If Retaliatory Tariffs Become Reality, Korean Companies Face Unavoidable Price Increases and Profitability Deterioration

Urgent Need for Countermeasures Focused on Cost Reduction and Risk Minimization

Since the inauguration of the Trump administration in the United States, tariff and tax policies as well as trade and commerce regulations are expected to be further strengthened, with domestic companies expressing the greatest concern over the loss of price competitiveness due to retaliatory tariffs.

On the 14th, global accounting and consulting firm EY Hanyoung revealed this through the results of a survey conducted among attendees of the recently held ‘2025 EY Hanyoung Revised Tax Law Seminar.’ A total of 265 domestic corporate tax and accounting officials participated in the survey.

According to the survey results, more than half of the respondents (59%) selected ‘strengthening of America First trade policies’ as the tax policy change expected to have the greatest impact on domestic companies following the inauguration of the second Trump administration. This was followed by ‘reduction and changes in incentive programs provided in the form of subsidies’ (14%) and ‘the U.S. government’s negative stance on Base Erosion and Profit Shifting (BEPS) 2.0’ (14%).

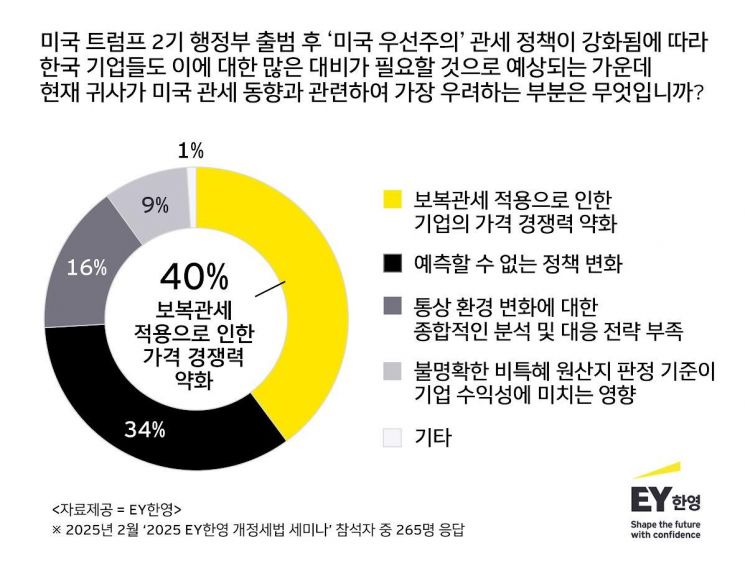

Forty percent of respondents said they were most concerned about ‘weakening of corporate price competitiveness due to the application of retaliatory tariffs.’ If retaliatory tariffs materialize, companies are likely to face a dilemma of either passing additional cost burdens onto consumers through unavoidable price increases or enduring profitability deterioration themselves.

Other major concerns domestic companies have regarding current U.S. tariff trends included ▲unpredictable policy changes (34%) ▲lack of comprehensive analysis and response strategies to changes in the trade environment (16%) ▲impact of unclear non-preferential origin determination criteria on corporate profitability (9%).

It was also found that preparing effective countermeasures is challenging. Respondents indicated the need for advice on ▲reviewing tariff and tax support systems (41%) ▲examining additional tariff imposition targets (32%) ▲reconsidering supply chain production bases to minimize tariff burdens (27%) ▲tax-efficient investment structures (27%) to respond to tariff and policy changes.

While minimizing additional tax burdens was the main task during the early implementation of the global minimum tax last year, after the system became fully operational, companies appear to be struggling more with practical responses than with strategic planning. In particular, the need for integrated management of basic data and the establishment of integrated management procedures encompassing accounting and taxation from a group consolidation perspective has grown significantly.

Meanwhile, when asked which part of the government’s 2025 tax law revision received the most emphasis, 34% of respondents answered ‘rationalization of the tax system,’ recording the highest response rate. This was followed by ‘support for economic dynamism’ (31%), ‘recovery of the livelihood economy’ (30%), and ‘taxpayer-friendly environment’ (3%).

Kyungtae Ko, Head of EY Hanyoung’s Tax Division, said, “Tariff policies under the America First principle are expected to cause structural changes in the cost structure of domestic export companies and the reorganization of the global value chain. Accordingly, companies need to redesign tariff taxable prices linked to transfer pricing, consider reviewing non-preferential origin criteria, and increase the utilization of Free Trade Agreements (FTAs), thereby establishing diversified tariff risk hedging strategies.”

EY Hanyoung launched its Global Trade Advisory Team in February to collaborate with local U.S. experts and provide more localized trade advisory and response strategies, helping Korean companies minimize tariff burdens and build efficient supply chains amid the rapidly changing international trade environment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)