 54.8%. This was followed by the rise in the won-dollar exchange rate (28.9%), changes in regulations, tariffs, and support from the U.S. and major countries (28.5%), and the slowdown in China's economy (21.9%).

The average exchange rate planned for business operations by export companies this year was 1,387 KRW per dollar. The average breakeven exchange rate was 1,370 KRW. Due to increased exchange rate volatility, the proportion of companies unable or unwilling to specify planned or breakeven exchange rates rose significantly to 27.1% and 41.4%, respectively, compared to last year's survey (7.6% and 10.5%). Responses indicating that won depreciation positively affects export activities accounted for 36.3%, while 34.9% said it had a negative effect, showing growing concerns about exchange rate increases. The institute stated, "Currently, the high won-dollar exchange rate positively affects export companies' price competitiveness, but since a large portion of export companies also import parts and raw materials, continued won depreciation will increase burdens."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)